Pfizer: Viagra für unser Musterdepot

Während viele Pharma- und Biotechfirmen davon träumen, wenigstens einen Wirkstoff mit so genannten „Blockbuster-Qualitäten“ in ihrer Pipeline zu haben, kann der US-Konzern Pfizer von diesen Heilsbringern mit Umsätzen von jeweils über einer Milliarde US-Dollar gleich eine Vielzahl sein Eigen nennen.

Einzigartige Produktpipeline ...

Fundamental: Umsätze mit sieben der 25 weltweit meistverkauften Medikamente - darunter Lipitor, Zithromax, Celebrex, Zoloft und nicht zuletzt die laut Prinz Frederic von Anhalt „blauen Viagra-Wunderpillen“ - füllen die Kassen der New Yorker. Dabei hat der Konzern bei derzeit acht der insgesamt 43 Medikamente mit einem Umsatz jenseits der eine Milliarde US-Dollar-Schwelle und bei vier der bislang 16 Präparate mit einem Volumen jenseits der Zwei Milliarden US-Dollar-Schallmauer die Patentrechte inne. Wichtig hierbei: Im Gegensatz zu Konkurrenten wie Merck, Bristol-Myers Squibb oder Schering Plough, die aufgrund auslaufender Markenschutzrechte kürzlich reihenweise Gewinnwarnungen aussprechen mussten, ist das Portfolio von Pfizer noch bis zum Jahr 2007 abgesichert! Mehr noch: .... und beispiellose Forschungsaktivitäten sichern Führungsposition über Jahre hinaus ab

Neben der herausragenden Marktposition bei verschreibungspflichtigen Präparaten ist der Konzern auch darüber hinaus durch die dominierende Rolle im Tierarzneimittelgeschäft und seine beeindruckende Innovationskraft abgesichert. Das allein für dieses Jahr eingeplante Forschungsbudget ist dabei mit 5,3 Milliarden US-Dollar das größte der gesamten Industrie und soll bis 2006 zu mindestens 15 neuen Medikamenten führen - darunter gegen Migräne, Osteoporose, Epilepsie, Brustkrebs oder HIV. Dabei stellt Pfizer die enge Zusammenarbeit mit vielen Biotechunternehmen bei der Medikamentenentwicklung klar in den Bereich eines Hightech-Pharmaunternehmens und prädestiniert den Titel so für ein langfristig ausgelegtes Investment im NTI. Vor diesem Hintergrund sind die erwarteten Geschäftszahlen der nächsten Jahre mit einer vergleichsweise hohen Prognosesicherheit ausgestattet. Hierzu:

Während die Wettbewerber ihre Ambitionen zurückschrauben mussten, hat Pfizer seine Erwartungen für 2001 und dieses Jahr bestätigt und zusätzlich eine Dividendenerhöhung um 18 Prozent angekündigt!

Mittelfristig neue Höchststände

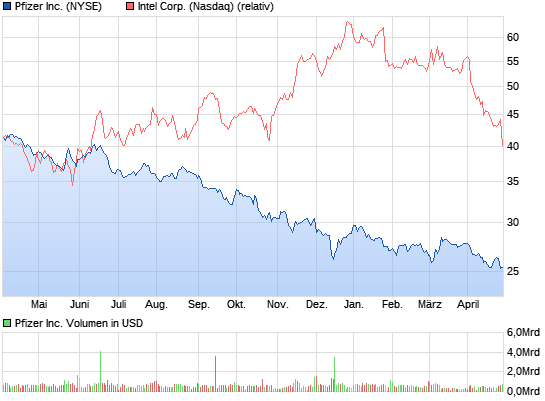

Charttechnisch: Auch aus technischem Blickwinkel bewegt sich Pfizer aktuell in soliden Gefilden. Der Unterstützungsbereich bei 43 bis 44 Euro dürfte genügend Halt für einen erneuten Anlauf an die Abwärtstrendlinie bei aktuell 50 Euro geben, bevor nach dessen nachhaltigem Überwinden dann sogar neue historische Höchstkurse in Aussicht stehen. Diese Einschätzung unterstützen auch die markttechnischen Indikatoren RSI und Stochastik, die jetzt beide auf überverkauften Niveaus Stabilisierungsanzeichen aufweisen. Order: Wir kaufen deshalb unmittelbar am Dienstag, den 15. Januar zur Eröffnung in Frankfurt 70 Pfizer-Aktien (WKN 852 009) für unser dynamisches Musterdepot und fassen anschließend einen Stoppkurs von 41,80 Euro ins Auge.

(Probeabo NewTec-Investor)

Schaut Euch die Pipelines auf den Investor Relations Seiten der Headquarters an. P. bietet ein bisserl wenig. Wird wohl wieder zukaufen müssen - am besten AMGEN. Dann hat P. endl. auch mal Biotech.

