Thompson Creek Metals (Blue Pearl Mng)

Seite 532 von 883 Neuester Beitrag: 24.04.21 22:58 | ||||

| Eröffnet am: | 18.01.07 07:23 | von: CaptainSparr. | Anzahl Beiträge: | 23.072 |

| Neuester Beitrag: | 24.04.21 22:58 | von: Lenaldbqa | Leser gesamt: | 2.691.381 |

| Forum: | Hot-Stocks | Leser heute: | 938 | |

| Bewertet mit: | ||||

| Seite: < 1 | ... | 530 | 531 | | 533 | 534 | ... 883 > | ||||

Pichon und Strato werden bis heute noch vermisst,welch grosser Verlust!Es ist zum Heulen.

Darum gebe ich für zweckdienliche Hinweise 1000 Euronen Belohnung aus ,der(die) sagen kann,auf welcher Baumkrone die Beiden gelandet sind!

fungi

Okay, manche werden mit TCM mehr verdient haben in diesen Tagen ,aber manche auch weniger!

Aber ein Mann(Frau)geht mir bis heute nicht aus den Sinn! Ja es ist der Mann der in dieser Woche behauptete,dass er lieber fleißig arbeiten möchte,um zu der Million Euronen zu kommen,als den ganzen Tag vor dem blöden Computer zu sitzen.

Dieser Mann hat mir mit seiner wohl ehrich gemeinten Aussage so imponiert,dass ich ihm spontan einen Grünen geschenkt habe.

Wer mich kennt,weiß wirklich,dass ich mit den Grünen wirklich nicht geize,aber dieser Mann (Frau) hätte zwei Grüne verdient,wenn ich sie nur hätte vergeben können,ärgerlich wirklich!

Ja einen Zweit-Job möchte er angehen um zur Million zu kommen,nur war er von Zweifel angenagt,ob sich denn wohl 1500 Euro so nebenbei verdienen könnte.

Daraus schließe ich einmal,dass er wohl kein Politiker sein wird, weil der diese Sorgen ja nicht hegen würde.

Aber welchem Beruf könnte der fleißige Mann wohl haben? Denn um 1500 Euronen nebenbei zu verdienen um zur Million zu kommen,bräuchte der Gute 30 Jahre.

Ja 30 Jahre ehrliche Arbeit um dann als Abferigung einen Holz-Pyjama zu bekommen,denn ausgeben wird er das Geld wohl nimmer können,wenn er die Million beisammen hat.

Das war die neue unregelmässige Glosse von "Mitternachts-Gedanken". Ich empfehle mich!

fungi

nach einiger Feierei frug ich mich zur guten Nacht, wat dat wohl war mit dem Anstieg ohne jede News ...

Neben dem DOW (allg. Marktumfeld) blieb da höchstens noch aus ard.de :

Kurzfristige Marktmacht In diesen Tagen werden bei Etrade Aktien wie Asian Dragon verstärkt geshortet. Auch Gulfside Minerals, KMA Global und JSX Energy sind recht populäre Werte. "Meist shorten Day-Trader diese Papiere Intraday und nutzen die Karenzzeiten im Sinne der Haltedauer - unter anderem auch, weil das Leihe-Desk diese Werte für einen langfristigen Short nicht immer verfügbar hat", erklärt Matthias Hach, Niederlassungsleiter von Etrade.

Kurzfristig haben die Shorties bei solch marktengen Werten große Macht: "Leerverkäufer können den Kurs phasenweise massiv beeinflussen", so Hach. Sie könnten tendenziell jeden Wert runterbringen, auch einen mit Substanz. "Aber irgendwann müssen sie ja wieder auf die Kaufseite gehen.

Deshalb fehlt ihnen langfristig die Marktmacht." "Wenn eine Aktie fundamental in Ordnung ist, wird sie auf lange Sicht steigen, da kann kein Shorty gegenhalten", meint auch Thomas Roters, Chefhändler von Sino. "Das würde auch kein Shorty tun", unterstreicht Matthias Schrade von GSC Research. "Stemmt sich jemand gegen den Markt, kann das wirtschaftlich tödlich sein." Der Shorty habe immer das Risiko, auf dem falschen Fuß erwischt zu werden und seine Position nicht schnell genug schließen zu können. Sehr schnell kann er dann weit mehr als seinen Einsatz verlieren.

Oder sollte es die Einschätzung von Pinnacle ausgemacht haben ?

In diesem Sinne - auf weitere Erklärungen und baldiges gemeinsames Anstossen auf etwaige Gewinne hoffender

Solong Don

__________________________________________________

Das Leben ist eins der schönsten ...

Hier die Meinung von GodmodeTrader.de mit Links zu Rohstoff-Report Probeausgaben. Ob die wohl noch funktionieren, wenn ich sie hier so rein stelle? Versucht es einfach mal. Wie ich sehe, ist der Artikel wohl schon vom 06.10. aber gerade erst von google an mich weitergeleitet worden. Also falls er hier doch schon drin stand, ist es mir jetzt auch egal. Hört sich positiv an und mit positiven Infos sollten wir ja nun jetzt nicht geizen, oder?

Jetzt geb ich das Wort mal weiter:

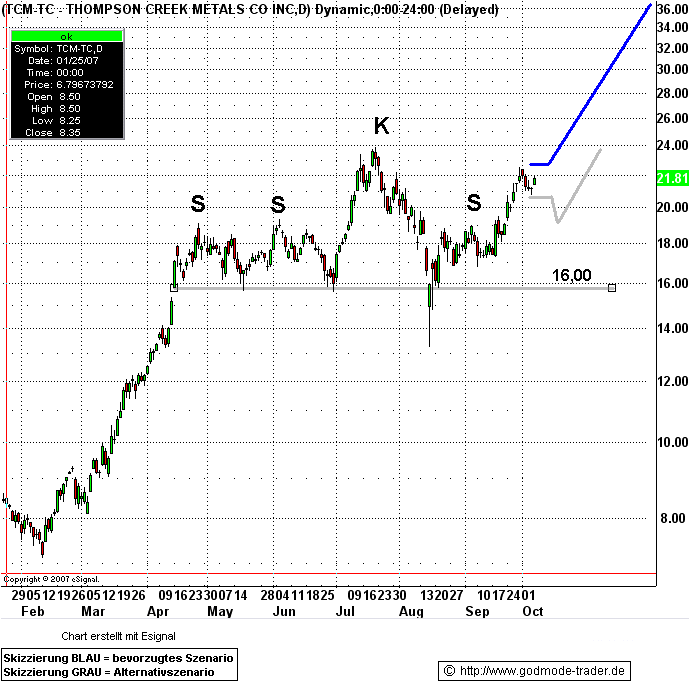

THOMPSON CREEK MET vor gewaltiger RallyeDatum 06.10.2007 - Uhrzeit 12:00 (© BörseGo AG 2007, Autor: Weygand Harald, Vorstand BörseGo AG, © GodmodeTrader - http://www.godmode-trader.de/) |

