Affimed Therapeutics B.V. - AFMD

Seite 29 von 68 Neuester Beitrag: 21.05.25 14:43 | ||||

| Eröffnet am: | 16.09.14 15:03 | von: NikGol | Anzahl Beiträge: | 2.697 |

| Neuester Beitrag: | 21.05.25 14:43 | von: Highländer49 | Leser gesamt: | 678.034 |

| Forum: | Hot-Stocks | Leser heute: | 36 | |

| Bewertet mit: | ||||

| Seite: < 1 | ... | 26 | 27 | 28 | | 30 | 31 | 32 | ... 68 > | ||||

Virtual Hiring of the C-Suite

Our CEO, Adi Hoess, was featured in this month's @PharmExec leadership column. Read about how he's navigated virtual hiring during #COVID19. https://t.co/8P2G2Kyhdr

— Affimed (@affimed) July 9, 2020

Vielleicht ein Lockaufruf für weitere Bieter in einem drohenden Buyout durch Genentech?

Meine Spekulation - KEINE Handelsempfehlung.

leider ohne Hinweis auf Genentech (still pending S.20)

Aber wie passen dann das ATM im Zusammenhang mit den Blockkäufen in letzter Zeit zusammen?

Die Giftpille war / ist so ausgelegt, dass eine feindliche Übernahme am Markt bislang durch die Ausgabe von Vorzugsaktien ausgestoppt werden konnte. Diese Möglichkeit ist laut Tagesordnung nun nicht mehr erforderlich.

Gleichzeitig hat man in den Verträgen der Aufsichtsrats- und Managementmitglieder eine 'change of control' Passage aufgenommen, die Ihnen grosszügige Kompensationen im Falle der Übernahme gewährt.

All diese Änderungen ab der Hauptversammelung Anfang August scheinen tatsächlich auf eine leichteren Eigentümerwechsel bei entsprechenden Angeboten hinzudeuten.

Meine Meinung - KEINE Handelsempfehlung.

Noch ohne offizielle Meldung und keine Handelsempfehlung von mir.

