Der USA Bären-Thread

Seite 485 von 6257 Neuester Beitrag: 06.07.25 13:32 | ||||

| Eröffnet am: | 20.02.07 18:45 | von: Anti Lemmin. | Anzahl Beiträge: | 157.419 |

| Neuester Beitrag: | 06.07.25 13:32 | von: Frieda Friedl. | Leser gesamt: | 25.598.298 |

| Forum: | Börse | Leser heute: | 7.479 | |

| Bewertet mit: | ||||

| Seite: < 1 | ... | 483 | 484 | | 486 | 487 | ... 6257 > | ||||

Die Diskussion um Staatsfonds mit Beteiligungen an Infrastruktur-, Telekommunikation,

und sonstwie Staatssicherheit relevanten Unternehmen erledigt sich aus Chinasicht perfekt:

Warum um die Früchte streiten, wenn man den ganzen Baum haben kann?

Ich werd schon immer ungläubig angeguckt, wenn ich sage, das Inder und Chinesen uns mit Haut und Haaren fressen werden..., aber das ist erst die erste Minispitze des Eisberges.

Was das Klopapier anbetrifft (war von mir), so ist der Dollar nur deshalb noch Stabil, weil

die Währungsreserven der US-Gläubiger einfach nicht zu sehr schrumpfen dürfen...

(noch nicht...)

Housing Starts Oktober 2007: 1,23 million units (November 2007: 1,17 million units)

New Home Sales Oktober 2007: 728.000 units

Offenkundig werden immer noch weitaus mehr neue Häuser gebaut, als aktuell verkauft werden können. Der Überhang an neu gebauten, leer stehenden Einfamilienhäusern und Condos nimmt ständig zu. Mike Shedlock hat dafür eine interessante Erklärung: In der Hoffnung auf bessere Zeiten bauen die Unternehmen munter weiter auf Halde.

http://globaleconomicanalysis.blogspot.com/2007/...-homebuilders.html

Meine Vermutung: Sie warten darauf, dass die Chinesen kommen und ihnen die Halden abkaufen.

aber auch das nur eine Frage der Zeit

Art for Art's Sake - nur leider Brotlos...

Wawidu, zu deinem Posting #12105 passt ja folgendes Zitat ganz prima:

"Lennar plans to finish building 259 homes -- the first phase of a 1,100-unit development in Irvine -- but it has decided not to sell any of them until the constrained mortgage market and swollen housing inventory improves."I feel the same about that strategy today as I did then: "Sitting on homes until swollen housing inventory improves is begging for trouble."

In Ergänzung zu #12084 und zu den diskutierten Faktoren (Kreditverknappung, Zwangsversteigerungen, etc) folgende Überlegungen (die auf der verlinkten Page auch aufgeführt werden), weswegen die Hauspreise zwingend weiter fallen werden, auch wenn man vielleicht meinen könnte -15% sei schon viel:

1. Angebot und Nachfrage bestimmen den Preis auch am Häusermarkt. Besonders wenn sichs um Leichtbauhäuser wie in den USA handelt:

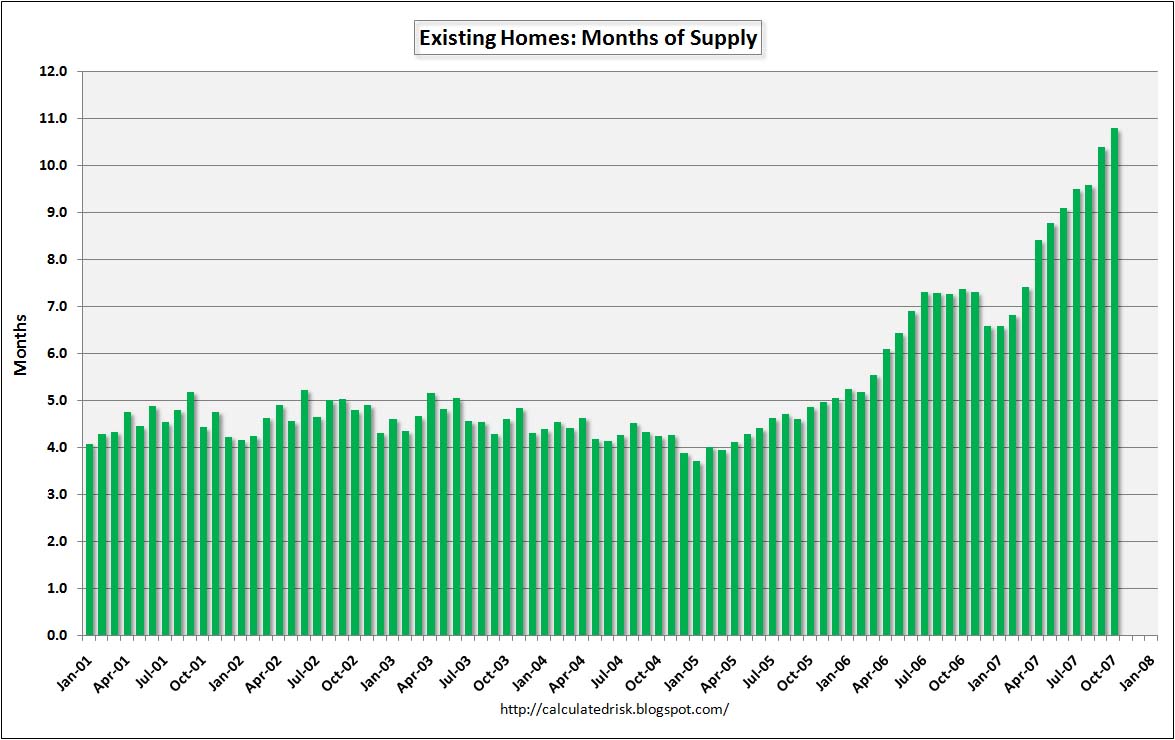

Hier das Angebot:

Passend dazu hier die Nachfrage:

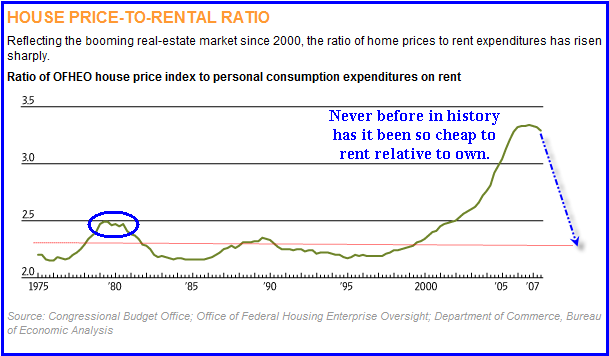

2. Lohnt es sich ein Haus zu kaufen, um es zu vermieten/anstatt es zu mieten?

Nein.

Die Mieteinnahmen stehen in historisch schlechter Relation zu den nötigen Investitionskosten.

Geht man von einem aktuellen Hauspreis von 440000 und einer langjährigen durchschnittlichen price-to-rental-ratio von 2,3 aus, werden "Schnäppchenjäger" sich erst wieder bei einem Hauspreis von um die 300000 für einen Hauskauf interessieren.

Wer jetzt vor der Wahl steht mieten oder kaufen, wird eher mieten... selbst wenn er genug Geld für den Kauf hätte.

3. Hoch verschuldete Häuser

Dies zeigt nochmals, wie viele Kredite schon bei geringen Verlust des Hauswertes in Bedrängnis kommen werden.

4. Homebuilder bauen auf Halde ;))

Die Hoffnung auf wieder steigende Hauspreise stirbt zuletzt. Dann ist es aber zu spät. Sobald Homebuildern die Liquidität ausgeht, bzw. neue Kredite so teuer für sie werden, dass einfach nichts mehr geht, werden sie diese Häuser evtl. unter Bauwert in Geld umwandeln müssen. Das wird die Krise weiter verschärfen.