THOMPSON CREEK METALS - Kürzel: TCM - ISIN: CA8847681027 (Ehemals Blue Pearl Mining) Börse: TSE in CAD / Kursstand: 21,81 CAD (Kanada-Dollar) Kursverlauf von 24.01.2007 bis 05.10.2007 (log. Kerzenchartdarstellung / 1 Kerze = 1 Tag) Rückblick: Der Kursverlauf seit April dieses Jahres zeigt die Konturen eines langgestreckten SSKS Trendwendeprozesses, der aber durch den Anstieg der vergangenen Handelstage im Begriff ist, abgebrochen zu werden. Entscheidend war hier der Anstieg über 19 CAD, da hier die Peaks der 3 Schultern lokalisiert sind. Heute sehen wir bei der Aktie ein kleines Gap Up aus einer Bullflag. Die Aktie ist ein beliebter Aktientitel bei spekulativ ausgerichteten Marktteilnehmern. Deshalb und wegen dem derzeit außerordentlich positiven Chartbild nun diese charttechnische Besprechung. Charttechnischer Ausblick: Die Aktie von THOMPSON CREEK METALS hat gute Chancen direkt weiter anzusteigen. Das mittelfristige charttechnisch ermittelte Kursziel liegt bei ca. 34 CAD. Mittel- bis langfristig sehen wir einen Zielbereich von ca. 50 CAD. Bezgl. der kurzfristigen Marschroute läßt sich festhalten, dass ein Kursverfall unter 20,70 CAD eine Konsolidierung bis 19 CAD einleiten würde. Ausgehend von 19 CAD könnte dann die weitere Anstiegsphase starten. Ein merklicher Rückfall unter 19, CAD würde für eine zeitlich ausgedehnte Korrekturphase sprechen. Beachten Sie, dass oben in der Kursanzeige der Kurs in Euro angezeigt wird.

Unsere BIG PICTURE Analysen zu den Edelmetallen werden übrigens ab jetzt bereits 2 Tage vorab im PREMIUM Bereich veröffentlicht und an die Abonnenten des Rohstoff-Reports versandt. Rohstoff Report - Ausgabe 17 zum Probelesen. Rohstoff Report - Ausgabe 18 zum Probelesen. Rohstoff Report - Ausgabe 07 zum Probelesen. Setzen Sie auf den Marktführer. (Anmerkung von mir, meinen die jetzt sich selber, also GodmodeTrader oder TCM?) |

LG, Harley

Allen einen schönen, sonnigen Samstag

Auch von mir an dich und Euch alle einen schönes WE!

LG, Harley

wie ich schon im posting #13249 schrieb,kommt der anstieg der letzten tage ohne news bestimmt nicht ohne grund.ich denke wir können insiderwissen in bezug auf news ausschließen.

bleiben noch shorties und übernahme.ich persönlich tendiere eher zu den shorties als zu einer übernahme.am montag kommen die neuen shortzahlen,dann könnte man eve.eine theorie ausschließen ;-)

also cih erwarte einen rückgang der zahlen,aber sicher sein kann man sich nicht,denn die jungs haben echt nerven wie drahtseile,wie wir schon das ein oder andere mal sehen konnten *gg*

der SK von 24.20CAN$ (17,58€)ist ein plus von 4,49% oder 1,04$ und sieht doch recht gut aus ;-)

da meiner einer leider keinen plan von charts hat,kann ich auch nicht sagen wie wir uns weiter entwickeln werden.würde mich freuen wenn SIR STRATO oder fungi sich da mal einklinken könnten ;-)

des weiteren habe ich euch noch nen bissel *hüstel* lesestoff mitgebracht.ist auch auf der HP von TCM zu finden,ist viel stoff aber sehr interessant.

hoffe mal das es noch nicht gepostet wurde.....sonst sorry ;-)

euch noch nen schönes WE.....

mfg

me

Link----> http://www.thompsoncreekmetals.com/i/pdf/MolyEnergyOctober12-2007.pdf

marketfriendly, inc. – research@marketfriendly.com – (816) 665-5577

Expanded Uses of Molybdenum in the Energy Industry

By

Denis Battrum

marketfriendly, inc.

October 12, 2007

Introduction

Global demand for molybdenum is driven by diverse applications, not the least of which

are in the energy sector. These include steels and alloys used in pipeline systems, in the

drilling for oil and gas, and in power plants. Molybdenum is also contained in catalysts

used by petroleum refiners.

Beneath the surface of the energy sector, structural changes like the emphasis on

environmental preservation, a global decline in the availability of fresh water relative to

salt water, and envelope-pushing technology that shows machines operating at better

efficiency when they run hotter, seem to have been tailor-made for molybdenum whose

unique material properties excel under these conditions.

Pipelines

Global demand has led to soaring energy prices in recent years and there are more than

91,100 miles of pipeline projects planned or under construction this year – a 30.4

percent increase from 2006, according to Pipeline and Gas Technology (2007).

The Far East, including eastern Russia, China, India and Indochina, leads in pipeline

construction activity, with 22,500 miles planned or under construction, 24.7 percent of

the world total.

Russia, for example, is in the midst of building a $13.7-billion East Siberia-Pacific Ocean

(ESPO) pipeline to transport crude oil to markets in China and Japan. China National

Petroleum Corp, the parent of PetroChina Co Ltd., will invest up to 8 billion yuan

(US$1.1 billion) to build the China branch of the Siberia-Pacific crude oil pipeline. The

965-kilometer Chinese mainland section of the pipeline will be started this year and

finished in 2010. (South China Morning Post).

The United States remains the second-largest builder of pipelines, with more than

16,750 miles of pipeline projects planned or under construction, representing about 18.4

percent of the global total.

Most notable among the U.S. projects is the $4.4-billion Rocky Express project, a joint

venture between Kinder Morgan Energy Partners LP, Sempra Energy, and Conoco

Phillips Co., which is expected to run 1,675 miles from Wyoming to Ohio – the country's

biggest natural gas project in about 20 years.