Roche ist hier interessant. Und Novartis. Allerdings kommt diese Aktie selten aus der Hüfte.

runterblättern dort...

Nun PFE hat hunderte Millionen USD Cash in der Kriegskasse. Mal sehen, wen sie kaufen wollen und zu welchem Preis.

6:33 [PFE] Pfizer Q4 adjusted earnings 65C vs 50C

6:33 [PFE] Pfizer plans additional cost savings of $2B by 2011

6:32 [PFE] Pfizer Q4 revenue $12.3B vs $12.9B

6:33 [PFE] Pfizer Q4 earnings 4C vs 40C

NEW YORK, Jan 26, 2009 (BUSINESS WIRE) -- --Fourth-Quarter 2008 Reported Diluted EPS of $0.04 Compared with $0.40 in the Year-Ago Quarter, Reflecting a $2.3 Billion Charge Resulting from an Agreement in Principle to Resolve Previously Disclosed Investigations

--Fourth-Quarter 2008 Adjusted Diluted EPS(1) of $0.65 Compared with $0.50 in the Year-Ago Quarter

--Achieves Full-Year 2008 Revenue and Adjusted Diluted EPS(1) Guidance; Reports $2.8 Billion in Adjusted Total Cost(2) Reductions During 2007 and 2008, Exceeding Target

--Announces New Cost-Reduction Program Targeting Additional Net Savings of $2 Billion by 2011; New Program plus Just-Completed Program have Potential to Yield Cost Savings of about $4.8 Billion

Pfizer Inc (PFE) :

($ in millions, except per share amounts)

Fourth-Quarter Full-Year

2008 2007 Change 2008 2007 Change

Reported Revenues $ 12,346 $ 12,870 (4%) $ 48,296 $ 48,418 --

Reported Net Income 266 2,724 (90%) 8,104 8,144 --

Reported Diluted EPS 0.04 0.40 (90%) 1.20 1.17 3%

Adjusted Revenues(1) 12,311 12,795 (4%) 48,341 48,209 --

Adjusted Income(1) 4,389 3,402 29% 16,366 15,113 8%

Adjusted Diluted EPS(1) 0.65 0.50 30% 2.42 2.18 11%

See end of text prior to tables for notes.

Pfizer Inc (PFE) today reported financial results for fourth-quarter and full-year 2008. For fourth-quarter 2008, the Company recorded reported revenues of $12.3 billion, a decrease of 4% compared with the year-ago quarter. This decrease was primarily attributable to the negative impact of the loss of U.S. exclusivity for Zyrtec in January 2008, and for Camptosar in February 2008, as well as the loss of exclusivity for Norvasc in Korea and Japan in February 2008 and July 2008, respectively. Zyrtec, Camptosar and Norvasc fourth-quarter 2008 revenues decreased by $515 million ($263 million, $144 million and $108 million, respectively), compared with the year-ago quarter. In addition, foreign exchange unfavorably impacted reported revenues by approximately $380 million or 3%, partially offset by the solid performance of key products.

U.S. reported revenues were $5.3 billion in fourth-quarter 2008, a decrease of 8% compared with the year-ago quarter. International reported revenues were $7.1 billion, a decrease of 1% compared with the year-ago quarter, and reflect operational growth of 5%, which was more than offset by the unfavorable impact of foreign exchange of 6%. U.S. reported revenues accounted for 43% of the total compared with 44% in the year-ago quarter, while international reported revenues accounted for 57% of the total compared with 56% in the year-ago quarter.

For fourth-quarter 2008, Pfizer posted reported net income of $266 million, a decline of 90% compared with the prior-year quarter, and reported diluted EPS of $0.04, a decrease of 90% compared with the prior-year quarter. Fourth-quarter 2008 results were impacted by a $2.3 billion pre-tax and after-tax charge resulting from an agreement in principle with the Office of Michael Sullivan, the United States Attorney for the District of Massachusetts, to resolve previously disclosed investigations regarding allegations of past off-label promotional practices concerning Bextra, as well as other open investigations. In addition, results were unfavorably impacted by an increased effective tax rate, as well as an increase in pre-tax charges of $1.2 billion ($700 million after-tax) associated with cost-reduction initiatives, which were partially offset by savings from those initiatives.

For full-year 2008, Pfizer recorded reported revenues of $48.3 billion, essentially flat compared with 2007 full-year revenues of $48.4 billion, despite the loss of exclusivity of Norvasc, Zyrtec and Camptosar, which collectively decreased revenues by $2.6 billion. Full-year revenues were favorably impacted by foreign exchange of approximately $1.6 billion, or 3%, and the solid performance of many key products. U.S. reported revenues were $20.4 billion, a decrease of 12% year over year, while international reported revenues were $27.9 billion, an increase of 10%, reflecting the favorable impact of foreign exchange of 6% and operational growth of 4%. U.S. reported revenues accounted for 42% of the total compared with 48% in the year-ago period, while international reported revenues accounted for 58% of the total compared with 52% in the year-ago period.