Zum Abschluss nochmals diese Grafik, die deutlich zeigt, wieviel Potential nach unten es für die durchschnittlichen Hauspreise gibt:

U.S. Home Foreclosures Rise 68 Percent in November

Dec. 19 (Bloomberg) -- U.S. home foreclosures rose 68 percent in November from a year earlier and may surge in 2008 as adjustable-rate mortgages leave subprime borrowers unable to meet higher payments, according to data compiled by RealtyTrac Inc.

There were 201,950 foreclosure filings in November, including default notices, auction letters and bank repossessions, down 10 percent from October's total, RealtyTrac reported today. California, Florida and Ohio had the most filings and Nevada had the highest foreclosure rate.

Aber entscheidend wird sein

Foreclosures probably will surge next year as payments rise on about 1 million home loans, said Rick Sharga, executive vice president for marketing at RealtyTrac, an Irvine, California-based seller of foreclosure information with a database of more than 1 million properties.

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=az3LawfPTxCU

Dieser Artikel geht näher auf die FED-"Informationspolitik" ein, über die ich mich in diesem Herbst auch schon genug geärgert habe und die mich viel Geld gekostet hat.

http://www.marketwatch.com/news/story/feds-failure-communicate-adds-risk/story.aspx?guid=%7BCA25CE26%2D8C88%2D41D3%2D80D4%2D78EFB6999D97%7D

CAPITOL REPORT

Fed's failure to communicate adds to risks

Fed watchers critical of central bank's recent say-one-thing-do-another stance

WASHINGTON (MarketWatch) -- As the clouds of economic worry have moved over the nation since August, the Federal Reserve under Ben Bernanke has fumbled badly in realizing its objective to communicate clearly with the financial markets.

The result has been a deep nostalgia in financial markets for the old winks and nods contained in the inscrutable remarks of former Fed chief Alan Greenspan. But more importantly, Fed watchers charge the communication woes have caused the Fed to miss opportunities to bolster confidence, which could be a key factor in whether a downturn morphs into a recession. While the Fed has been steadily easing monetary policy, by one percentage point since the turmoil began, at the same time the central bank has been talking tough on inflation. This "verbal tightening" has undercut its actual policy easing, said Ethan Harris, chief U.S. economist at Lehman Brothers. "The market isn't sure whether the Fed is really going to provide help in an emergency and so there is a lingering question if they are ready to cut if the economy weakens substantially," Harris said. "The Fed has created that concern by continuing to focus on inflation and at times sounding like they were completely out of touch with what the markets are thinking." Lyle Gramley, a former Fed governor, now at Stanford Policy Research, agreed: "Right now, the Fed is having communications problems with the market...Markets are a little confused. It is this going-back-and-forth that bothers the market," he said. The do-one-thing-say-another pattern started in early August when the Fed, despite signs of distress in capital markets, held interest rates steady and announced a tough anti-inflation posture. But within a matter of days, the central reversed course and cut the discount rate.

The pattern has been repeated several times, most recently in November, when the Fed officials insisted they would not cut rates at the December meeting of the Federal Open Market Committee, even if the credit conditions deteriorated. But the FOMC, of course, eventually decided to cut rates.

Gramley said that financial market participants constantly ask him if the Fed "really gets" the credit crunch and if Bernanke is up to the job. In perhaps the biggest communications gaffe, the Fed was widely criticized for only cutting rates a quarter percentage point on Dec. 11. Then the next morning, the central bank introduced an innovative periodic auction of loans to banks. This announcement was met with applause and a market rally. "Something is strange," said Western Carolina University economist James F. Smith, a long-time Fed watcher. "The Fed probably could have saved a lot of grief if they had added something [about the auction plan] to their policy statement," on the previous day, he said. "It is a mystery why on earth they didn't do that. Undue market turmoil is not generally something the Federal Reserve System likes to create," he added. Analysts said it is crucial for the Fed to be more careful in their communications with the market. "The key here is confidence. They need to shore it up. The window is closing. They had a couple of chances and they may only have one more," said Mark Zandi, chief economist for Moody's Economy.com.

Consensus approach Fed watchers said the confusion may stem from the consensus nature of the Bernanke Fed. In contrast to the iron hand of Greenspan, Bernanke allows the committee debate to flow freely. "This Fed, because it is more consensus-oriented, is having a harder time finding its voice, Zandi said. Zandi said it appears that Bernanke is leaning towards easing while others on the central bank are not so keen to lower rates. "Maybe there is a lot of difference of opinion among Fed officials about what is happening in the economy and what ought to be done about it. When you have a committee process, that could lead to a failure to take a strong enough position," Gramley said. "I don't think this Fed can come to clear consensus quickly on being aggressive in response to the crisis, and, as such, I think the odds of a recession are higher than would otherwise be the case," Zandi said.

Einige Fakten in diesem Artikel sind sicherlich diskussionswürdig, andererseits weiss jeder von uns um die tägliche Verarsche ;-)))

Kommentare wilkommen :-)

The collapse of the modern day banking system

By Mike Whitney

Online Journal Contributing Writer

Stocks fell sharply last week on news of accelerating inflation which will limit the Federal Reserves ability to continue cutting interest rates.

Last Tuesday the Dow Jones Industrials tumbled 294 points following the Fed's announcement of a quarter point cut to the Fed Funds rate. On Friday, the Dow dipped another 178 points when government figures showed consumer prices had risen 0.8 percent last month after a 0.3 percent gain in October. The stock market is now lurching downward into a "primary bear market."

There has been a steady deterioration in retail sales, commercial real estate, and the transports. The financial industry is going through a major retrenchment, losing more than 25 per cent in aggregate capitalization since July. The real estate market is collapsing. California Gov. Arnold Schwarzenegger announced on Friday that he will declare a "fiscal emergency" in January and ask for more power to deal with the $14 billion budget shortfall from the meltdown in subprime lending.

Economists are beginning to publicly acknowledge what many market analysts have suspected for months; the nation's economy is going into a tailspin.

Morgan Stanley's Asia Chairman, Stephen Roach, made this observation in a New York Times op-ed on Sunday: "This recession will be deeper than the shallow contraction earlier in this decade. The dot-com-led downturn was set off by a collapse in business capital spending, which at its peak in 2000 accounted for only 13 percent of the country's gross domestic product. The current recession is all about the coming capitulation of the American consumer -- whose spending now accounts for a record 72 percent of G.D.P."

Most people have no idea how grave the present situation is or the disaster the country will face if trillions of dollars of over-leveraged bonds and equities begin to unwind. There's a widespread belief that the stewards of the system -- Bernanke and Paulson -- can somehow steer the economy through this "rough patch" into calm waters. But they cannot, and the presumption shows a basic misunderstanding of how markets work. The Fed has no magical powers and will not allow itself to be crushed by standing in the path of a market avalanche. As foreclosures and bankruptcies increase; stocks will crash and the Fed will step aside to safety.

In the last few weeks, Bernanke and Paulson have tried a number of strategies that have failed. Paulson concocted a plan to help the major investment banks consolidate and repackage their nonperforming mortgage-backed junk into a "Super SIV" to give them another chance to unload their bad investments on the public. The plan was nothing more than a public relations ploy which has already been abandoned by most of the key participants. Paulson's involvement is a real black eye for the Dept. of the Treasury. It makes it look as if he's willing to dupe investors as long as it helps his d Wall Street buddies.

