Kursziel 1 USD bis 31.12.2010

Das sollte denke ich schwer werden. Ich glaube, dass der Kurs morgen stark zulegen wird, denn für Risikofreudige Spekulanten, wäre morgen der letzte Versuch für einen annähernd guten Kurs einzusteigen!

Da wir außerbörslich bei 0,30 Euro Cent sind, sollte es schwer werden.

Ich lege aber im Falle der 0,29 auch nochmal dick nach :-D

http://www.fool.com/investing/general/2010/07/30/...ide-is-a-buy.aspx

sekko1982

YRCW- YRC Worldwide Inc.

YRC Worldwide, through wholly owned operating subsidiaries offers its customers a range of transportation services. These services include global, national and regional transportation, as well as logistics.You might have seen its Yellow and Roadway trucks on the highway.

YRC is a Fortune 500 company with a stock price of 39 cents a share. This is a huge company and its stock price should be much higher than that. But there are chances of it going bankrupt. Investors are much active in YRCW and if this company survives, it will be a magic button giving heavy profits.

http://www.hotstockseveryday.com/2010/08/...ong-traders-abk-genz.html

da wurden ca, 65 Millionen zu Kursen von 0,1800 bis 0,1804 $$$ gehandelt

das hat doch mit irgend einem Deal zu tun....oder????

sekko1982

Schau doch mal bitte, was teilweise vor der http-Adresse steht?

Danke und Gruß

mir wäre aber lieber eine vernünftige Antwort !!!

oder darf man hier nicht über in der Vergangenheit liegende Dinge diskutieren ???

mich beschäftigen eben diese Aktionen von dem Nachbörslichen Handel.

der ganze 25.06.10 war sehr interessant...zum beispiel der ausergeöhnich hohe Handel an dem Tag und der seltsame Kursverlauf von ca, 0,1800 bis kurzzeitig 0,22 $$

und am gleichen Tag dan der merkwürdige Nachbörsliche Handel in dieser sehr engen Marge um 0,18$

und das wirft eben Fragen bei mir auf....(ich pers.sah da die ersten positiven Zeichen)

@Sekko

vielen Dank für Deine Einschätzung/Antwort

so war eben auch meine Vermutung

aber es gibt eben daüber nichts schwarz auf weiß...

Leute macht endlich Eure Augen auf. Solche eine Chance gibts nicht alle Tage. Das wird hier mit großer Wahrscheinlichkeit wie bei Infineon ablaufen = erst der Absturz und dann 1000% vom Allzeittief. Daher auch das längst formulierte Kursziel 1 USD!

Ich selber gebe keine Stücke unter 1 USD. Selbst dann ist das Unternehmen im Vergleich zu seinen Konkurrenten wie JB Hunt, Fedex oder UPS nicht marktkonform bewertet!

sekko1982

da laufen schon im Hintergrung Dinge ,die uns mit hoher Wahrscheinlichkeit äußert positiv überraschen werden.

@all

und jetzt der alte Spruch....der Kurs hat immer Recht....dann schaut doch bitte mal GENAU hin......

Hier sieht man, dass die letzten Zahlen besser ausgefallen waren, als erwartet wurde:

http://data.cnbc.com/quotes/YRCW/tab/5 (runterscrollen zur Grafik wo Q1 2010 steht)

sekko1982

sekko1982

creditor push the company to the wall, right?

who the creditors are here?

1. Bond Holders ( after Debt to Equity Swap) now they are share holders !

They can not push YRCW to file BK after DES !

2. The Banks - They provide 1 billion rollover credit line. They are very cooperative with YRCW and provide them the best possible rates of Interests.

3. Teamsters ( pension obligations, 7.60 usd/hour, 18 months non payment

advantage will expire in 12/2010 ). Teamsters can not push YRCW to file BK , because they will lost the future payments and their members will lost their check forever. Teamsters can cooperate on YRCW only !

They can demonstrate power, but only on paper....they can't do anything at all regarding YRCW BK !

SO WHO ELSE?

IF YRCW is EBIDTA Positive ...i simple can not see who can push YRCW to file BK !

those who play against YRCW are the WS crooks and competitors who want YRC market share !

they can influense the share price with strong short attack and naked short, plus brutal paid bashing...and that is it !

they drive the share price to level of BK already ! as you see ...most long capitulated already.

BUT those short sellers can not puh YRCW to file BK even if the share price is 0.05 !!

So if YRCW is EBIDTA positive...i simple do not see treators to YRCW future.please realize that YRCW start working with the biggest national logistic companies( the best 200 of the total of 2000) !this will grab additional market share for YRCW !

WE may see additional 40% increase of the year revenue over the next 12 months in fact after those logistic companies start sending customers to YRCW !! the distribution network will create 40% more business for YRCW according my calculations !

Those of you who invest 100 000 usd in YRCW at this level will make a million in 18 months....mark my words !!!

Siri was at the same situation. 0.05 USD share price, huge debt, operating loss for years...and now...12 months later is over 1 usd on profit of 0.01 per share ( eps = 0.01) ! siri have more than 3.89 billions of shares! YRCW have only 1 billion !

Siri have 2.4 billion revenue per year !

YRCW have 5 billions revenue per year !

Siri market cap is 3.8 billlions USD !

YRCW market cap is 150 millions usd !

Siri have 7.6 billion liabilities !

YRCW have only 1 Billion Debt and around 700 millions pension obligation !

THIS COMPANY WILL SURVIVE ...BELIEVE OR NOT....YRCW is reorganizing and those crooks will be surprised when they see the second Q results !!

the share price drop is all about the manipulations of wall street crooks. use it in your own adantage !!

Fundamentals are great...techical indicators are great...manipultion is at it highest level....!!

the reversal is close !!

good luck to all long investors

Blauwal bittet um Antwort.

Schönen Abend

gerade noch über google/finance reingekommen

To buy now: YRC Worldwide stock

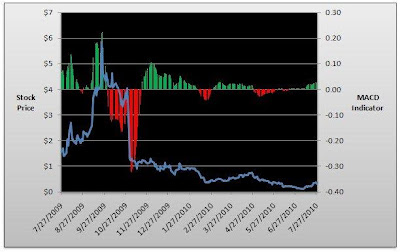

Written by Staff and Wire Reports Alerts Aug 1, 2010 There are many ways to interpret MACD, but a common interpretation is signal line crossover. Signal line crossover uses a series of moving averages (in this case, nine, 12, and 26 days) to look for bullish and bearish crossovers that indicate a stock has momentum in one direction or another.

Below, you can find a current chart of YRC Worldwide's MACD profile:

via fool.com

YRC Worldwide (NASDAQ:YRCW) has a price to free cash flow ratio of 14x based on a current price of $0.39 and a free cash flow per share of $0.03.

YRC Worldwide Inc. (YRC Worldwide) is a holding company. YRC Worldwide, through wholly owned operating subsidiaries offers its customers a range of transportation services. These services include global, national and regional transportation, as well as logistics. Its operating subsidiaries include YRC National Transportation, which is a reporting unit for the transportation service providers focused on business opportunities in the regional national and international markets; YRC Regional Transportation is the reporting unit for the transportation service providers focused on business opportunities in the regional markets; YRC Logistics plans and coordinates the movement of goods worldwide to provide customers a single source for logistics management solutions, and YRC Truckload (Truckload) reflects the results of Glen Moore, a provider of truckload services throughout the United States.

http://www.themarketfinancial.com/to-buy-now-yrc-worldwide-stock/28676

Gruß

p.