2

marketfriendly, inc. – research@marketfriendly.com – (816) 665-5577

Canada's oil sands are also adding to the increase in North American pipeline

construction. Enbridge Inc., for example, has begun building a $500 million line called

Southern Access to Illinois and Wisconsin. The project is expected to use 630 miles of

36- and 42-inch pipe. The company is also building Southern Lights, a 675-mile, 20-inch

pipeline running from Alberta to Chicago. Enbridge has $9 billion worth of new pipelines

planned, most of which will take Alberta oil sands production to the refineries of the U.S.

Midwest and Gulf Coast.

South America is third with about 15,950 miles of pipeline, 17.5 percent of the world

total. It is one of the world's fastest-growing regions, with construction this year expected

to be more than three times what was built last year. Much of that growth is being driven

by the $25-billion Gran Gasoducto del Sur project, which could see up to 9,000 miles of

pipe running from Venezuela to Brazil, Argentina and possibly other South American

countries.

European pipeline projects include 13,700 miles of pipe, up 16.7 percent from 2006, and

the region continues to lead the world in offshore pipelines, with about 4,400 miles

planned or under construction.

Other major projects include:

• Calgary-based TransCanada Pipelines Ltd.'s $1.7-billion Keystone Oil

Pipeline project, which will run 1,845 miles from Hardisty, Alberta, to Patoka,

Illinois;

• Brazilian state oil company Petróleo Brasileiro SA's $6.5-billion, 800-mile

project to import and distribute gas;

• The $5.7 billion, 745-mile Nord Stream gas pipeline, which will connect

Vyborg, Russia and Greifswald, Germany;

• State-owned gas utility GAIL (India) Ltd will invest Rs 18,000 crore to lay five

new pipelines resulting in an additional 3,300 km of pipe;

• The $3.5 billion Turkmenistan-Afghanistan-Pakistan-India (TAPI) gas pipeline,

that rivals a similar line from Iran;

• The IGI pipeline that Italy, Greece and Turkey hope will be operational by

2012.

The vast majority of pipelines built — about 72 percent of the total — are designed for

natural gas. Increasingly, molybdenum is being used in the steels that make these

pipelines. The presence of molybdenum significantly reduces weight for overall volume

carrying capability. Smaller diameter pipe can be used with lesser wall thickness for the

same transmission capability. Alternately, in the same size of pipe, transmission

capability (pressure) can be increased. Either way there are significant savings in overall

material cost and easing of the transport logistics – a critical consideration given the

remote locations of these pipelines.

3

marketfriendly, inc. – research@marketfriendly.com – (816) 665-5577

Over the years, molybdenum levels in the more advanced pipe have crept up from less

than 0.1 percent to 0.2-0.3 percent. Depending on the size of pipe, one mile of pipeline

at these levels can absorb a ton of molybdenum1.

(1For a 30” x 0.625” pipeline at 0.24 percent Mo, the pipeline steel represents a

theoretical molybdenum demand of 2,487 pounds Mo per mile (1,554

pounds/km). For a 52” x 1” pipeline, the equivalent is 6,909 pounds per mile

(4316 pounds/km) using the X-80 steels called for. This does not include losses

in alloying or conversion from concentrates, nor does it include molybdenum in

the weld metal, which can be higher on a weight percentage basis than the

molybdenum level in the steel. The pipe sections, called “joints”, are typically 40

feet long, so the Alaska pipeline, for example, would have over 280,000 welds.)

The newest formulations for oil and gas pipeline steels can double this amount. While

the percentage quantity of molybdenum in the steel is small, the reader can see the

tremendous leverage on absolute molybdenum demand exerted by the number of miles

laid and the new pipeline chemistries.

Capacity for rolling the newer moly-bearing grades is growing, but demand for

molybdenum in this application is severely bottlenecked by pipe mill capacity – or lack

thereof. The capacity for X-120 pipe (0.4%+ Mo) is very limited as there are only a

handful of mills in the world that can produce this relatively high molybdenum grade.

Baosteel, the largest Chinese steelmaker came on line this year with X-120 product.

Magnitogorsk Iron and Steel Works OJSC (MMK), the largest of the Russian

steelmakers, just announced X-120 capacity for late 2009 or early 2010 at their CCM6

basic oxygen furnace, as noted in the announcement, below:

The facilities will be fitted with the state-of-the-art equipment

ensuring the processing of any steel grades produced in the

BOF Shop including the steel grades used for production of

automotive steel sheets, large diameter longitudinal welded

pipes of enhanced hydrogen-sulfide resistance and corrosion

resistant pipes of X80 and higher strength classes; special steel

grades; shipbuilding and high pressure vessels steel grades;

steel grades used in automotive industry (ultra low carbon steel,

high strength steel, dual phase steel, multi-phase steel and TRIP

steel).

SKRIN News Service

Europipe and three Japanese mills (including Nippon Steel and Sumitomo, for example,

which have been extremely aggressive and open in their research and development of

X-120 pipe) are the only others.

The capacity constraint is easing, but it remains true that a vast majority of the pipe

manufactured today is absent molybdenum. This application remains a huge latent

source of demand for the metal given that converting even half of the pipeline miles

noted above to a mid-level moly content would add substantially to the world’s annual

demand for molybdenum.

4

marketfriendly, inc. – research@marketfriendly.com – (816) 665-5577

Oil and Gas Drilling

The current drill rig count is holding about the same as this time last year, this despite a

significant pullback in Canadian shallow gas drilling activity. Overall, there is a positive

bias to the drill rig count since total feet drilled per rig and the number of holes drilled per

rig has been increasing.

Offshore drilling is stronger than last year, operating at over 87 percent of capacity and

with an increase in available rigs. (See charts below.)

2007 OIL AND GAS RIG COUNTS

Current Previous Year Ago Change

United States 1760 1769 1,776 -1%

Canada 347 359 353 -2%

International 1,009 1,018 954 +6%

World 3,116 3,146 3,083 +1%

US and Canadian statistics are published for the week ending

September 28, 2007. International numbers reflect August, 2007.

International count excludes Iran and Sudan. Change is

calculated from the previous year. Source: Baker Hughes.

2007 OFFSHORE RIG UTILIZATION REPORT

Current Month Ago 6 Mo Ago 1 Yr Ago

Rigs Working 511 520 500 493

Total Rigs 599 597 587 577

Utilization 85.3% 87.1% 85.2% 85.4%

Competitive rigs. Data for week ending September 28, 2007.