Paulson also put together an "industry friendly" rate freeze that is supposed to help struggling homeowners avoid foreclosure. But the plan falls well short of providing any meaningful aid to the estimated 3.5 million homeowners who are facing the prospect of defaulting on their loans if they don't get government assistance. Recent estimates by industry experts say that Paulson's plan will only help 140,000 mortgage holders, leaving millions of others to fend for themselves. Paulson has proved over and over that he is just not up to the task of confronting an economic challenge of this magnitude head-on.

Fed chief Bernanke hasn't done much better than Paulson. His three-quarter point cut to the Fed's Funds rate hasn't lowered interest rates on mortgages, stimulated greater home sales, stabilized the stock market or helped banks deal with their massive debt-load. It's been a flop from start to finish. All it's done is weaken the dollar and trigger a wave of inflation. In fact, government figures now show energy prices are rising at 18.1 per cent annually. Bernanke is apparently following Lenin's supposed injunction though there's no conclusive evidence he actually said it -- that "the best way to destroy the Capitalist System is to debauch the currency."

On Wednesday, the Federal Reserve initiated a "coordinated effort" with the Bank of Canada, the Bank of England, the European Central Bank, and the Swiss National Bank to address the "elevated pressures in short-term funding of the markets." The Fed issued a statement that "it will make up to $24 billion available to the European Central Bank (ECB) and Swiss National Bank to increase the supply of dollars in Europe." [Bloomberg] The Fed will also add as much as $40 billion, via auctions, to increase cash in the U.S. Bernanke is trying to loosen the knot that has tightened Libor (London Interbank Offered Rate) rates in England and reduced lending between banks. The slowdown is hobbling growth and could send the world into a recessionary spiral.

Bernanke's "master plan" is little more than a cash giveaway to sinking banks. It has scant chance of succeeding. The Fed is offering $.85 on the dollar for mortgage-backed securities (MBSs) and collateralized debt obligations (CDOs) that sold last week in the E*Trade liquidation for $.27 on the dollar. At the same time, the Fed has promised to keep the identities of the banks that are borrowing these emergency funds secret from the public. The Fed is conducting its business like a bookie.

Unfortunately, the Fed bailout has achieved nothing. Libor rates -- which are presently at seven-year highs -- have not come down at all. This is causing growing concern among the leaders of the central banks around the world, but there's really nothing they can do about it. The banks are hoarding cash to meet their capital requirements. They are trying to compensate for the loss of value to their (mortgage-backed) assets by increasing their reserves. At the same time, the system is clogged with trillions of dollars of bad paper which has brought lending to a halt. The huge injections of liquidity from the Fed have done nothing to improve lending or lower interbank rates. It's been a flop. The market is driving interest rates now. If the situation persists, the stock market will crash.

Staring into the abyss

One of Britain's leading economists, Peter Spencer, issued a warning on Saturday: "The Government must suspend a set of key banking regulations at the heart of the current financial crisis or risk seeing the economy spiral towards a future that could make 1929 look like a walk in the park."

Spencer is right. The banks don't have the money to loan to businesses or consumers because they're trying to raise more cash to meet their capital requirements on assets that continue to be downgraded. (The Fed may pay $.85 on the dollar, but investors are unwilling to pay anything at all.) Spencer correctly assumes that the reason the banks have stopped lending is not because they "distrust" other banks, but because they are capital-strapped from all their "off balance" sheets shenanigans. If the Basel regulations aren't modified, money markets will remain frozen, GDP will shrink, and there'll be a wave of bank closings.

Spencer said: "The Bank is staring into the abyss. The Financial Services Authority must go round and check that all banks are solvent, and then it should cut the Basel capital requirement level from 8pc to about 6pc." [Call to Relax Basel Banking Rules, UK Telegraph]

Spencer confirms what we already knew; the banks are seriously under-capitalized and will come under growing pressure as hundreds of billions of dollars of mortgage-backed securities (MBSs) and collateralized debt obligations (CDOs) continue to lose value and have to be propped up with additional capital. The banks simply don't have the resources and there's going to be a day of reckoning.

Pimco's Bill Gross put it like this: "What we are witnessing is essentially the breakdown of our modern day banking system." Gross is right, but he only covers a small portion of the problem.

The economist Ludwig von Mises was more succinct in his analysis: "There is no means of avoiding the final collapse of a boom brought on by credit expansion. The question is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved."

The basic problem originated with the Federal Reserve when former Fed chief Alan Greenspan lowered interest rates below the rate of inflation for 31 months straight, which pumped trillions of dollars of low interest credit into the financial system and ignited a speculative frenzy in real estate. Greenspan has spent a great deal of time lately trying to avoid any blame for the catastrophe he created. He is a first-rate "buck passer." In last Wednesday's Wall Street Journal, Greenspan scribbled out a 1,500-word defense of his actions as head of the Federal Reserve, pointing the finger at everything from China's "low cost workforce" to "the fall of the Berlin Wall." The essay was typical Greenspan gibberish. In his trademark opaque language; Greenspan tiptoes through the well-documented facts of his tenure as Fed chief to absolve himself of any personal responsibility for the ensuing disaster.

Greenspan's apologia is a masterpiece of circuitous logic, deliberate evasion and utter denial of reality. He says, "I do not doubt that a low U.S. federal-funds rate in response to the dot-com crash, and especially the 1 per cent rate set in mid-2003 to counter potential deflation, lowered interest rates on adjustable-rate mortgages (ARMs) and may have contributed to the rise in U.S. home prices. In my judgment, however, the impact on demand for homes financed with ARMs was not major."

"Not major"? -- 3.5 million potential foreclosures, 11-month inventory backlog, plummeting home prices, an entire industry in terminal distress pulling down the global economy is not major?

But Greenspan is partially correct. The troubles in housing cannot be entirely attributed to the Fed's "cheap credit" monetary policies. They were also nursed along by a Doctrine of Deregulation which has permeated US capital markets since the Reagan era. Greenspan's views on how markets should function were -- to a great extent -- shaped by this non-interventionist/non-supervisory ideology which has created enormous equity bubbles and imbalances. The former Fed chief's support for adjustable rate mortgages (ARMs) and subprime lending shows that Greenspan thought of himself as more of a cheerleader for the big market players than an impartial referee whose job was to monitor reckless or unethical behavior.

Greenspan also adds this revealing bit of information in his article, "The value of equities traded on the world's major stock exchanges has risen to more than $50 trillion, double what it was in 2002. Sharply rising home prices erupted into major housing bubbles worldwide, Japan and Germany (for differing reasons) being the only principal exceptions." ["The Roots of the Mortgage Crisis," Alan Greenspan, Wall Street Journal]

This admission proves Greenspan's culpability. If he knew that stock prices had doubled their value in just three years, then he also knew that equities had not risen due to increases in productivity or demand.(market forces) The only reasonable explanation for the asset inflation, therefore, was monetary policy. As his own mentor, Milton Friedman, famously stated, "Inflation is always and everywhere a monetary phenomenon." Any capable economist would have known that the explosion in housing and equities prices was a sign of uneven inflation. Now that the bubble has popped, inflation is spreading like mad through the entire economy.

Greenspan is a very sharp man. It is crazy to think he didn't know what was going on. This is basic economic theory. Of course he knew why stocks and housing prices were skyrocketing. He was the one who put the dominoes in motion with the help of his printing press.

But Greenspan's low interest credit is only part of the equation. The other part has to do with way that the markets have been transformed by "structured finance."

What's so destructive about structured finance is that it allows the banks to create credit "out of thin air," stripping the Fed of its role as controller of the money supply. David Roache explains how this works in an excerpt from his book, "New Monetarism," which appeared in the Wall Street Journal: "The reason for the exponential growth in credit, but not in broad money, was simply that banks didn't keep their loans on their books any more -- and only loans on bank balance sheets get counted as money. Now, as soon as banks made a loan, they 'securitized' it and moved it off their balance sheet.