For full-year 2008, the Company posted reported net income of $8.1 billion, essentially flat compared with the prior year, and reported diluted EPS of $1.20, an increase of 3% compared with $1.17. This was primarily attributable to savings associated with our cost-reduction initiatives, the 2007 after-tax charges of $1.8 billion related to the decision to exit Exubera and the favorable impact of foreign exchange, offset by the aforementioned charge related to Bextra and other open investigations in fourth-quarter 2008, as well as the after-tax charge of $640 million resulting from the agreements in principle to resolve certain litigation involving the Company's non-steroidal anti-inflammatory (NSAID) pain medicines in third-quarter 2008 and an increased effective tax rate.

Adjusted Revenues(1), Adjusted Income(1) and Adjusted Diluted EPS(1) Results

For fourth-quarter 2008, Pfizer posted adjusted revenues(1) of $12.3 billion, a decrease of 4% compared with $12.8 billion in the year-ago quarter. For full-year 2008, Pfizer posted adjusted revenues(1) of $48.3 billion, essentially flat compared with $48.2 billion in full-year 2007. Adjusted revenues(1) in both periods were positively impacted by the solid performance of key products, and negatively impacted by the loss of exclusivity of Norvasc, Zyrtec and Camptosar. In addition, foreign exchange unfavorably impacted fourth-quarter 2008 revenues compared with the year-ago period by $389 million, but favorably impacted full-year 2008 revenues by $1.6 billion compared with the prior year.

Fourth-quarter 2008 adjusted income(1) was $4.4 billion, an increase of 29% compared with $3.4 billion in the year-ago quarter, and adjusted diluted EPS(1) was $0.65, an increase of 30% compared with $0.50 in the year-ago quarter. Both adjusted income(1) and adjusted diluted EPS(1) were positively impacted by savings associated with our cost-reduction initiatives and higher fourth-quarter 2007 spending levels in comparison with fourth-quarter 2008, partially offset by an increase in the effective tax rate. Full-year 2008 adjusted income(1) was $16.4 billion, an increase of 8% compared with $15.1 billion in the year-ago period, and adjusted diluted EPS(1) was $2.42, an increase of 11% compared with $2.18. Full-year 2008 adjusted income(1) and adjusted diluted EPS(1) were primarily impacted by the favorable impact of foreign exchange and savings from cost-reduction initiatives.

Reported and adjusted diluted EPS(1) were also positively impacted by the full benefit of Pfizer's purchase of $10.0 billion of the Company's common stock in 2007.

Executive Commentary

"We are pleased with our performance in 2008," said Chairman and Chief Executive Jeff Kindler. "We achieved our financial objectives, including exceeding our cost-reduction target, despite the tumultuous global economy. Notwithstanding an extremely competitive and increasingly challenging environment in 2008, we made significant progress by: establishing customer-focused business units; reprioritizing and refocusing our research on the greatest opportunities for scientific, medical and commercial success; and increasing our Phase 3 portfolio by approximately 60%, from 16 to 26 programs at year-end. These successes have provided the ideal platform from which we're advancing Pfizer forward."

mit der pfizer-aktie hat man nun beides auf einen schlag: generika und pharma.

leider habe ich momentan keine traute sie mir in`s depot zu legen :-(

aber - man muss es zur kenntnis nehmen. was ist nun mit pfizer? sind die schon runtergestuft worden?!

Pfizer übernimmt den Konkurrenten Wyeth (WKN: 850229) für 68 Mrd. US-Dollar. Belastend wirkte, dass die beiden Ratingagenturen Moody`s und Standard & Poor`s eine Abstufung des AAA-Ratings von Pfizer erwägen. Als Begründung wird die durch die Übernahme deutlich verschlechterte Verschuldungssituation von Pfizer genannt.

Pfizer: Goldman Sachs lobt stabilen Ertragsstrom

New York (BoerseGo.de) - Defensive Aktien sind derzeit bei den skeptischen Analysten schwer angesagt. Das gilt auch für Pfizer. (News/Aktienkurs) Der Pharmariese (Viagra) wurde heute bei Goldman Sachs (News) mit „Kaufen“ wieder aufgenommen. Gelobt wurde die Dividendenrendite und der Freie Cashflow. Der künftig Ertragsstrom erscheine stabil.

Pfizer gewinnt 0,6 Prozent auf 12,57 Dollar.