Jiangbo Pharmaceuticals (ehem. GNPH) - A0RNJB/JGBO

Cash/share 7.50$ !!!!!!!!!

Das transition jahr ist forbei..die GMP rezertifizierung ist durch...das muss nur alle 5 Jahre gemacht werden..deswegen standen die pillenmaschinen still...aber seit 4 monaten ballern die wieder pillen raus... :-)

Ihr werdet sehen die nächsten Quartalszahlen werden gut sein...

Kursziel ? Das ist schwer zu sgane, ich hoffe das NASDAQ uplisting wird bald wahr und dann weiss der Herrgott... :-)

Rino lief von 10-35€ bei uplisting in nur ein paar wochen....

Aber sei beruhight bei 7.50$cash/Aktie und soviel potential kann hier eigentlich nicht viel schiefgehen.

Übrigens war JGBO war schonmal bei 14$ !

With a forward P/E between 2 and 3 and $85M in cash, Jiangbo is priced for bankruptcy at $113 million and it is nowhere close considering it has been growing both top and bottom lines at 50% annually.

http://www.thestreet.com/story/10553499/2/...hinese-pharma-plays.html

"OTCBB-listed Jiangbo Pharma is also currently preparing to list on the Nasdaq within the next six to 12 months, Sung said. "

Jiangbo Pharma aims high as health care reform rolls out - CFO

Shanghai April 24

By Karl Zhong, Interfax

Jiangbo Pharmaceuticals Inc., a U.S.-incorporated pharmaceutical company that operates primarily in China and was formerly known as Genesis Pharmaceuticals Enterprises Inc.,is well positioned to benefit from the health care reform given its sound pharmaceutical marketing network and expanded product portfolio, according to Elsa Sung, the company's chief financial officer.

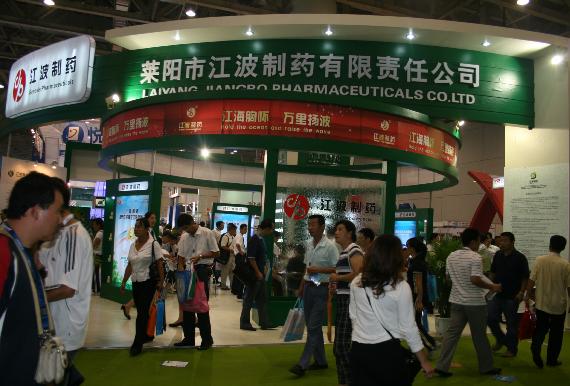

In January this year, the company's wholly-owned subsidiary Laiyang Jiangbo Pharmaceutical Co. Ltd. entered into an asset transfer agreement with Hongrui Pharmaceuticals Co. Ltd. for the purchase of most of Hongrui Pharma's assets, including the production rights to 22 types of traditional Chinese medicines (TCM), at a deal price of RMB 110 million ($16.11 million).

“The acquisition has expanded our product portfolio. Two of the TCM medicines in particular, a drug to treat bone marrow inflammation and a cough suppressant, have great market potential,” Sung said.

According to Sung, the Chinese government's expansion of the new rural cooperative medical insurance program as part of the health care reform will help to promote the company's TCM sales.

Jiangbo Pharma expects to generate fast growth sales for the TCM products by leveraging on its sound marketing network, which consists of 470 full-time sales representatives and 620 part-time representatives in 30 provinces, cities and regions across China.

“Regional distributors are more familiar with the situation in their local markets. Jiangbo Pharma will benefit by working closely with these distributors, especially in the future when essential drugs [which are commonly purchased generic drugs that patients receive reimbursements for under their medical insurance] are distributed on a regional basis,” Sung said. The company recently lowered its wholesale prices in a bid to motivate regional distributors to improve sales.

While maintaining sales of its existing products and growing the market shares of new products form Jiangbo Pharma's short-term strategy, Sung said the company is looking towards merger and acquisition (M & A) deals and strengthening its research and development (R & D) efforts in the long run.

More M & A opportunities have opened up as a result of the economic downturn and the company is eyeing drug developers that hold the rights to national class one or two new drugs, the highest levels of innovation in China, according to Sung.

With regards to R & D efforts, Jiangbo Pharma put about 3.34 percent of its sales revenue towards R & D in the second half of last year, considerably higher than what many other generic drug manufacturers in China allocated to R & D. “We have been working with Shandong University and the Chinese Academy of Sciences (CAS) on new drug development, which gives us priority in commercializing the products they develop,” Sung said.