Increasingly, molybdenum-bearing steels are employed to replace mild carbon steels in

drilling under conditions of increased temperature, pressure and/or corrosion.

Just one of many new steel products available is the Timken “Impact8” brand, which was

recently certified to exceed the National Association of Corrosion Engineers (NACE) and

American Petroleum Institute (API) standards for resistance to sulfide stress corrosion

cracking above 95 ksi. This drill pipe assays 0.65-0.75% Mo and serves to replace a

popular drill steel, grade 4140, that runs 0.15-0.25 percent Mo. Note the 3-times

increase in the use of molybdenum in this application.

Coiled tubing (CT) is becoming one of the fastest growing oilfield technologies. Between

2001 and 2006, CT services expanded 140 percent and these steels show a higher

molybdenum level. Most of the world’s CT units and strings are made in the United

States. In fact, the market is essentially split between two companies, both within 4 miles

of Houston.

Coiled tubing is made by seam welding long, flat steel strips which are then coiled on a

large reel for field deployment. The CT strings have to be light enough to transport on

trailers, yet strong enough to withstand the rigorous exposure: load, operating and

5

marketfriendly, inc. – research@marketfriendly.com – (816) 665-5577

external pressures, and metal fatigue. CT purchases are growing between 10-15 percent

per year. In 2006, shipments were as follows:

COILED TUBING

SHIPMENTS (2006)

To: %

Canada 29

U.S.A. 21

Europe / North Sea 13

Alaska 10

Middle East 9

North Africa 8

Latin America 8

Far East 2

Tenaris recently announced a new depth record using coiled tubing, drilling in the U.S.

Rocky Mountain area along with its partner Xtreme Coil Drilling. This product, HS110™,

contains 0.25–0.45% Mo. To date, Tenaris has produced 12 strings of the newly

developed coiled tubes for Xtreme Coil to use on the project, and it anticipates that

demand for 10,000-foot well strings will increase as more experience is gained drilling

the deeper wells.

Tenaris holds the record for the world’s longest continuously milled coiled tubing work

string – 32,800 ft. of 1-3/4” HS90™ used in West Africa. HS90™ uses molybdenum in

the 0.10–0.15 percent range: Note how their product development, from HS90 to HS110,

entails increasing the molybdenum addition rate by a factor of 2-3 times.

Offshore drilling has always used higher-molybdenum grades than onshore drilling, and

this sector is showing no letup. The 2007 Oil & Gas Journal forecast for offshore drilling

is shown in the graphic below (blue line), indicating roughly a 30 percent increase in the

next 10 years:

Global Offshore Oil Production Outlook

Source: Oil & Gas Journal (2007)

6

marketfriendly, inc. – research@marketfriendly.com – (816) 665-5577

Sandvik, a major supplier of offshore drilling equipment, this year opened a service

center and warehouse in Houston, offering master coil stocks of both seamless and

laser welded tubing. According to the company, products include stainless steel grades

316L (2-2.5% Mo) and Alloy 825 (2.5-3.5% Mo), “…these stocks cover the most popular

grades used in these oil and gas applications. Other grades such as SAF2507 (a superduplex

stainless containing 3-5% Mo), and San28 (3.5% Mo) are also available on short

lead times.”

Offshore oil and gas drilling and production use much more molybdenum than just what

is found in the drill string and well casing. The Sable Offshore Energy Project in Atlantic

Canada was a well-documented example of the strong role molybdenum plays:

The most called-upon alloys for Sable were the duplex stainless steels S31803 (2.5%

Mo) in the offshore process piping, and S31600 (2-3% Mo) in the cryogenic systems at

the Goldboro gas plant.

Separators, although fabricated from carbon steel, are clad with a 3-millimetre-thick layer

of N08904 (904L stainless – 4.5% Mo), which makes them resistant to pitting corrosion.

The hydrocyclones, which purify water coming from the separators, are fabricated from

S31803 (2.5% Mo). And where there is potential for internal corrosion from carbonic acid

in the process fluid, S31803 is used to fabricate the heat exchangers.

The risers (the tubular steel structure that stands on the seabed and upon which

platforms sit) are also made of S31803.

In Phase II (2004-2007), the sub-sea pipeline between South Venture and Venture is

designed entirely of 8.5-inch S31803 (2.5% Mo) piping instead of the moly-free carbon

steel pipelines used in Phase I.

As more oil and gas projects are approved, with concomitant increasing demand for

advanced high-strength and corrosion-resistant steels in these applications, there will be

a need for still larger quantities of molybdenum additive.

Petroleum Refining

Demand for molybdenum-bearing catalysts in petroleum refining will depend on

feedstock qualities and changing product specifications.

From the following chart, it can be seen that supply in the sour (higher sulfur) categories

is increasing relative to others. At the same time, product specifications are moving to

the lower sulfur limits. So already there is a highly-leveraged call on molybdenumbearing

catalyst that exceeds the typical refining capacity forecasts which typically hover

in the 1-2 percent annual range:

7

marketfriendly, inc. – research@marketfriendly.com – (816) 665-5577

Increase in Global Crude Production 2005-2015

Source: Oil & Gas Journal (2007)

Product specifications are universally changing to lower sulfur:

From the chart below, it can be seen that, with gasoline, there has been a significant

shift in production volumes from Category 2 (200-1,000 ppm sulfur) to Category 4 (<30

ppm), largely due to the mandated reduction in gasoline sulfur content in the U.S. in

2005. Another shift in demand by quality is anticipated in 2014-15 when China and a

number of African and Asian developing countries are expected to move from Category

2 (200-1,000 ppm) to Category 3 (30-200 ppm).

Demand for low-sulfur gasoline (<30 ppm) is rising quickly, and is forecast to reach 15

million barrels per day (b/d) by the end of the decade. The figure shows that, after

representing 100 percent of demand in 2001, gasolines with over 200 ppm sulfur will fall

to less than 10 percent of demand by 2020.

Global Gasoline Demand

Source: Oil & Gas Journal (2007)

8

marketfriendly, inc. – research@marketfriendly.com – (816) 665-5577

For the global diesel market, demand growth will be even stronger than for gasoline. In

fact, global diesel demand is forecast to exceed global gasoline demand by 2020,

whereas today, gasoline demand exceeds diesel by more than 2 million barrels per day.

Like gasoline, diesel is in the midst of a worldwide shift to primarily low-sulfur

specifications. (See chart, below.)