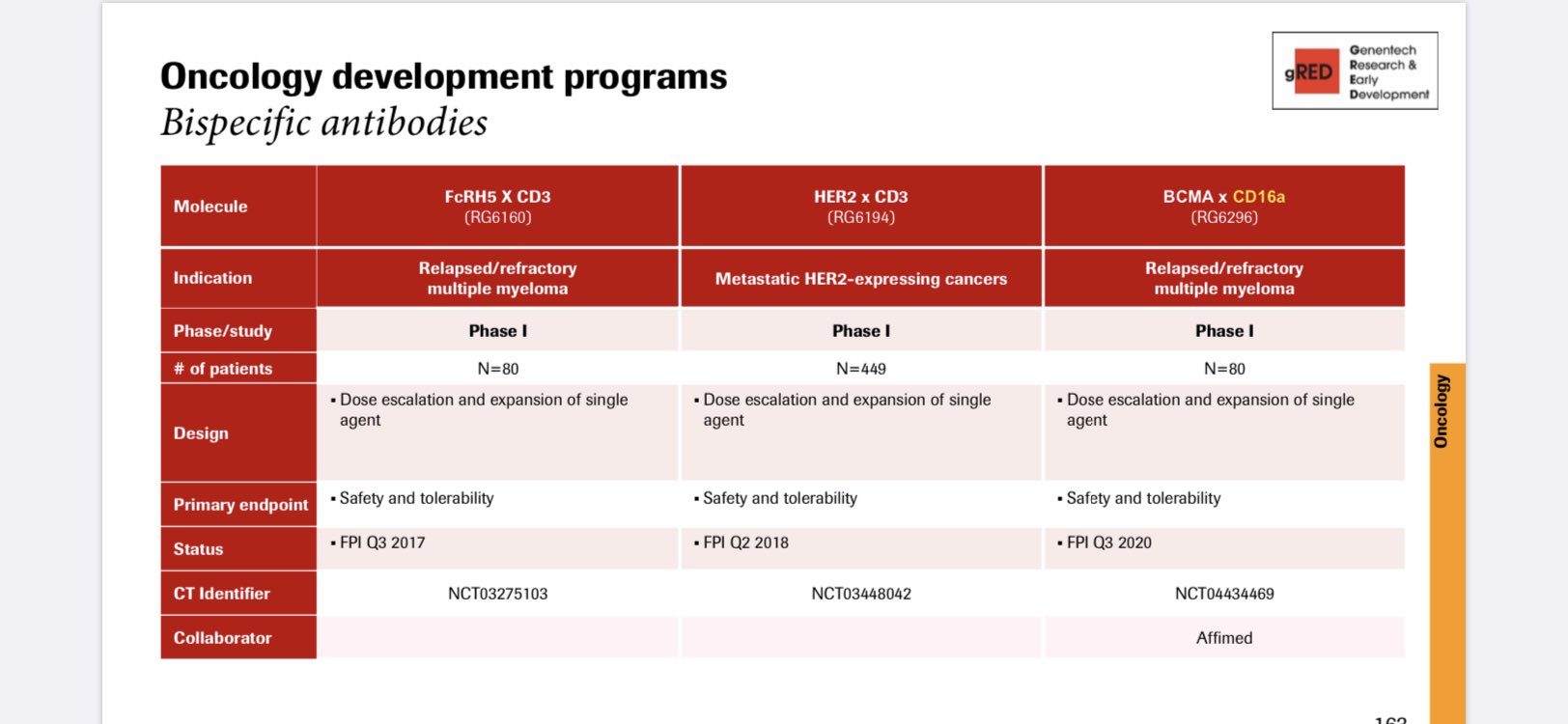

Quelle: Roche

https://www.roche.com/dam/...-4708-a376-6780b2735e5d/en/irp200723.pdf

Zur Info - KEINE Handelsempfehlung

Zur Info - KEINE Handelsempfehlung.

Affimed Reports Second Quarter 2020 Financial Results and Operational Progress

Continued progress in the AFM13 pTCL REDIRECT monotherapy study

AFM24 is recruiting patients in cohort 2 of a Phase 1/2a clinical trial

Genentech’s RO7297089 is actively recruiting patients into a first-in-human Phase I trial resulting in the achievement of a milestone payment under the terms of the collaboration

Data on AFM24 and RO7297089 (formerly AFM26) were presented at the virtual AACR II conference in June

Angus Smith joins the company as Chief Financial Officer

Dr. Annalisa Jenkins and Harry Welten added to the Supervisory Board

€92.6 million of cash, cash equivalents and current financial assets as of June 30, 2020, providing anticipated cash runway into the first half of 2022

Conference call and webcast scheduled for August 11, 2020 at 8:30 am EDT (14:30 CET)

Heidelberg, Germany, August 11, 2020 – Affimed N.V. (Nasdaq: AFMD), a clinical-stage immuno-oncology company committed to giving patients back their innate ability to fight cancer, today reported financial results for the second quarter 2020 and provided an update on clinical and corporate progress.

“Affimed’s first half performance demonstrates the strength of the new management team and our ability to stay focused on executing our business strategy despite the continuing challenge of the COVID-19 environment. Always with the patient in mind, we are committed to advancing our pipeline as well as continuing to deepen our research to unlock the full potential of the innate immune system to fight cancer,” said Dr. Adi Hoess, CEO of Affimed. “We have multiple Innate Cell Engager (ICE®) programs in clinical development, both partnered and wholly-owned, which are the basis for providing a cadence of a continuous data output in 2020 and 2021.”

Development Program Updates

AFM13 (CD30/CD16A)

Affimed has now successfully activated 54 clinical study sites in 10 countries in the on-going Phase 2 registration-directed study of AFM13 as monotherapy in relapsed or refractory patients with CD30-positive peripheral T-cell lymphoma (pTCL). The study follows a two-stage Simon design with a preplanned interim analysis after 40 patients. At the current recruitment rate the company expects the readout of the interim analysis to happen in mid-2021.

The investigator-sponsored Phase 1 study with the University of Texas, MD Anderson Cancer Center (MDACC), which investigates the combination of AFM13 with allogeneic NK cells in CD30+ Lymphomas, has completed the required validation work in order to administer a stable complex of AFM13 pre-mixed with cord blood-derived allogeneic NK cells. MDACC has recently posted this study as enrolling on its website and it is expected to recruit patients as soon as the COVID-19 conditions in Texas permit.

AFM24 (EGFR/CD16A)

AFM24-101, a first-in-human Phase 1/2a clinical trial of AFM24, the EGFR/CD16A targeted innate cell engager for relapsed/ refractory patients with advanced EGFR-expressing solid tumors continues to recruit according to plan in cohort 2.

AFM24-101 is an open-label, non-randomized, multi-center, multiple ascending dose escalation/expansion study to evaluate AFM24 as monotherapy in adult patients with advanced solid malignancies known to be EGFR-positive.

No dose limiting toxicity was observed in dose cohort 1.

A preclinical poster presentation was shown at the virtual AACR II conference in June on AFM24, demonstrating that it is differentiated from all other EGFR targeting entities: (i) it appears safe - no skin toxicity or other dose limiting toxicities (DLTs) in cynomolgus monkeys, (ii) it addresses a broad patient population – AFM24 targets EGFR independent of its mutational status, and (iii) in contrast to monoclonal antibodies, AFM24 strongly activates NK cells and macrophages.