"There were two ways of doing this. One was to sell the securitized loan as a bond. The other was 'synthetic' securitization: for example, using derivatives to get rid of the default risk (with credit default swaps) and lock in the interest rate due on the loan (with interest-rate swaps). Both forms of securitization meant that the lending bank was free to make new loans without using up any of its lending capacity once its existing loans had been 'securitized.'

"So, to redefine liquidity under what I call New Monetarism, one must add, to the traditional definition of broad money, all the credit being created and moved off banks' balance sheets and onto the balance sheets of nonbank financial intermediaries. This new form of liquidity changed the very nature of the credit beast. What now determined credit growth was risk appetite: the readiness of companies and individuals to run their businesses with higher levels of debt."

The banks have been creating trillions of dollars of credit (by originating mortgage-backed securities, collateralized debt obligations and asset-backed commercial paper) without maintaining the proportional capital reserves to back them up. That explains why the banks were so eager to provide mortgages to millions of loan applicants who had no documentation, no income, no collateral and a bad credit history. They believed there was no risk, because they were making enormous profits without tying up any of their capital. It was, quite literally, money for nothing.

Now, unfortunately, the mechanism for generating new loans (and fees) has broken down. The main sources of bank revenue have either been seriously curtailed or dried up entirely. (Mortgage-backed) commercial paper (ABCP), one such source of revenue, has decreased by a full third (or $400 billion) in just 17 weeks. Also, the securitization of mortgage-backed securities is DOA. The market for MBSs and CDOs and other complex bonds has followed the Pterodactyl into the history books. The same is true of structured investment vehicles (SIVs) and other "off balance-sheet" swindles, which have either gone under entirely or are presently withering with every savage downgrade in mortgage-backed bonds. The mighty juggernaut that was grinding out the hefty profits ("structured investments") has suddenly reversed and is crushing everything in its path.

The banks don't have the reserves to cover their downgraded assets and the Federal Reserve cannot simply "monetize" their bad bets. There's no way out. There are bound to be bankruptcies and bank runs. "Structured finance" has usurped the Fed's authority to create new credit and handed it over to the banks.

Now everyone will pay the price.

Investors have lost their appetite for risk and are steering clear of anything connected to real estate or mortgage-backed bonds. That means that an estimated $3 trillion of securitized debt (CDOs, MBSs and ASCP) will come crashing to earth, delivering a violent blow to the economy.

It's not just the banks that will take a beating. As Professor Nouriel Roubini points out, the broker dealers, the investment banks, money market funds, hedge funds and mortgage lenders are in the crosshairs as well.

"Non-bank institutions do not have direct access to the Fed and other central banks liquidity support and they are now at risk of a liquidity run as their liabilities are short term while many of their assets are longer term and illiquid; so the risk of something equivalent to a bank run for non-bank financial institutions is now rising. And there is no chance that depository institutions will re-lend to these to these non-banks the funds borrowed by central banks as these banks have severe liquidity problems themselves and they do not trust their non-bank counterparties. So now monetary policy is totally impotent in dealing with the liquidity problems and the risks of runs on liquid liabilities of a large fraction of the financial system." [Nouriel Roubini's Global EconoMonitor]

As the downgrades on CDOs and MBSs continue to accelerate, there'll likely be a frantic "flight to cash" by investors, just like the recent surge into US Treasuries. This could well be followed by a series of spectacular bank and non-bank defaults. The trillions of dollars of "virtual capital" that were miraculously created through securitzation when the market was buoyed-along by optimism will vanish in a flash when the market is driven by fear. In fact, the equity bubble has already been punctured and the process is well underway.

Mike Whitney lives in Washington state. He can be reached at fergiewhitney@msn.com.

Homebuilder versuchen mit ihrer Politik die Preise hoch zu halten.

Das ist ersichtlich, wenn man den Preisverfall für neue und "alte" Häuser vergleicht. Doch diese Strategie ist auf Dauer enorm, aussichtlos und im Endeffekt kontraproduktiv.

November 2007

| New Single-Family/Condominiums | |||

| Zone | Median (06) | Median (07) | % Change |

| Central San Diego | $375,000 | $404,250 | 7.8% |

| East County | $313,000 | $356,000 | 13.7% |

| North County Inland | $547,500 | $543,500 | -0.7% |

| North County Coastal | $703,000 | $583,000 | -17.1% |

| South County | $491,500 | $440,000 | -10.5% |

| Resale Single Family Homes | |||

| Zone | Median (06) | Median (07) | % Change |

| Central San Diego | $525,000 | $525,000 | 0% |

| East County | $470,000 | $423,000 | -10.0% |

| North County Inland | $555,500 | $521,250 | -6.1% |

| North County Coastal | $587,500 | $669,500 | 14.0% |

| South County | $540,000 | $457,000 | -15.4% |

S&P cut ACA's rating to "CCC," or eight levels below investment grade, from "A," the sixth-highest investment-grade rating. It also said it may cut Financial Guaranty Insurance Co's 'AAA' rating.

http://www.nytimes.com/2007/12/19/business/...oref=slogin&oref=slogin

Officials from Merrill Lynch, Bear Stearns and other major banks are in talks to bail out a struggling bond insurance company that has guaranteed $26 billion in mortgage securities, according to two people briefed on the situation, because the insurer’s woes could force the banks to take on billions in losses they had insured against....The troubles at ACA could also serve as the first real test for credit default swaps, the tradable insurance contracts used by investors to protect, or hedge, against default on bonds. In June, the value of bonds underlying credit default swaps rose to $42.6 trillion, up from just $6.4 trillion at the end of 2004, according to the Bank for International Settlements.

The Bank for International Settlements (BIS) was reporting Derivatives traded on exchanges surged 27 percent to a record $681 trillion in the third quarter.

Comment: There is absolutely no way all the hedges can be paid. Look at the number of derivatives and swaps above as proof.

Investment banks, hedge funds and insurance companies often use credit default swaps to bet on or against bonds without trading the underlying securities. Warren E. Buffett and other critics have described the contracts as financial time bombs, because they say that traders often misprice risk of default and do not set aside enough reserves to cover claims. They also note that investors have become complacent about the risks in recent years because default rates fell to historically low levels.

Comment: Those time bombs are now going off.

Banks that insured securities with ACA have another reason to keep the company afloat — if it fails they may have to restate earnings they have already booked as a result of their dealings with the company.

....Mr. Egan and other analysts also note that ACA more than doubled its credit default business in the last 12 months; it had contracts outstanding on $70 billion in bonds on Sept. 30, up from $30 billion a year ago. The timely use of credit default swaps this summer helped large investment banks like Goldman Sachs and Lehman Brothers avoid huge losses on mortgage securities as others had billions in losses. But Jim Keegan, a senior vice president and portfolio manager at American Century Investments, questions whether the firms that sold protection will be able to pay up when losses materialize.

“It’s a zero-sum game,” he said, noting that the gains at the investment banks buying the protection have to eventually result in losses for the firms they hedged with. “If you put trades on that worked so well that you bankrupt your counterparty, you will not collect on those trades.”

Comment: It is obvious here that the emperor has no clothes. There is going to be a global collapse in derivatives as soon as a key counterparty defaults. ACA is one such domino. It remains to be seen if it is THE domino or not.

Last week, the New York Stock Exchange delisted ACA Capital after its stock price had collapsed and the company declined to offer a plan to bring itself back into compliance with listing standards. The stock was trading at about 40 cents over the counter on Tuesday; it traded as high as $15 in the summer.

Comment: ACA capital was delisted last week, but S&P kept its credit rating at A up until today. Actions speak louder than words. It is clear the rating agencies are hopelessly and purposely behind the curve.