Global Diesel Demand

Source: Oil & Gas Journal (2007)

The United States has just changed to 15 ppm ultra low-sulfur diesel (ULSD). With the

EU following by the end of the decade, diesel demand in the lowest-sulfur category (<15

ppm) will climb to nearly 12 million b/d by 2020, becoming the largest category.

Demand for the highest-sulfur diesel (> 3,000 ppm) will fall to about 2.5 million b/d.

There is extraordinary new growth occurring in catalyst demand for the production of

ultra low sulfur diesel (ULSD). Achieving the reduced sulfur specification of less than 15

ppm more than doubles the use of catalyst at the same refinery.

The production of ultra low-sulfur diesel first treats the distillate stream with a cobaltmolybdenum

(CoMo) catalyst to take out the easier sulfur components, then a second

catalyst bed of nickel-molybdenum (NiMo) removes the "hard" sulfur components.

About 95 percent of refiners use molybdenum-bearing catalysts for sulfur removal in the

ULSD application. Refiners advise that catalyst usage is exceeding the theoretical as

operators err on the side of compliance. Catalyst manufacturers are introducing higher

grade catalysts to meet the new demand.

ULSD is the single largest environmental mandate since the removal of lead from

gasoline 25 years ago, although the complete impact on emissions reduction will not be

realized until the highway diesel transportation fleet fully turns over in 25-30 years. It is

another entirely new molybdenum demand driver.

9

marketfriendly, inc. – research@marketfriendly.com – (816) 665-5577

Since October 15, 2006, most of the diesel fuel sold in stations in Canada and the

United States has been ULSD. The first diesel engines specifically designed for ULSD

fuel are in 2007 vehicles. The EPA mandated a June 2007, interim, 500-ppm sulfur cap

for off-road diesels, and then a June 2010 deadline for all highway trucks and off-road

diesels (except locomotive and marine, and small refiners) to conform to the 15-ppm

sulfur limit. Two years later, the lowest sulfur requirement will extend to locomotive and

marine diesels, and by June 2014 it will apply to everyone.

The number of diesel-fueled cars and light trucks sold in the United States has grown

consistently in the last 10 years and is up 80 percent in the last six.

The European Commission has confirmed a 10 ppm sulfur highway diesel limit starting

December 31, 2008, followed by the same limit effective December 31, 2009 for off-road

diesel. Inland waterway diesel engines would have to switch to 10 ppm ULSD starting

December 31, 2011.

Annual world demand for diesel light vehicles is expected to nearly double over the next

decade, increasing to 29 million unit sales, according to J.D. Power and Associates.

Albermarle, a major catalyst producer, says molybdenum use in catalysts is racing

ahead at 6-8 percent a year, based in large part upon the new sulfur restrictions in place

and still to come for diesel fuels worldwide.

Gas Turbines

Electrical power generation is increasingly developed from gas turbines.

A gas turbine is an internal-combustion engine consisting essentially of an air

compressor, combustion chamber, and turbine wheel that is turned by the expanding

products of combustion.

There are three kinds of power generating turbine systems: gas turbines, steam

turbines, and combined-cycle turbines (CCGT), which employ the first two together. The

Integrated gasification combined-cycle (IGCC) gas turbine is a sub-species of the CCGT

wherein coal is converted to “syngas” and the syngas is then used as fuel for a gas

turbine, whose exhaust provides heat to generate steam to run a steam turbine.

The word “gas” in this instance refers to the gas that is compressed – typically air. A

number of fuels are available for a gas turbine, but natural gas is the main one. Simple

cycle (gas turbine only), combined cycle (gas turbine with its exhaust producing steam

for steam turbine generation), and cogeneration (gas turbine, with its exhaust producing

steam for heat) are all generally discussed under the heading “gas turbines”.

General Electric's new LMS100 gas turbine, at 46 percent, has the highest efficiency of

any simple cycle gas turbine, but when the heat from the simple gas turbine exhaust is

used to make steam to run a steam turbine – essentially using the same fuel twice – a

combined-cycle gas turbine (CCGT) can demonstrate thermal efficiencies as high as 60

percent.

10

marketfriendly, inc. – research@marketfriendly.com – (816) 665-5577

Forecast International, Inc. predicts significant growth in coming years in the demand for

gas turbines in electrical power generation, up 60 percent from 2006 to 2008. This

exceptional growth is underpinned by both technical and commercial factors.

Operating efficiencies are increasing. The 46 percent efficiency level noted above for the

simple gas turbine is now well above the typical nuclear power plant at 30-33 percent.

The combined cycle option at 60 percent is even more promising.

Gas turbines come with a much shorter planning and construction cycle. Increasingly

this becomes important as consumers debate the alternatives until it is too late.

SaskPower, for example, which had been considering a world-class clean coal project,

ran out of time and opted for gas turbines this year in order to meet the province's

electricity needs by 2010. The Crown Corporation announced that the planned 300-

megawatt (MW) thermal generating station could not be built in time to meet rising

electricity demands. Instead of the coal plant, SaskPower will install 400 MW of naturalgas

turbines over the next five years.

The Middle East is becoming a high-growth market. Certainly it is one of GE's fastestgrowing

markets, along with China and India, with revenues derived increasing 15 -20

percent a year, according to the company. GE expects to get about 60 percent of its

growth from emerging markets, including the Middle East, China, India and Brazil, in the

next decade. Recently, GE announced $1.8 billion in energy-related orders to the Middle

East: The company is providing 20 natural-gas-powered turbines to a 2,500-megawatt

power-plant project in Kuwait, and they have sold an additional 12 natural-gas and 5

steam turbines for two projects in Qatar. These contracts come on the heels of another

$2 billion in contracts, announced in December and January, to supply 35 gas turbines

to Saudi Arabia.

High growth potential has also been identified for the Central and Eastern European gas

turbine markets. Turbine sales will increase over the next few years as a result of the

rising demand for electricity and improved electricity pricing, the need to replace

obsolete power plant equipment, and the relative improvement in the availability of

investment funds as countries in the region have become members of the EU.

Gas turbines are becoming relatively more attractive as delivered coal prices escalate

and as natural gas prices drop. Natural gas prices are coming down, and as new LNG

projects send meaningful quantities of previously “stranded” gas to the marketplace, the

downward pressure should continue, with a corresponding improvement in natural gasfuelled

turbine economics.

The co-generation market for gas turbines will become much stronger in Europe and

generally in any country that signed the Kyoto Accord. It is also worthwhile noting that

CO2 emissions are lower with the new combined-cycle turbine projects.