Genentech Collaboration Update

The Genentech-partnered, novel BCMA-targeted innate cell engager for the treatment of multiple myeloma has now entered a first-in-human Phase I, open-label, multicenter, global dose-escalation study designed to evaluate the safety, tolerability, and pharmacokinetics of RO7297089. The milestone was achieved in the third quarter and triggers a payment in an undisclosed amount to Affimed, which is expected to be recognized in the Company’s third quarter 2020 financial statements.

At the June virtual AACR II conference, a preclinical poster presentation on RO7297089 showed potent cell killing in tumor cell lines employing NK cells as effector cells with minimal increase in cytokines. A 4-week safety study in cynomolgus monkeys showed a favorable safety profile with no cytokine release or adverse findings at the 15 and 50 mg/kg tested dose levels. Furthermore, time- and dose-dependent reductions in serum IgG levels and plasma cell markers were observed suggesting selective killing of BCMA positive cells by engaging CD16a positive immune cells.

Preclinical Pipeline Update

Progress continues on AFM28 and AFM32 towards late stage preclinical development.

Management Appointments

Angus Smith joined the company as Chief Financial Officer on July 13. Mr. Smith brings broad biopharmaceutical experience to the company including financial strategy and planning, capital markets, business development and operations. Mr. Smith’s appointment completes the planned additions to the management team which now includes Dr. Andreas Harstrick, Chief Medical Officer and Dr. Arndt Schottelius, Chief Scientific Officer.

Additions to the Supervisory Board

Dr. Annalisa Jenkins and Harry Welten were appointed to the Supervisory Board during the recent Annual General Meeting of Shareholders. Dr. Jenkins brings a wealth of expertise in advancing clinical programs through development and regulatory approval. Mr. Welten is an accomplished financial executive who is well suited to help drive value-creating strategies for the company. These additions to the Supervisory Board are expected to further strengthen the company’s industry know-how, experience and diversity.

Second Quarter 2020 Financial Highlights

(Figures for the second quarter ended June 30, 2020 and 2019 are unaudited.)

As of June 30, 2020, cash, cash equivalents and current financial assets totaled €92.6 million compared to €104.1 million on December 31, 2019. During the quarter, the company received net proceeds of approximately €20.8 million under its at-the-market (“ATM”) program.

Based on its current operating plan and assumptions, Affimed anticipates that its cash, cash equivalents and current financial assets will support operations into the first half of 2022.

Net cash used in operating activities for the quarter ended June 30, 2020 was €15.0 million compared to €5.6 million in the second quarter of 2019. The second quarter 2019 net cash used in operating activities included a milestone payment to the company from the Genentech collaboration.

Total revenue for the second quarter of 2020 was €2.9 million compared with €4.0 million in the second quarter of 2019. Revenue in 2020 and 2019 predominantly relate to the Genentech collaboration (2020: €2.7 million, 2019: €3.7 million). Revenue from the Genentech collaboration in the second quarter 2020 was comprised of revenue recognized for collaborative research services performed during the quarter.

R&D expenses for the second quarter of 2020 were €11.7 million compared to €11.5 million in the second quarter of 2019. Expenses in 2020 relate predominantly to our AFM13 and AFM24 clinical programs as well as to our early stage development and discovery activities.

G&A expenses for the second quarter of 2020 were €2.6 million compared to €2.3 million in the second quarter of 2019. The increase is primarily related to higher Sarbanes-Oxley compliance costs, as well as an increase in legal, consulting and audit costs.

Net loss for the second quarter of 2020 was €12.2 million or €0.16 per common share. For the second quarter of 2019, the company’s net loss was €10.3 million or €0.17 per common share.

Weighted number of common shares outstanding for the quarter ended June 30, 2020 were 79.2 million.

Affimed encourages shareholders to also review its 6-K filing for the quarter ended June 30, 2020, as filed with the United States Securities and Exchange Commission.

Note on International Financial Reporting Standards (IFRS)

Affimed prepares and reports consolidated financial statements and financial information in accordance with IFRS as issued by the International Accounting Standards Board. None of the financial statements were prepared in accordance with Generally Accepted Accounting Principles in the United States. Affimed maintains its books and records in Euro.

Conference Call and Webcast Information

Affimed will host a conference call and webcast today, Tuesday, August 11, 2020 at 8:30 a.m. EDT to discuss second quarter 2020 financial results and recent corporate developments. The conference call will be available via phone and webcast.

To access the call, please dial +1 (646) 741-3167 for U.S. callers, or +44 (0) 2071 928338 for international callers, and reference passcode 8855368 approximately 15 minutes prior to the call.

A live audio webcast of the conference call will be available in the “Webcasts” section on the “Investors” page of the Affimed website at https://www.affimed.com/investors/webcasts_cp/. A replay of the webcast will be accessible at the same link for 30 days following the call.

About Affimed N.V.