One look at ACA should be enough to tell anyone that the reaffirmations by the ratings agencies of Ambac (ABK), MBIA (MBI) and others are completely suspect at best, and purposeful manipulation at worst.Neither Ambac nor MBIA deserves the AAA ratings they have. However, the ratings agencies do not want to downgrade MBIA and Ambac because it would trigger the re-rating and possible forced sale of $2.5 trillion in municipal bonds.

However, the market will eventually force a downgrade those companies whether anyone likes it or not. Indeed, Professor Depew is reporting Ambac, MBIA: Prognosis Negative in today's dose of Five Things,S&P this morning lowered the credit rating outlook for MBIA (MBI) and Ambac (ABK) to negative from stable, according to Bloomberg.* S&P also reduced its outlook for Financial Guaranty Insurance Co. and XL Capital Assurance Inc. to negative, Bloomberg said.# Ambac, the second-largest bond insurer, guarantees $546 billion of securities, according to Bloomberg.

# MBIA backs about $652 billion of municipal and structured finance bonds, and FGIC Corp., parent of Financial Guaranty Insurance Co., insured $314 billion.

# As a side note, municipal bonds are headed for their worst year since 1999, according to Merril Lynch (MER) indexes that track muni bonds.http://www.minyanville.com/articles/MER-MBI-SLM-abk-gis/index/a/15275

http://globaleconomicanalysis.blogspot.com/

Ich frage mich: WANN zum Henker kommen denn nun endlich echte Abstufungen?

Was treiben die da bloß alle den ganzen Tag lang?

Ich halte Abstufungen für 100% sicher.

Die Frage ist nur, wie lange zögern die Junx dort das ganze Dilemma bloß noch heraus?

Grund, weshalb die Builder immer weiter builden ist die Bilanzierung;

halbfertige oder nur erschlossene Bauplätze können bei weitem nicht so hoch angesetzt werden wie fertiggestellte Häuser.

Der Turbo für die Bilanz wird dann eingeschlaten, wenn man für die Bewertung der fertigen Häuser noch den "offiziellen" OFHEO-Index ansetzt; laut dem sind die Preise auf Jahressicht noch gar nicht gesunken.

Benni ist neu und der Markt muss sich an seine Kommunikationspolitik erst noch gewöhnen. Daher sind Mißverständnisse normal. Der Lerneffekt schreitet voran, ist aber noch nicht perfekt gelungen wie man an der Enttäuschung über die Dezembersenkung ablesen kann. Ich denke, der Markt braucht genau einen kompletten Zyklus, um in Zukunft Benspeak verstehen zu können.

Notiere in dein rotes Merkheft: Ben ist definitiv eine Zinstaube! Sobald es was zu senken gibt wird Benni senken. Umgekehrt wird er mit Zinserhöhungen so lange wie irgend geht warten. Die nächste Blase ist damit vorprogrammiert und Permabär zu sein wird sich a la long nicht auszahlen.

LEAP/E2020 warnt: Das globale Finanzsystem steht 2008 vor dem Zusammenbruch

- Pressemitteilung des GEAB vom 18. Dezember 2007 –

Der GEAB ist noch kein Jahr alt und hat sich dennoch schon weltweit als Informationsbrief der Entscheidungsträger in Politik und Wirtschaft durchgesetzt. Jeden Monat präsentiert das GlobalEuropa Antizipations-Bulletin Ihnen Analysen über den Zerfall der Weltordnung der Nachkriegszeit und seine Konsequenzen für die Weltpolitik, sowie weitreichende Ratschläge für Ihre politischen, wirtschaftlichen und finanziellen Entscheidungen.

Wie vorhergesagt frisst sich die Aufprallphase (1) der weltweiten umfassenden Krise weiter in die Wirtschaft und die Finanzmärkte hinein und führt zu einer raschen Verschlechterung der Situation insbs. an den Finanzmärkten : Unsere Forscher gehen davon aus, dass 2008 das gegenwärtige globale Finanzsystem zusammen brechen wird.

Die Indikatoren, die uns ermöglichen, den Ablauf der Krise zu verfolgen, weisen darauf hin, dass in den nächsten Monaten nicht nur mit Konkursen von großen und vielen kleinen Banken in den USA und etwas später auch in anderen Ländern zu rechnen ist (wir schrieben darüber ausführlich in der 19. Ausgabe des GEAB). Vielmehr gehen wir davon aus, dass das gesamte internationale Finanzsystem auseinander zu brechen droht.

Heute schafft nicht einmal mehr eine konzertierte Aktion der großen Zentralbanken, die Liquiditätsengpässe auf den Finanzmärkten aufzulösen ("credit crunch"). Weiterhin befindet sich die US-Wirtschaft in Rezession und der Dollar steht vor dem Kollaps; damit bröckeln die zwei historischen Pfeiler, die bisher das gegenwärtige internationale Finanzsystem trugen. Heute fehlt es den internationalen Finanzmärkten an der verbindenden Klammer, die die jedem System immanenten widerstreitenden Interessen entgegen wirken konnten.

Wir sind heute in einer Situation, in der auch die besten Zentralbanker und die größtmöglichen Interventionsmaßnahmen nur noch versagen können. Das Zeitfenster für mögliche korrigierende Eingriffe hat sich mit Ende des Sommers 2007 geschlossen. Nach unserer Auffassung sind wir heute Zeugen einer Entwicklung, in der die unterschiedlichen Interessen der verschiedenen Komponenten des internationalen Finanzsystems dessen Fortbestand gefährden.

Als Beleg für diese These genügt es, den Versuch der US-Zentralbank zu analysieren, im Zusammenspiel mit den anderen großen Zentralbanken die Versorgung der Finanzmärkte mit US-Dollar (2) sicherzustellen. Dieser Versuch konnte nur mit einem Fehlschlag enden. Es ging in erster Linie darum, das Vertrauen in die Finanzmärkte mit zwei Maßnahmen zu restaurieren:

1. Indem der Eindruck erweckt werden sollte, die großen Zentralbanken zögen in ihrem Kampf zur Beseitigung der Liquiditätsengpässe an einem Strang, sollte dem heute praktisch zum Erliegen gekommenen Geldmarkt zwischen den Banken wieder auf die Beine geholfen werden.

2. Den großen, in Liquiditätsschwierigkeiten befindlichen Banken wurde die Möglichkeit verschafft, sich ohne Kenntnis der übrigen Marktteilnehmer bei den Zentralbanken mit US-Dollar zu versorgen; als Sicherheiten für diese Kredite durften sie überbewertete Aktiva hinterlegen, da sie nach dem Marktpreis von vor vielen Monaten bewertet wurden, obwohl diese Preise heute sicherlich nicht mehr zu erzielen wären (3).

Natürlich war die Restaurierung des Geldmarkts zwischen den Banken das prioritäre Anliegen dieser konzertierten Aktion der großen Zentralbanken; denn kurzfristige Kredite für Banken, die am Rand des Konkurses stehen, können das letztendliche Ergebnis nur um einige Monate verzögern, nicht aber verhindern.

Heute ist jedoch schon sicher, dass dieses Ziel nicht erreicht wurde (4). Denn der LIBOR (London interbank offered rate), der Referenzzinssatz des Geldmarkts der Banken und damit verläßlicher Indikator für dessen Zustands, verharrt auf seinem sehr hohen Niveau (5). Und die Tatsache, dass als Folge der Meldung über die konzertierte Aktion der Zentralbanken die Aktienkurse abstürzten, ermöglicht einen sehr guten Einblick in die pessimistische Stimmung an den Finanzmärkten: Die Händler und Investoren schöpften aus der zur Schau gestellten "bonne entente" der Zentralbanken nicht Zuversicht für ein baldiges Ende der Kreditkrise. Vielmehr interpretierten sie es als Eingeständnis, dass die finanzielle Situation der großen US-Banken viel schlimmer ist als noch vor einigen Monaten eingeräumt (6).