The Integrated Gas Combined Cycle (IGCC) provides an opportunity to “clean” coal. In

many countries, like China, the United States, and South Africa, coal is a major energy

resource. Of every three power plants currently being built in the world, two are in China,

where the major fuel is coal. The IGCC plants convert coal into syngas, a low calorific

value gas composed of carbon monoxide and hydrogen; the syngas is then used as fuel

for a gas turbine, whose exhaust provides heat to generate steam to run a steam

11

marketfriendly, inc. – research@marketfriendly.com – (816) 665-5577

turbine. Using the same fuel twice, in essence, a combined-cycle power plant can show

thermal efficiencies as high as 60 percent.

More than 4 dozen alloys containing molybdenum ranging from 1-25 percent have been

identified in gas turbines. Molybdenum-bearing superalloys are used because of their

enhanced creep strength1, fatigue strength, oxidation resistance, and hot corrosion2

resistance at elevated temperatures.

(1Creep is the form of deformation that takes place in metals held for long periods

at high temperature. Although most of us know molybdenum in the context of

corrosion, its ability to resist creep is without equal in a number of metal

products. 2There are more than a dozen different types of corrosion. Hot

corrosion is a phenomenon where two or more media present combine

synergistically to degrade materials at a rate much faster than any of the

individual elements separately. Normal oxidation can be greatly accelerated in

the presence of sulfides and/or chlorides because the normally stable oxide film

is continually being damaged by lower melting point films allowing reactions to

accelerate.)

Related to these phenomena, and based on comments from GE Power Systems,

manufacturers have stepped up their orders for the following moly-bearing alloys from

the foundries for use in the hot sections of turbines: 718 (3% Mo), 263 (6% Mo), 625 (9%

Mo), Hastelloy X (9% Mo), 617 (9% Mo) and Haynes 230 (2% Mo).

Nuclear Power

According to the World Nuclear Association (WNA), the nuclear-power industry's

umbrella organization, there are 439 reactors operating globally, generating 371,000

megawatts (MW) of electricity or about 16 percent of total demand. Another 34 are under

construction, with 81 planned and 223 proposed – 88 of which are in China.

The WNA estimates nuclear power could double over the next 30 years.

Nuclear power plant construction is well under way in China. Finland’s Olkiluoto-3 unit,

the first nuclear plant ordered in western Europe since Chernobyl, has been delayed at

least two years for a number of reasons, including flawed welds in the reactor's steel

liner, unusable water-coolant pipes and suspect concrete in the foundation.

This serves to highlight that we are very much on a learning curve again after many

years of nuclear power plant (NPP) construction inactivity.

The United States hasn’t broken any new ground yet but even as construction appears

slow to start, there is a healthy market for molybdenum bearing steels and alloys in

retrofit: power uprates and licence extensions. A 10 percent power uprate on a typical

1,000 MW nuclear unit can supply an additional 50,000 homes. The reactor’s useful

operating life can in some instances be doubled through a defined set of modifications

and indeed these modifications are being fully exhausted (worldwide – not just in the

U.S.) prior to any new construction decision.

12

marketfriendly, inc. – research@marketfriendly.com – (816) 665-5577

But molybdenum benefits either way: A variety of molybdenum-bearing alloys are found

in the piping and various components like the shells and tubes of steam generators, the

turbines, and coolant circuit pipes, for example.

Piping retrofit in power plants (coal or nuclear) can be completed with so-called P91

pipe. This is nominally a 1 percent molybdenum alloy (ASME 0.85-1.05% Mo). Pipes can

also be changed to Type 317 stainless (3-4% Mo), 904L (4-5% Mo), or duplex alloys like

S32205 (3-3.5% Mo). The original materials, like 304 stainless steel for example, contain

no molybdenum.

Condenser tubing is another significant application. The alloys used today run 1-4% Mo.

The table below shows the molybdenum composition of superferritic stainless steels

used in this condenser tubing.

CONDENSER TUBING ALLOYS

Name / UNS No. Mo (%)

E-Brite 26-1 / S44627 0.75-1.50

18-2 / S44400 1.75-2.50

29-4 / S44700 3.50-4.20

29-4-2 / S44800 3.50-4.20

Monit / S44635 3.60-4.20

AL 29-4C / S44735 3.60-4.20

Sea-CURE / S44660 3.00-4.00

Source: Trent Tube

Work completed at the Browns Ferry nuclear power plant, for example, includes

replacement of condenser tubes, core spray piping, turbine cross-over and -under

piping, and extraction steam piping. According to the Nuclear Regulatory Commission,

any pipe containing fluids over 200oC must now be 316 stainless steel (2-3% Mo).

Another new application for molybdenum in NPPs is in stainless steels resistant to

microbiologically induced corrosion (MIC). This is of particular interest to power plant

operators where condensers are chlorinated to kill colonies of bacteria in the water.

(Chlorine or hypochlorous acid reacts with the metabolic byproduct of certain bacteria to

produce hydrochloric acid, which causes pitting of the existing molybdenum-free steels.)

Several nuclear power plants built in the United States in the 1970s and ’80s are now

replacing their water service piping with moly-bearing duplex stainless steel pipe for

longer life and corrosion resistance.

The Catawba Nuclear Station in South Carolina, for example, is replacing original carbon

steel cooling water piping (mostly API 5L Grade B) with duplex stainless steel S32205

(3-3.5% Mo). This 2.25 gigawatt plant uses fresh-water for cooling, and carbon steel was

the material of choice when it was designed in the 1970s. But as it turns out, the water

supply has become rich in nutrients, like so many fresh water bodies today, and this has

caused MIC.

13

marketfriendly, inc. – research@marketfriendly.com – (816) 665-5577

In general, the choice of alloys for nuclear power remains a work-in-progress.

In September 2007, Thyssen Krupp reported the first commercial application of Alloy 33

(1.6% Mo) as a weld overlay to carbon steel boiler tubes retrofit. This is another new

application for molybdenum-bearing material where none existed before.

For reference, the number of components and weights for new nuclear power plants in

(the current) Generation III are shown below. It is estimated that one of these plants

could use 400,000-500,000 pounds of molybdenum.

GENERATION III+ NUCLEAR REACTOR COMPONENTS

ELEMENT

NUMBER

PER PLANT

MAX WT.

