Evergreen Solar - Interessantes Unternehmen

Künftige EverQ-Solarfabrik in Sachsen-Anhalt

§

Evergreen Solar, Inc. (Nasdaq: ESLR), Hersteller von Photovoltaikprodukten unter Anwendung seiner ressourcenschonenden String-Ribbon™ Technologie, setze einen weiteren Meilenstein in Deutschland, berichtet das Unternehmen in einer Pressemitteilung. Das in Marlboro (Massachusetts) beheimatete Unternehmen feierte am 12.10.2005 das Richtfest seiner Solar-Wafer-, Solarzellen und Solarmodul-Fabrik in Thalheim (Sachsen-Anhalt). Verantwortlich für den Bau zeichnet EverQ, eine strategische Partnerschaft zwischen der Evergreen Solar Inc. und der in Thalheim ansässigen Q-Cells AG, dem größten unabhängigen Hersteller von Solarzellen aus kristallinem Silizium. Die EverQ-Produktionsstätte werde eine jährliche Produktionskapazität von 30 Megawatt haben. "Das heutige Richtfest läutet die nächste Entwicklungsphase des EverQ-Werks ein", erklärte Richard M. Feldt, President und Chief Executive Officer von Evergreen Solar. "Wir freuen uns über die großen Fortschritte, die wir in Thalheim erzielt haben. Nach unseren Planungen werden wir zum Jahresende mit der Installation unserer Fertigungsanlagen beginnen. Angesichts der aktuellen Terminlage bleiben wir zuversichtlich, dass wir die Vollproduktion bis Sommer 2006 erreichen", so Feldt weiter.

Der deutsche Staat fördert den Bau der EverQ-Produktionsstätte mit Zuschüssen in Höhe von umgerechnet zirka 27,5 Millionen Euro. Die Kosten für die 30-Megawatt-Fabrik belaufen sich nach Schätzungen auf 60 Millionen Euro. Bei einer Kapazität von 30 Megawatt schaffe das Werk 350 bis 400 neue Arbeitsplätze in dem rund 150 Kilometer südwestlich von Berlin gelegenen Thalheim, erwartet das Unternehmen. Abhängig vom Erfolg der Produktionsstätte wollen Evergreen Solar und Q-Cells die Erhöhung der Werkskapazität von 30 auf bis zu 120 Megawatt prüfen.

17.10.2005 Quelle: Evergreen Solar, Inc.

Noch haben wir eine Durststrecker vor uns!

Cu

Röckefäller

Cu

Röckefäller

www.wealthdaily.net/mc.php?id=175

Kurs ist ganz schön volatil! Rauf, runter, rauf, runter, rauf, runter, aber die 8€ lassen wir noch nicht hinter uns :(

Na ja, vielleicht ab Mitte 2006, wenn die deutsche Produktionsstätte endlich in Betrieb geht ;)

Cu

Röckefäller

Hier der Quartalsbericht:

Evergreen Solar Reports Third-Quarter 2005 Results; Company Executes Growth Strategy with Record Revenue and Margins, and Technology Advancements

Evergreen Solar, Inc. (Nasdaq: ESLR), a manufacturer of solar power products with its proprietary, low-cost String Ribbon(TM) wafer technology, today announced financial results for the quarter ended October 1, 2005.

"The third quarter was another period of significant accomplishment for Evergreen Solar as we pursue our vision of becoming the low-cost provider in the solar industry," said Richard M. Feldt, President and Chief Executive Officer. "We achieved record product revenue at our Marlboro facility of $11.1 million, with gross margins of 10.4 percent. We made good progress on our research and development programs, and plan to begin converting our Marlboro factory to our thin wafer manufacturing process by year end. We also ordered five Quad ribbon production prototype furnaces to further the development of that platform."

"The state-of-the-art 30-megawatt manufacturing plant we are constructing in Thalheim, Germany through our EverQ venture remains firmly on schedule," Feldt continued. "The construction phase moved rapidly in the third quarter as we broke ground in July and celebrated the plant's roof closing in October. Hiring and training for this facility are progressing extremely well. In order to accelerate the start up of the Thalheim plant, we are shipping 10 furnaces to an offsite location in Thalheim this month. These will be used to train our EverQ employees and provide wafers for use in the startup of our cell and module lines."

Third-Quarter 2005 Financial Results

For the quarter ended October 1, 2005, product revenues were $11.1 million, nearly double the $5.6 million reported for the third quarter of 2004 and an increase of 4 percent from the $10.7 million reported in the second quarter of 2005. For the third quarter of 2005, Evergreen Solar achieved positive product gross margin of 10.4 percent. This compares with negative 29.0 percent for the third quarter of 2004 and positive 6.2 percent in the second quarter of 2005.

Net loss attributable to common stockholders for the third quarter of 2005 was $4.6 million, or $0.07 per share, compared with a net loss of $4.6 million, or $0.10 per share, for the third quarter of 2004. For the third quarter of 2005, weighted average shares outstanding were approximately 61.2 million. Third-quarter 2004 earnings per share figures were based on approximately 47.5 million weighted average shares outstanding.