Konzentration von Finanzderivaten bei allen US-Geschäftsbanken zum 30.09.2007 - Quelle Federal Deposit Insurance Corporation (FDIC) - Kommentar: Sieben Finanzinstitute (7) konzentrieren 98% der Gesamtsumme, also 155 400 Milliarden USD, während 929 andere

Vor einigen Monaten war der US-Zentralbank die Kontrolle über die Entwicklung der Leitzinsen entglitten, wie wir in der 16. Ausgabe des GEAB beschrieben; nunmehr hat sie einen weiteren wesentlichen Machtverlust erlitten: Zum einen hat sie das Vertrauen der Investoren und Händler in ihre Fähigkeit, die Märkte zu steuern (8), verloren, zum anderen die Macht eingebüßt, die anderen großen Zentralbanken für ihre Ziele einzuspannen. Damit kann sie heute nicht mehr die Rolle als alleiniger Steuermann des internationalen Finanzsystems ausüben, die ihr nach dem Ende des 2. Weltkriegs und dank der Verträge von Bretton -Woods zugefallen war. Und das gegenwärtige internationale Finanzsystem ohne eine bestimmende Rolle der US-Zentralbank ist nicht mehr das System, das wir seit 60 Jahren kennen.

Den Finanzmärkten erscheint der Verlust der Marktsteuerungskräfte der US-Zentralbank zur Zeit noch das größere Übel zu sein (9). Nach unserer Auffassung ist jedoch der Verlust ihrer Führungsrolle im Netzwerk der großen Zentralbank das Ereignis, das entscheidend für den im nächsten Jahr zu erwartenden Zusammenbruch sein wird, da das System ohne Steuerung durch eine zentrale Stelle nur schwerlich wird überleben können. Wir rechnen mit dem Zusammenbruch für den Sommer 2008, wenn die Auswirkungen der US-Rezession im Alltag der Menschen spürbar sein und die Zentralbanken Asiens und Europas sich gezwungen sehen werden, rücksichtslos gegen den Führungsanspruch der US-Zentralbank zu opponieren, um die Interessen ihrer eigenen Wirtschaftszonen zu schützen.

In dieser 20. Ausgabe des GEAB vom 15. Dezember 2007 (deutsche Ausgabe 18. Dezember) beschreibt unser Forschungsgruppe detailliert die wachsenden Divergenzen in den Strategien der vier großen Zentralbanken (Federal Reserve USA, Europäische Zentralbank, Bank of England, Schweizer Nationalbank)

Wenn man bedenkt, dass schon heute, wo die Auswirkungen der US-Rezession noch nicht im Alltag der Menschen spürbar sind, solche Spannungen im Netzwerk der großen Zentralbanken und im internationalen Finanzsystem herrschen, kann man sich ausrechnen, welch zerstörerische Kraft sie entwickeln können, wenn die Krise in den Geldbeuteln der Menschen angekommen sein wird. Dann werden die unterschiedlichen Interessen das System unter einen solchen Druck setzen, dass es im Sommer 2008 darunter zusammenbrechen wird.

Dieser Zusammenbruch wird für die großen internationalen Banken katastrophale Folgen haben, insbs. für die unter ihnen, die selbst heute noch nicht begriffen haben, aus welcher Richtung der Wind weht und die daher weiterhin sehr stark in Dollarwerten engagiert sind, obwohl nichts mehr den Absturz des Dollars aufhalten kann. Die Banken, die die Subprime-Krise nicht zur Kenntnis nehmen wollten, konnten den Konkurs (bisher) vermeiden; dies wird den Banken, die nicht verstehen wollen, dass das internationale Finanzsystem am Zusammenbrechen ist, nicht möglich sein (10).

Für die Anleger und Investoren wird dieser Zusammenbruch ebenfalls große Risiken mit sich bringen. Um sich dieser Risiken zu vergegenwärtigen, genügt es, die Erfahrungen in zwei andere Zeitspannen zu betrachten, in denen bestehende Systeme zusammenbrachen, also 1929 (11) und die folgenden Jahre, bzw. 1973 und bis zum Ende der siebziger Jahre. Unserer Forscher gehen davon aus, dass die Folgen des zu erwartenden Zusammenbruchs noch tiefgreifender sein werden; denn damals war die Finanzmärkte ein Teil der Wirtschaft - heute ist ihre Bedeutung um ein Vielfaches höher als die Realwirtschaft. Wir werden uns in dieser Ausgabe in der Rubrik "Empfehlungen" Ratschläge geben, wie man sich gegen diese Auswirkungen schützen kann.

Quartalsmäßige Entwicklung der Privatkredite für die US-Banken (in blau) im Verhältnis zu den privaten Spareinlagen (in rot) - Quelle FDIC - Kommentar: Hier zeigt sich, dass diese beiden Kurven, also ausgegebene Kredite bzw. Einlagen, seit Ende 2006 in bi

Zur Zeit ist es noch zu früh, um vorher zu sagen, wie sich das internationale Finanzsystem nach dem Zusammenbruch neu organisieren wird. Bis zum Sommer 2008 sollte dies jedoch mit relativer Exaktheit möglich sein. Für unsere Forscher ist aber schon heute klar, dass ein solches neues System nur durch eine enge Zusammenarbeit der Asiaten, geführt von dem Tandem China-Japan, der Europäer, also im wesentlichen die Eurozone, der Russen und der erdölfördernden Länder geschaffen werden kann.

Leidtragender dieser Entwicklung werden die USA sein. Denn natürlich wird das neue System nicht mehr vor allem ihrem Nutzen dienen, wie dies die letzten sechzig Jahre der Fall war. Die neue US-Regierung, die ab Januar 2009 im Amt sein wird, wird sich in einer sehr schwierigen Lage finden. Ihre Hauptsorge muss sein, die USA durch diese schwierige Phase des Systemwechsels zu steuern. Dies wird nur unter wirtschaftlich und finanziell schwer zu tragenden Belastungen möglich sein, die zu schultern die Rezession noch erschweren wird. Die Europäer und Asiaten wären gut beraten, dies zu bedenken, um zu verhindern, dass aus den Trümmern des Zusammenbruchs Chaos erwächst.

--------

Noten:

(1) Vgl. hierzu insbs. die 18. Ausgabe des GEAB für die Abfolge der Ereignisse innerhalb der Aufprallphase

(2) Und zwar im Ausgleich für jegliche Art von Sicherheite sowie unter Zusicherung, dass diese Inanspruchnahme nicht publik werde. Ein solches Vorgehen läßt sich eigentlich nur mit Panik erklären und läuft im Endeffekt auf einen Bail-out der Banken mit staatlichen Mitteln hinaus. Für weitere Einzelheiten verweisen wir auf die Webseite der US-Zentralbank (US Federal Reserve).