At the moment, the company has three drugs that are awaiting final approval from the State Food and Drug Administration (SFDA), including Bezoar Yijin tablets to treat inflammation, felodipine sustained-release tablets for hypertension, and Yuandu Hanbi capsules to relieve arthritis pain.

OTCBB-listed Jiangbo Pharma is also currently preparing to list on the Nasdaq within the next six to 12 months, Sung said.

Jiangbo Pharma is located in an economic development zone in Shandong Province's Laiyang City and produces both western and TCM drugs. Its sales revenue amounted to $60.5 million in the second half of last year, up 40.2 percent from the same period of the previous year.

Links:

http://www.interfax.cn/news/9277/

http://messages.finance.yahoo.com/...id=5910&tof=1&frt=2#5910

In zwei Wochen kommen die Zahlen und ich denke die werden wieder besser aussehen...war ja Produktionsstop wegen der Rezertifizierung.. (siehe post 153)

Contract for Transfer of State-owned Construction Land Use Right

http://www.sec.gov/Archives/edgar/data/1091164/.../v177867_ex10-1.htm

Sellers gone...holding nice..lowfloater..STILL VERY CHEAP !!!

12mill O/S ... uplisting possible soon...next quater will be better than last because they had to recertify their pillfatory !! :-)

Unknown turd moving on low traffic...LOL !!!!

http://stockcharts.com/c-sc/...amp;dy=0&i=p36196962615&r=1674

Factory nicht Fatory... ;-) Naja wegen Fabrik zu für 6 Wochen war vorletztes Quartal wegen der Rezertifizierung weniger Umsatz...aber die Pillenmaschinen laufen ja nun seit Dezember wieder... ;-)

Siehe oben schonmal gepostet (mit links) usw.. ich denke die Zahlen werden im nächsten Monat wieder besser aussehen..und noch traden wr hier zu Spottpreise...ehrlich...ich kenne das Ding hier wie meine Westentasche..sozusagen innen und Auswendig....

Wahrscheinlich denkt ihr ich bin hier nur am rumpushen aber NEIN guckt mal in die alten Threads...war schon zu GTEC/GNPH Zeiten dabei und durch den R/S durch der ja zum Uplisten dienen soll usw... Wird schon...wir sind weit über 5$ und die Anforderungen für NASDAQ uplisting sollten alle gegeben sein imo !

(Beispiele: RINO,NEP,CWS, usw...viele Chinesenaktien haben upgelistet) und bei JIANGBO könnte das durchaus klappen demnächst...oben lesen..mit links und allem.. So jetzt wieder gut, und Chart sieht auch gut aus ! (hält sich tapfer)

TSCHANGBO DJANGO !!! :-)

Boden sollte hier nun drin sein....

l8er bbb

.jpg)

sind wir ja schon lange drüber weg.. :-)

"Wahrscheinlich denkt ihr ich bin hier nur am rumpushen aber NEIN guckt mal in die alten Threads...war schon zu GTEC/GNPH Zeiten dabei und durch den R/S durch der ja zum Uplisten dienen sollte usw... Wird schon...wir sind weit über 5$ und die Anforderungen für NASDAQ uplisting sollten alle gegeben sein imo ! "

War ich mal wieder zu hektisch.... :-)

Bald kommen die Zahlen und die werden wieder besser aussehen.

Das letzte Quartal hat den kurs von 12 auf 7$ gedrückt das sind 5$ !!

Ohne uplisting (was trotzdem jeder Zeit kommen könnte) würden gute Zahlen sicherlich einen Kurssprung zurück auf 12$ auslösen..

IMO !

http://www.jiangbopharma.com/...&fir_lineid=79&sec_lineid=490

OTCBB-listed Jiangbo Pharma is also currently preparing to list on the Nasdaq within the next six to 12 months, Sung said.

Hm..sind ja kräftig am Händeschütteln.

Und auch das Video auf der Hauptseite der chin. Webpage MUSS man einfach gesehen haben !

Analyst Ratings

Buy 1

Outperform 0

Hold 0

Underperform 0

Sell 0

Consensus

Buy

(As of 04/23/2010)

Stock Snapshot

Friday's open $9.74

Thursday's close $9.20

52-week range

52-week high $14.50

52-week low $5.90

Market capitalization 108.9M

Avg. volume (10-day) 5.6K

Shares outstanding 12.0M

http://topics.nytimes.com/topics/news/business/...ises-inc/index.html