PER EACH

(tonnes)

REACTOR PRESSURE VESSEL 1 1,200

STEAM GENERATOR 2 730

MOISTURE SEPARATOR REHEATER 4 440

STEAM TURBINE GENERATORS 3 550

LOW PRESSURE TURBINE 3 250

GENERATOR STATOR 1 500

GENERATOR ROTOR 1 250

CONDENSERS 3 660

PUMPS 138 n/s

VALVES +3 INCH 3-6,000 n/s

VALVES 2.5 INCH / UNDER 6-12,000 n/s

CONTROL ROD DRIVES 200 n/s

PIPING > 2.5 INCHES 260,000 ft. n/s

PIPING < 2.5 INCHES 430,000 ft. n/s

NOTES:

1. Not all types of reactors use all these components.

2. Each Gen III unit will use either 2 steam generators or 2-4 moisture separator

reheaters

3. Each steam turbine generator would have up to 3 condensers

4. Quantities are listed as maximum per plant

5. These designs in general are considered: General Electric (GE): Economic

Simplified Boiling Water Reactor (ESBWR); Toshiba-Version, GE-Design:

Advanced Boiling Water Reactor (ABWR); and Westinghouse: Advanced

Pressurized Water Reactor (AP1000). The Framatome ANP (Areva). European

Pressurized Water Reactor (EPR) design, occurred too late to be included.

6. n/s = not specified

Another development that involves molybdenum in the nuclear fuel cycle is Brazil's

research into the use of uranium-molybdenum fuel alloys.

In-vessel retention (IVR) of core melt that may fall to the lower head of a reactor vessel

is a severe accident management strategy adopted by some operating nuclear power

plants and is also proposed for several of the advanced light water designs. Molten core

14

marketfriendly, inc. – research@marketfriendly.com – (816) 665-5577

materials that burn through to the ground below would cause a catastrophic steam

explosion when contacting ground water. A U.S.-Korean International Nuclear Energy

Research Initiative project is exploring design enhancements that could increase the

margin for IVR for advanced reactors power levels up to 1,500 MW. One such design

includes an oxide-coated Inconel 718 plate (3% Mo) with thickness sufficient to support

and contain the mass of core materials that may relocate during a severe accident.

A relatively new development is the use of nuclear power for desalination – itself a

significant end-use application for molybdenum. The concept is becoming popular in the

Middle East and North Africa.

During a visit to Libya by French President Nicolas Sarkozy in late July, the leaders

signed a memorandum of understanding that would allow French nuclear-giant Areva to

build a nuclear power plant there. Egypt has said it will pursue a similar scheme, as have

Saudi Arabia and the other Gulf Cooperation Council countries -- Bahrain, Qatar, Oman,

Kuwait and the United Arab Emirates.

Japan and Kazakhstan already have working nuclear-powered desalination plants.

The Middle East, like much of the rest of the world, is increasingly in need of fresh water.

About 60 percent of the roughly 7,500 traditionally powered desalination plants can be

found in the Middle East. In fact, Saudi Arabia holds about a quarter of the world's

desalination capacity, according to the International Desalination Association.

Removing enough salt from seawater to make it usable for irrigation and drinking takes a

tremendous amount of energy – between 2.8 and 9.8 megawatts of energy to produce

100,000 cubic meters of drinkable water per day, depending on source salinity and the

method used, according to the Argonne National Laboratory.

Using nuclear power for desalination has some very powerful backers. Not only do

Japan's Mitsubishi Heavy Industries and Areva hope to build in North Africa and the

Middle East, but the International Atomic Energy Agency has thrown its weight behind

the idea as well with its Nuclear Desalination Project.

The use of nuclear power in desalination changes the conventional wisdom that ties

nuclear power to the electricity grid and thereby enhances its growth potential.

A gas-cooled reactor known as the pebble bed moderated reactor (PBMR) is being

developed in South Africa. Instead of fuel rods, the PBMR uses coated graphite pebbles

filled with uranium fuel. The decay heat is transferred to helium, an inert gas, which

eventually moves to a gas turbine to produce electricity. In fact, this reactor will take

advantage of turbines in a closed-cycle gas turbine configuration which will give it a

thermal efficiency of just about double that of a conventional light water reactor. These

turbines are also rich in molybdenum-bearing alloys. (See Gas Turbines, above.)

The generation of reactors that will see development after what we are building today –

the so-called Generation IV – will produce more heat and less radioactive waste with

different cooling mechanisms than light water reactors, and will be able to produce

hydrogen as a replacement for fossil fuels.

15

marketfriendly, inc. – research@marketfriendly.com – (816) 665-5577

mfg

me

wäre ja toll wenn wir das hinkriegen würden. nur der

18.11. ist ganz schlecht. da es ein so ist. bin immer

von immer von do-so in b.

gruß

Aber ich kann Dir versichern,dass charttechnisch am Freitag auf Schlusskurs-Basis von 24,20 CAD ein "Kaufsignal" generiert wurde.

Ganz Vorsichtige sollten noch die 24,5 CAD-Marke auch auf Schlusskurs-Basis abwarten,bevor sie kaufen.

Ich gehe davon aus,dass 28 CAD in relativ kurzer Zeit drinnen liegen müssten,sollten Dow&Co noch 1-2 Wochen mitspielen!

Der Dow ist in dieser Rechnung nämlich die grosse Unbekannte,denn 2-3 schlechte Quartalsergebnisse von namhaften Firmen könnten "jetzt" bereits ausreichen,um den Dow 200-300 Punkte gegen Süden zu drücken.

Wir haben zurzeit eine recht nervöse Marktstimmung,musst Du nämlich wissen.

Aber da ich aber davon ausgehen das kurzfristig noch die Zinzsenkungs-Fantasie den Markt beherrscht,wird TCM auch nächste Woche steigen.

Rohstoffe generell würden steigen,sollten die Leitzinsen in Amerika noch im Oktober gesenkt werden,eben wegen der Inflationsgefahr die ein schwacher USD noch unterstützen würde.

Da sich Rohöl auch auf Rekord-Höhe in USD gerechnet befindet(83-84 Dollar das Barrel)

könnte es jederzeit zu einem Kippen des Dow kommen.

Die Chancen das TCM nächste Woche weitersteigt,hängt also von vielen Faktoren zurzeit ab: Trotzdem bin ich für die nächste Woche noch zuversichtlich,dass die Perle weitersteigt,also 26-27 CAD könnten schon noch drinnen sein.

Sollten aber die Leitzinsen wider Erwarten nicht gesenkt werden,würde es gerade die Rohstoff-Titel am Meisten treffen.

Du siehst also,es bleibt spannend an der Börse!