(3) Mit diesem Trick versucht die US-Zentralbank, Zeit zu gewinnen, denn es bedürfte eines Wunders, damit diese Anlagenwerte wieder den Wert erlangen, der ihnen bis zum Sommer 2007 zugeschrieben war. Da es sich um Kredite der US-Zentralbank an die Banken handelt, sind diese eigentlich verpflichtet, sie im Lauf des Jahres 2008 wieder zurück zu zahlen. Oder sie werden es so machen wie Northern Rock im Vereinigten Königreich, also zusammen brechen und damit mit einem Schlag zweistellige Milliarden-USD-Beträge zu vernichten. Insoweit ist es sehr hilfreich, die Aufstellung der Wertstellungen der Vermögensteile (Discount Collateral Margins Table) zu lesen, die von der Fed als Sicherheiten für Kredite akzeptiert werden. Dabei kann man feststellen, dass die US-Zentralbank 70 bis 80 cent pro Dollar für Vermögenswerte leiht, die heute auf dem Markt noch nicht einmal mit der Hälfte dieser Summe gehandelt werden (vgl. 19. Ausgabe des GEAB)

(4) Quelle: Reuters, 14.12.2007

(5) Quelle: Bloomberg, 13.12.2007

(6) Jenseits der täglichen Verlautbarungen über die notwendigen Rückstellungen für Abdeckung von Verlusten aus der Subprime-Krise oder wegen anderer CDOs gibt die FDIC (Federal Deposit Insurance Corporation, deren Aufgabe darin besteht, die Spareinlagen der bei diesem Bundesversicherungssystem versicherten US-Banken bis zu einer Höhe von 100.000 Dollar zu garantieren) in ihrer Pressemitteilung vom 28. November 2007 bekannt, dass der Netto-Ertrag der US Banken im dritten Quartal 2007 um 28,7 Milliarden zurückgegangen ist.

(7) Vgl die hier wiedergegebene Liste der wichtigsten US-Geschäftsbanken

(8) Vgl. hierzu den sehr interessanten Artikel von Paul Krugman in International Herald Tribune, v. 14.12.2007.

(9) Die Anonymität ermöglicht den Banken, die sich bei der US-Zentralbank Geldmittel besorgen, ohne dass ihre ernsthaften finanziellen Schwierigkeiten bekannt werden. Auf diese Art und Weise versucht die US-Zentralbank zu vermeiden, dass sich in den USA das gleiche ereignet wie in Großbritannien bei den Geldspritzen der Bank of England für Northern Rock.

(10) Hierzu möchten wir bekannt geben, dass Lehman Brothers, eine der beiden großen US-Banken neben Goldman Sachs, die das Subprime-Desasater vermeiden konnten, weil sie ihre Anlagen noch rechtzeitig gegen Ende 2006 abstießen, die einzige große internationale Bank war, die sich mittels eines Leitenden Mitarbeiters ihrer Londoner Niederlassung unmittelbar mit uns im Frühjahr 2006 in Verbindung setzte, um sich über den Hintergrund unserer Analysen zur US-Subprimekrise zu informieren. Denn schon im Februar 2006 sagten wir das Platzen der US-Immobilienblase und ihre finanziellen Auswirkungen voraus, was uns in den traditonellen Bankerkreisen einen hohen Bekanntheitsgrad eingebracht hat. Interessant ist jedoch, dass die meisten anderen großen Banken in den USA und Europa, die uns kontaktiert haben, dies erst im Frühjahr 2007 unternahmen; mit anderen Worten, als es zu spät war, um noch zu reagieren. Diese Anekdote zeigt nach unserer Auffassung, wie wichtig Voraussagen in einem komplexen System sind, wie die Welt, in der wir leben, es ist. Man muss agieren, bevor das Problem sich stellt, denn wenn es sich stellt, ist es im allgemeinen zu spät, um noch etwas zu bewirken. Und in diesem Fall kann man den Unterschied beziffern: 886 Millionen Dollar für Lehman Brothers, im Vergleich zu 49 Milliarden Dollar an Finanzspritzen, die Citigroup für einige seiner Investitionsfonds setzen musste, um sie vor dem Konkurs zu retten.

(11) Hierzu ist die Lektüre des Arbeitsdokuments 197 der Bank für den internationalen Zahlungsverkehr interessant, der den Titel trägt: 130 Jahre Zusammenarbeit zwischen den Zentralbanken aus der Sicht der BiZV, erstellt von Claudio Borio und Gianni Toniolo. Er verschafft eine historisch sehr notwendige Perspektive auf die Turbulenzen, die dem internationalen Finanzsystem bevor stehen.

Mardi 18 Décembre 2007

scheint also alles andere als gut zu laufen.

Analysts in fantasylandDespite years of reform, the latest numbers show that Wall Street prognosticators are every bit as deluded and inaccurate as they ever were.

By Geoff Colvin, senior editor-at-large

NEW YORK (Fortune) -- Maybe Wall Street analysts are more honest and less compromised than they were pre-SarbOx, but recent events show that they're still awful at their most important job: predicting bad news. They haven't lost their habit of falling in love with the companies they cover and refusing to face unpleasant realities until everyone else has already done so. Now, eight years after they were inflating the bubble, we again have to question whether analysts do retail investors any good.

The latest evidence: Analysts have only just discovered that corporate profits in the fourth quarter aren't going to be nearly as strong as they had supposed a month or two ago. The consensus view going into the quarter was that S&P 500 profits would go up 12 percent to 15 percent, a large jump coming on top of the 20 percent rise in last year's fourth quarter. In light of the credit crunch, the housing collapse, and the towering price of oil, that forecast seemed highly - one might say insanely - optimistic. This it proved to be, but only after the quarter began did the consensus view finally lurch into the real world. Their growth forecast is now about 1.5 percent and still falling.

It has been obvious for many months that profit growth would have to slow way down simply because it couldn't continue at recent rates. Profits have been rising sharply the past few years, which makes sense after the hole they fell into in 2001 and 2002. But by early this year they had grown to 12 percent of GDP, way above their historical average of 9 percent. Analysts knew all this, and in case they didn't, various commentators (including Fortune's Shawn Tully) were insistently pointing it out. But the analysts, ever hopeful, chose to believe that U.S. companies would perform magic.

They still believe it. To see the stubbornness of Wall Street's Pollyannas, look at new data from Merrill Lynch. The firm's chief North American economist, David Rosenberg, regularly and realistically forecasts S&P 500 profit growth. He cut his 2008 forecast sharply (to zero growth) in June, even before the credit crunch. He has since cut it twice more, and it's now -3 percent.

But Merrill's analysts hold a far different view. Add up their 2008 profit growth forecasts for individual S&P companies, and you get 14 percent. In analyst-land, 2008 is going to be another knockout year, with profits yet again growing several times faster than the economy. What's more, Merrill's analysts have actually been increasing their 2008 growth forecasts in recent months. In their bizarre world the logic goes like this: Since we must now admit that 2007 profits will be much lower than we expected, and since we're still certain that 2008 will nonetheless be totally fabulous, then the percentage increases will be even bigger than we thought.

How these nonsensical situations arise is no mystery. Each analyst can accept that the future may be tough overall while still believing that the companies he or she covers are special and will beat the trend. The analysts individually think they're being reasonable, but in the aggregate, they're crazy.

It's similar to what happened in subprime mortgages in recent years or stocks in the late 1990s: Many players realized the situation wasn't sustainable but figured they were especially perceptive and would get out ahead of the pack.

In the days of the market bubble, when many analysts failed to cut their earnings estimates until the collapse was underway, we blamed their motivation. They were afraid their firm's investment-banking arm would lose business. That problem has at least been reduced by SarbOx and by fear of public scrutiny. But if analysts are still predicting fantasy earnings, who cares why? Individual investors are no better off than they were.

Not every analyst gets it wrong. It's always possible in retrospect to find some who hit bull's-eyes. The trouble is, you never know who they'll be. Of course, you may be tempted to believe that while analysts in general are poor, the ones you're relying on are special and will ... no, wait. We know how that turns out.

http://money.cnn.com/magazines/fortune/fortune_archive/2007/12/24/101939717/index.htm?section=magazines_fortune

China: Notenbank erhöht Leitzinsen für Ausleihungen und Einlagen

20.12.07 11:27

PEKING (dpa-AFX) - Die chinesische Notenbank hat ihre Leitzinsen für Ausleihungen und Einlagen weiter erhöht. Beide Sätze würden mit Wirkung von diesem Freitag an steigen, teilte die Bank am Donnerstag in Peking mit. Der Zinssatz für Einlagen erhöhe sich um 0,27 Prozentpunkte, der Satz für Ausleihungen um 0,18 Prozentpunkte. Mit den Zinserhöhungen solle eine Überhitzung der Wirtschaft verhindert werden, begründete die Notenbank die Maßnahmen. Der Zinssatz für Einlagen bei den Geschäftsbanken wurde indes um 0,09 Prozentpunkte gesenkt./FX/bf/jha/

Peter Schiff geht hart ins Gericht mit dem New Hope Plan. Doch seine Argumente sind etwas vage. Gerade was die Vermietungen angeht. Ich denke im Endeffekt verzögert der Plan das Einbrechen der Hauspreise etwas, doch das ist alleine für sich gesehehn schon ein gutes Ziel. Sie brechen ohnehin schon schnell genug ein.