Business Outlook & Financial Guidance

"Demand for solar energy continues to strengthen worldwide and is expected to exceed supply for the foreseeable future," Feldt said. "Evergreen Solar is capitalizing on this growth while investing in ongoing technology initiatives. In Marlboro, we will continue to advance toward full production implementation of our promising thin wafer technology."

"In Thalheim, we remain on track with our aggressive construction schedule. We anticipate installing our first pieces of manufacturing equipment in the facility by the end of 2005. We expect to begin manufacturing our first wafers in the Thalheim plant in the first quarter of 2006, with full-scale production slated to commence during the summer of 2006."

Conference Call Information

Management will conduct a conference call at 10:00 a.m. (ET) this morning to review the Company's third-quarter financial results and highlights. Those interested in listening to the live webcast should log on to the "Investors" section of Evergreen Solar's website, www.evergreensolar.com, prior to the event.

The call also can be accessed by dialing (719) 457-2727 or (800) 474-8920 prior to the start of the call. For those unable to join the live conference call, a replay will be available from 1:00 p.m. (ET) on November 4 through midnight (ET) on November 10 at (719) 457-0820 or (888) 203-1112 (passcode: 6795498), or by visiting the Company's website.

PowerLight Corporation is a market leader in developing innovative solar electric technologies and large-scale, grid-connected projects for customers worldwide. PowerLight plans to use Evergreen Solar's products within its proprietary applications for solar power projects around the globe. It is currently anticipated that these materials will be produced at Evergreen Solar's manufacturing plant in Massachusetts and EverQ's 30-megawatt facility, which is currently under construction in Thalheim, Germany. EverQ is a strategic partnership between Evergreen Solar and Q-Cells AG, the world's largest independent manufacturer of crystalline silicon solar cells.

"This new agreement with PowerLight is a significant milestone for Evergreen Solar. It reaffirms the value proposition of our String Ribbon wafer technology and our expansion strategy," said Richard M. Feldt, Evergreen Solar's President and Chief Executive Officer.

Evergreen Solar's patented String Ribbon wafer technology enables the Company to manufacture solar wafers, cells and modules more efficiently than conventional methods. This proprietary technology generates nearly one-and-a-half times as much power per pound of refined silicon as conventional methods.

Daniel Shugar, PowerLight's President, stated, "With its pioneering String Ribbon technology and rapidly expanding manufacturing capabilities, Evergreen Solar is setting a new industry standard and is emerging as a key player in the solar power market. We anticipate that Evergreen will play an important role in PowerLight's continued growth and look forward to leveraging this relationship to meet the worldwide needs of our corporate, government and residential customers."

Feldt concluded, "PowerLight's distinctive products, reputation and global reach make them an outstanding distribution partner and powerful new ally for Evergreen. We look forward to leveraging these value-added resources to promote our brand and to expand and strengthen our distribution capabilities."

About PowerLight Corporation

PowerLight Corporation (www.powerlight.com) is a leader in developing innovative solar electric technologies and large-scale, grid-connected projects for customers worldwide. Incorporated in 1995, PowerLight delivers reliable, clean power solutions for business, government and residential customers. PowerLight has built and operates many of the largest solar electric systems in North America and Europe. For more information, visit www.powerlight.com.

About Evergreen Solar, Inc.

Evergreen Solar, Inc. develops, manufactures and markets solar power products using the Company's proprietary low-cost manufacturing technologies. The products provide reliable and environmentally clean electric power in global markets. Solar power applications include complete power systems for electric utility customers choosing to generate their own environmentally benign power, as well as wireless power for remote homes, water pumping, lighting and rural electrification. For more information, visit www.evergreensolar.com.

Evergreen Solar(R) is a registered trademark and String Ribbon(TM) is a trademark of Evergreen Solar, Inc.

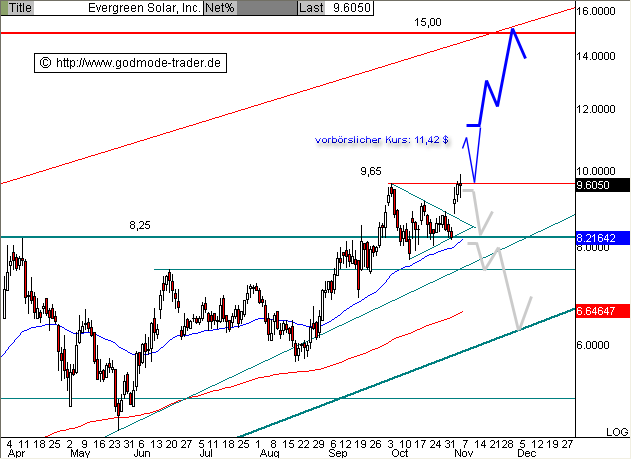

Kurs ist vorbörslich schon bei 11.30 $ angekommen! :)

http://de.finance.yahoo.com/q/ecn?s=ESLR

Evergreen Solar Reports Third-Quarter 2005 Results

Friday November 4, 7:30 am ET

Company Executes Growth Strategy with Record Revenue and Margins, and Technology Advancements

MARLBORO, Mass.--(BUSINESS WIRE)--Nov. 4, 2005--Evergreen Solar, Inc. (Nasdaq: ESLR - News), a manufacturer of solar power products with its proprietary, low-cost String Ribbon(TM) wafer technology, today announced financial results for the quarter ended October 1, 2005.