Ich hoffe Dir die augenblickliche Lage in der sich die Börse und im speziellem TCM befindet ein bisschen aus meiner Sicht näher gebracht zu haben und wünsche eine gute Nacht nach "good old Germany"!

fungi

thx fungi,genau die richtige antwort,in bezug auf meine frage und meine erwartung *gg*

na,mach doch nur spaß ;-)

ich wollte keine chart-lehrstunde,dazu bedarf es bestimmt mehr als nur ein posting ;-)

deine antwort war mal wieder supi....dir noch nen schönen rest sonntag bei den ösis *fg*

mfg

me

Prognosen onvista vom 12.10.07

Datum§Kurs (EUR) Änd. in %

15.10.2007, 17:30 17,50 +1,0%

16.10.2007, 17:30 17,67 +2,0%

17.10.2007, 17:30 17,84 +2,9%

18.10.2007, 17:30 18,01 +3,9%

19.10.2007, 17:30 18,19 +5,0%

Nett wär´s ja, ist aber ohne Garantie meinerseits

reKIWI

Prognoseerstellung

Datum Kurs (EUR, Stuttgart)

13.10.2007, 01:17 17,33

Prognosen

Datum Kurs (EUR) Änd. in %

12.11.2007, 17:30 18,40 +6,2%

12.12.2007, 17:30 19,54 +12,8%

14.01.2008, 17:30 20,75 +19,7%

14.02.2008, 17:30 22,03 +27,1%

14.03.2008, 17:30 23,39 +35,0%

Man beachte vor allem die exakte Uhrzeit-Angabe ;o)))

GN8-Grüsse vom verkaterten Don ...

__________________________________________________

Das Leben ist eins der schönsten ...

Mensch rekiwi. Das sagst Du erst jetzt, daß Du in die Glaskugel schauen kannst, um den Kurs für TCM vorherzusagen? Dat hättste aber auch mal eher sagen können, wa? ;-)

Aber schon mal´n netter Chart, den Du da hast. Ich bin dafür, diesen 1zu1 in die Tat umzusetzen. ;-)

Aber ich glaub, dafür müssen wir mal wieder alle das rudern anfangen. ;-) So, dann wür ich mal sagen, bis später mal. Ich geh mir jetzt erst mal´n Kaffee holen.

LG, Harley

@13290 Signore Gerome: soweit wollte ich der Zeit nicht vorgreifen. Schließlich leben wir ja ganz entspannt im Hier und Jetzt. Wäre natürlich schon schön...

So, stop the clocks, it´s time for breakfast: ( hoffe es ist nicht nur für den hohlen Zahn)

Und dann bin ich ja mal gespannt, wo die TCM Reise heute hingeht.

Uuups, jetzt, wo ich endlich Kaffee getrunken habe und meine verklebten Augen doch endlich mal richtig aufmachen kann, seh ich ja erst, daß der Chart ja von Don war. Ich hab heute morgen in meinem ersten Posting 13291 irgendwie rekiwi angesprochen.

Tut mir leid Don! Da weiß man doch wozu der Kaffee gut ist. ;-)

Bis später dann mal. ;-)

LG, Harley

Mein unmaßgebliches Bauchgefühl sagt mir, dass diese Woche der Dienstag ausfällt..

lg, Rainer

Aber das soll mir ja egal sein, wenn unsere Perle schön Richtung Norden wandert.

LG, Harley

Thompson Creek Posts New Report on 'Expanded Uses of Molybdenum in the Energy Industry'

Shares outstanding: 113,073,000

TSX: TCM, TCM.WT

Frankfurt: A6R

TORONTO, Oct. 15 /CNW/ - Thompson Creek Metals Company Inc., one of the

world's largest publicly traded, pure molybdenum producers, today announced it

has posted on its website a new report entitled "Expanded Uses of Molybdenum

in the Energy Industry" by metals expert Denis Battrum. The report outlines

new and expanded uses of molybdenum in steel alloys and catalysts for energy

applications worldwide.

Mr. Battrum, who is founder and president of marketfriendly, inc. of

Kansas City, Missouri, publishes a daily summary of molybdenum news and is the

author of several studies on the molybdenum sector. He has more than 30 years

of purchasing, research and sales experience in the mining, steel

manufacturing and recycling industries. Mr. Battrum has held the positions of

Sales Manager at American Compressed Steel Inc., Purchasing Manager at the

Iowa and Minnesota plants at Cargill's North Star Steel Company (subsequently

acquired by Gerdau Ameristeel Corporation), and Director, Market Research, at

Saskatchewan Mining Development Corporation (later renamed Cameco

Corporation). Mr. Battrum is a director of the Sprott Molybdenum Participation

Corporation.

The report was commissioned by Thompson Creek Metals Company Inc.;

however, the author is solely responsible for the information and opinions in

the report.

About Thompson Creek Metals Company Inc.

Thompson Creek Metals Company Inc. (formerly Blue Pearl Mining Ltd.) is

one of the largest publicly traded, pure molybdenum producers in the world.

The Company owns the Thompson Creek open-pit molybdenum mine and mill in

Idaho, a 75% share of the Endako open-pit mine, mill and roasting facility in

northern British Columbia, and a metallurgical roasting facility in Langeloth,

Pennsylvania. Thompson Creek is also developing the Davidson high-grade

underground molybdenum project near Smithers, B.C. The Company has more than

700 employees. Its head office is in Toronto, Ontario. It also has executive

offices in Denver, Colorado (including sales and marketing) and Vancouver,

British Columbia. More information is available at

www.thompsoncreekmetals.com.

@all....liest hier auch wer postings ????? *gg*

hmm....also auf ein neues....hatte ja schon ein,zweimal meine gedanken bezüglich des kurses gepostet,aber irgendwie steigt keiner darauf ein ;-)

habe diesbezüglich etwas neues gefunden......aber vlt. interessiert es ja auch keinen *eingeschnapptist* ;-)

na....könnte wer vlt. heute die shortzahlen besorgen.

muß gleich zum POKALFINALE ..... und wenn sollten wir gewinnen,kann es sein das ich heute ...morgen,oder die nächsten 2 wochen nen prob mit dem posten habe *fg*

www.amprogram.com

A9 Thompson Creek ( TCM)

The cash flow that is TCM is attracting more interest.

It is possible a takeover is about to be announced. The stock had retreated to the $17 level before climb

ing about $7 in the past few weeks.

Something may be afoot.

B U.S. Large Cap Trend ( and the trend IS a friend of THE AMP