Peter Schiff on the Housing Market and the Rescue Planposted on: December 20, 2007

I had some harsh words last week for Peter Schiff, which prompted a comment from Jack:

Taking on Schiff? Get ready for a barrage of hate mail from him and his lackeys!

In fact, I got no hate mail at all, just a polite email from Peter's brother Andrew, saying that I should talk through my ideas with Peter. I did, and the following Q&A is the result. I hope you find it interesting. As always with these things, my interlocutor gets the last word.

Felix Salmon: You write that "Without question, the Bush administration’s mortgage rescue plan will exacerbate, not alleviate, the problems in the housing market," and that "there is no question that as lenders factor in the added risk of having their contracts re-written or of being held liable for defaulting borrowers, lending standards for new loans will become increasingly severe". If these things are really so certain, why do you think that the Bush administration and the American Securitization Forum were so happy to sign on to this plan?

Peter Schiff: In the short run the plan will keep some homes out of foreclosure and appease voters, who will be able to continue the delusions that they still have home equity. Also, the plan might create some false hope, thereby slowing down the adjustment. However, over the long run, which may happen sooner then many politicians naively believe, the plan will make mortgages even harder to get,[mann, das ist auf dauer das einzig richtige!!!] and ultimately lead to even lower home prices and more foreclosures than might have been the case without the plan.

The best thing is for the government to stay out and let the lenders work this out with the borrowers without any outside interference. In many cases foreclosure is better then keeping people in homes they cannot afford that are worth less then their mortgages. [korrekt, doch zu schnelle Zwangsversteigerung von vielen ist kontraproduktiv und zerstört die Preise komplett. Das ist einzig im Interesse der Shortseller;))] Let investors buy these properties, put up real cash, have some equity, and rent them out.

FS: Surely though we've seen quite clearly that the loan servicers simply don't have the capacity to work out every delinquent or soon-to-be-delinquent loan on a case-by-case basis.

And when you say that foreclosure is "better" in many cases if it comes sooner rather than later, presumably you don't mean for the borrower, but rather for the lender. Given that lenders can be trusted to act in their own self-interest, do you really think that they will put off foreclosures in such situations just because Hank Paulson had a press conference?

PS: I did not say it would be easy for the lenders but they should be allowed to work it out without government interference. For most subprime borrowers, their houses are liabilities not assets. How does it serve their interests to keep them in huge mortgages they cannot afford on homes that are worth less than the mortgages? Losing these homes means getting out of debt and a chance of a new start. They can rent something they can afford, or save up to buy a house once they are actually in a position to afford one. This will be a lot easier in a few years anyway when houses are much cheaper.

FS: Do you have any evidence that the lenders resent the government "interference" which I consider to be little more than allowing the lenders to get around a table and work something out without risk of being accused of illegal collusion? It seems to me that the lenders are actually quite happy about having been able to work out this deal, and would be happy whether the government chivvied them along or not.

As for the homeowners, of course their houses are assets: it's their mortgages which are liabilities. Losing their houses only means getting out of debt in certain limited circumstances: (a) when the loan is non-recourse -- which is rare in the subprime world, especially since most subprime mortgages were refinances; (b) when the servicer accepts a short sale; (c) when the homeowner declares bankruptcy as part of the foreclosure process. If they do declare bankruptcy, then their ability to even rent a smaller house in the near term, let along buy a new one in the long term, is definitely diminished.

And in all of these cases, the homeowner is still better off staying in their own home if the frozen teaser mortgage payments are lower than the amount the homeowner is going to have to pay in rent. Since the mortgage-freeze plan is explicitly targeted only at those subprime borrowers who have been making their teaser-rate mortgage payments in full so far, does it not make sense for both homeowner and lender to continue that state of affairs? You might be right that home prices are going to fall a lot in the coming years, in which case it would make sense for any homeowner -- not just subprime borrowers -- to sell their house right now and rent. [witzig. überzogen. Aber irgendwo wahr.]

But I don't see that anybody's speculation about the future direction of housing prices should be enough to start turfing people out of their homes.

PS: Lenders do not need any help from government to negotiate deals that are in their best interests. This plan amounts to coercion, where lenders are being "asked" to make concessions that absent government intervention that might not otherwise be willing to make. It is possible that in some cases freezing teaser rates might make sense, but such decisions should be left to the lenders. It is also possible that in many cases foreclosure would be a better option for the lender then a freeze, yet this plan may prevent such an outcome to the detriment of lenders.

Apart from moral and legal issues, such actions are bound to have a chilling effect on the willingness of lenders to continue extending credit to American borrowers or cause future rates and terms by which such credit is extended to be less favorable.

Sure a house is an asset (though despite conventional wisdom a depreciating one) but you cannot separate it from a mortgage that encumbers it. They must be viewed together, and if the mortgage exceeds the value of the house, then together they amount to a liability. Most subprime borrowers either put none of their own money into these properties, or if they did, they extracted any original down-payments though refinancing. As such they have no right to occupy properties that rightfully belong to the lenders who actually paid for them. If a teaser rate is so low that it amounts to less then what "owners" might otherwise pay in rent, why should lenders be required to provide such subsidies -- especially since these "owner/renters" have no equity in the properties and will likely not maintain them at all during the period of the freeze? Therefore not only will lenders suffer below market interest payments during the freeze, but the houses will be that much less valuable when they are ultimately sold in foreclosure when the freezes expire.

Why not let lenders foreclose now, cut their losses, and put these homes in the hands of responsible owners with financial incentives to maintain their investments? Let current occupants either rent back their houses from investors, or move elsewhere. [wie oben beschrieben: Investoren haben kein interesse, Häuser zwecks vermietung zu kaufen] There is nothing wrong with being a renter, I should know as I am one myself. If these overstretched subprime borrowers actually want to be home owners one day and not simply real estate speculators with other peoples' money, they can save up a 20% down payment and buy a less expensive house they can actually afford.

For those subprime borrowers with other assets and good incomes, let them negotiate new mortgages with the banks for lesser amounts, but where the borrower kicks in some new cash back to the lender. This way the owners will actually have an asset (a house worth more than the mortgage against it) and a financial incentive to take care of it.

This approach will allow for a far more rapid decline in real estate prices and therefore a return to a normal housing/mortgage market. However as politicians would rather voters continue to harbor delusions of phantom home equity, this market based approach is being resisted by those seeking re-election. However, in the long run, this plan will actually cause real estate prices to fall even further than what might have been the case without it.

Das ist status quo.

Was passiert in solchen Fällen statistisch betrachtet?

Meist nichts Gutes!"

Na ja, das zumindest bei 12 der letzten 18 Gelegenheiten die anschließende (Quartalss-) Entwicklung positiv verlief, lässt hoffen ;-))

Daher sollte man langfristig niemals der Markttechnik trauen, sondern Fundamentaldaten.

Gehen beide von der Aussage her in die gleiche Richtung, hat man gute Chancen mit seinem Investement richtig zu liegen!

;))