Affimed (Nasdaq: AFMD) is a clinical-stage immuno-oncology company committed to giving patients back their innate ability to fight cancer. Affimed’s fit-for-purpose ROCK® platform allows innate cell engagers to be designed for specific patient populations. The company is developing single and combination therapies to treat hematologic and solid tumors. The company is currently enrolling patients into a registration-directed study of AFM13 for CD30-positive relapsed/refractory peripheral T cell lymphoma and into a Phase 1/2a dose escalation/expansion study of AFM24 for the treatment of advanced EGFR-expressing solid tumors. For more information, please visit www.affimed.com.

Forward-Looking

https://finance.yahoo.com/news/...-cohen-pulls-trigger-193037220.html

wiederholt von drei renommierten Analysten (Leerink $8, BMO $6, Laidlaw $10) in den letzten 3 Monaten

ist jetzt offiziell in der Patientenrekrutierung via MD Anderson.

Wenn die Kombination so effektiv und sicher wie erwartet dosiert werden kann, könnte diese Kombination von allogenen Immunzellen mit den zielgerichteten Engagern von Affimed das wegweisende Verfahren werden. Im Gegensatz zu den genmanipulierten Zelltherapien wird es hier möglich auf einer definierten Ausgangsdosis wiederholt weitere und sogar andere zielführende Moleküle je nach Verlauf der Therapie einzusetzen. In Kombination mit anderen Modulationen des Tumormileaus zum Beispiel via Checkpoint-Inhibitoren wie Keytruda von Merck dürften die Möglichkeiten (auch für kommerzielle Partnerschaften) nahezu grenzenlos sein.

Aktuell sind Anti-CD47 und TGF-Beta zwei weitere systemische Modulationen, die insbesondere bei Festtumoren hilfreich für eine starke und anhaltende Immunreaktion sein könnten und bei denen Affimed CD16a Moleküle die Immunzellen gezielt in die Nähe der Tumorzellen lenken und somit für eine besser lokalisierte, stärkere aber auch sichere Anwendung sorgen dürften.

Meine Meinung - KEINE Handelsempfehlung.

Date: Wednesday, September 9, 2020

Presentation Time: Fireside chat with Dr. Jim Birchenough at 8:00 a.m. Eastern Time

Citi’s 15th Annual BioPharma Virtual Conference (September 8-11, 2020)

Date: Wednesday, September 10, 2020

Affimed will host meetings with investors at the conference

Cantor Fitzgerald Virtual Global Healthcare Conference 2020 (September 15-17, 2020)

Date: Thursday, September 17, 2020

Presentation Time: 12:40 p.m. Eastern Time

Oppenheimer Fall Healthcare Life Sciences and Med Tech Summit (September 21-23, 2020)

Date: Monday, September 21, 2020

Presentation Time: 3:20 p.m. Eastern Time

Location: Virtual

Webcasts of each presentation may be accessed on Affimed’s website at https://www.affimed.com/investors/webcasts_cp/

und die 5er Zone hat sich doch als unüberwindbar erwiesen. Irgendwie sehen die charts

auf den verschiedenen Zeitebenen auch ziemlich zäh aus und ich kann nur hoffen, dass

wir uns so um die 3 halten können und nicht noch eine Etage runterrasseln. Da ich gerne

auf die längere Zeitebene schaue und mit Affimed noch ganz gut im Plus bin, bleibt es

jedenfalls im Depot. Was mir immer noch gefällt: Dass wir im Monatschart über dem

38er Expodurchschnitt sind und der MACD immer noch im positiven Bereich ist.

Affimed gab bekannt dass das Management auf der Jefferies Virtual Cell Therapy Conference am Dienstag kommender Woche, 6-ten Oktober um 8:00 a.m. Eastern Time eine Präsentation mit webcast abhalten wird.

Dies ist natürlich interessant, da Affimed bislang nicht als Zelltherapie sondern als BiSpecific Antibody Engager Firma aufgetreten ist. Damit wird dann wohl die Studie mit MD-Anderson zu pre-mix NK-Zellen im Fokus stehen und man kann nun spekulieren, ob vielleicht ein weiterer NK-Zellen Partner gesucht oder gar vorgestellt werden wird.

Meine Spekuklationen - KEINE Handelsempfehlung.

- vorbörslich im Plus

https://www.affimed.com/...nation-with-the-innate-cell-engager-afm13/

Welchen Stellenwert hat AbCheck? Der garantierte Betrag ist ja auch nicht so hoch, allerdings von Tschechien, was von meiner Laienwahrnehmung auch nicht finanziell so stark zu sein scheint. Warum macht Tschechien das und andere Länder nicht? Und wo liegt die Bedeutung finanziell aber auch materiell (forschungstechnisch) für AFMD?

Sorry, wenn ich frage, aber so einfach erschließt sich mir das nicht ...