"The third quarter was another period of significant accomplishment for Evergreen Solar as we pursue our vision of becoming the low-cost provider in the solar industry," said Richard M. Feldt, President and Chief Executive Officer. "We achieved record product revenue at our Marlboro facility of $11.1 million, with gross margins of 10.4 percent. We made good progress on our research and development programs, and plan to begin converting our Marlboro factory to our thin wafer manufacturing process by year end. We also ordered five Quad ribbon production prototype furnaces to further the development of that platform."

"The state-of-the-art 30-megawatt manufacturing plant we are constructing in Thalheim, Germany through our EverQ venture remains firmly on schedule," Feldt continued. "The construction phase moved rapidly in the third quarter as we broke ground in July and celebrated the plant's roof closing in October. Hiring and training for this facility are progressing extremely well. In order to accelerate the start up of the Thalheim plant, we are shipping 10 furnaces to an offsite location in Thalheim this month. These will be used to train our EverQ employees and provide wafers for use in the startup of our cell and module lines."

Third-Quarter 2005 Financial Results

For the quarter ended October 1, 2005, product revenues were $11.1 million, nearly double the $5.6 million reported for the third quarter of 2004 and an increase of 4 percent from the $10.7 million reported in the second quarter of 2005. For the third quarter of 2005, Evergreen Solar achieved positive product gross margin of 10.4 percent. This compares with negative 29.0 percent for the third quarter of 2004 and positive 6.2 percent in the second quarter of 2005.

Net loss attributable to common stockholders for the third quarter of 2005 was $4.6 million, or $0.07 per share, compared with a net loss of $4.6 million, or $0.10 per share, for the third quarter of 2004. For the third quarter of 2005, weighted average shares outstanding were approximately 61.2 million. Third-quarter 2004 earnings per share figures were based on approximately 47.5 million weighted average shares outstanding.

Business Outlook & Financial Guidance

"Demand for solar energy continues to strengthen worldwide and is expected to exceed supply for the foreseeable future," Feldt said. "Evergreen Solar is capitalizing on this growth while investing in ongoing technology initiatives. In Marlboro, we will continue to advance toward full production implementation of our promising thin wafer technology."

"In Thalheim, we remain on track with our aggressive construction schedule. We anticipate installing our first pieces of manufacturing equipment in the facility by the end of 2005. We expect to begin manufacturing our first wafers in the Thalheim plant in the first quarter of 2006, with full-scale production slated to commence during the summer of 2006."

Im Conference Call wurde übrigens die Umsatzprognose fürs Gesamtjahr leicht auf 41-43 Mio. $ angehoben.

Auch könnten natürlich in den nächsten Tagen noch einige positive Analystenstimmen für weiteren Auftrieb sorgen.

Warten wir's ab und genießen... :)

++++++++++++++++++++++++++++++++++++++++++1

|

Non Reliance on Prev Financials, Audits or Interim Review

Item 4.02(a) Non-Reliance on Previously Issued Financial Statements or a Related

Audit Report or Completed Interim Review.

On November 9, 2005, management of Evergreen Solar, Inc. (the "Company"), concluded, with the approval of the Audit Committee of the Company's Board of Directors (the "Audit Committee"), that the Company's previously issued financial statements for the quarterly periods ended April 2, 2005 and July 2, 2005, which are included in the Quarterly Reports on Form 10-Q filed with respect to such periods, should not be relied upon because of errors in the balance sheet and statement of cash flows of such financial statements and that the Company would restate these financial statements to make the necessary accounting corrections.

A material weakness is a control deficiency, or a combination of control deficiencies, that results in more than a remote likelihood that a material misstatement of the annual or interim financial statements will not be prevented or detected.

As of October 1, 2005, the Company did not maintain effective controls over the preparation, review and presentation and disclosure of the Company's consolidated financial statements. Specifically, the Company's procedures did not detect that its condensed consolidated statement of cash flows incorrectly recorded capital contributions by the minority interest holder of $614,000 and $3,788,000 to EverQ for the quarterly periods ended April 2, 2005 and July 2, 2005, respectively, as cash flows from operating activities rather than as cash flows from financing activities. This control deficiency resulted in the need to restate the Company's previously issued financial statements for the quarterly periods ended April 2, 2005 and July 2, 2005, which are included in the Quarterly Reports on Form 10-Q filed with respect to such periods. In addition, this control deficiency could result in a misstatement of cash flows that would result in a material misstatement to the annual or interim consolidated financial statements that would not be prevented or detected. Accordingly, management has determined that this control deficiency constitutes a material weakness.

As of October 1, 2005, the Company did not maintain effective controls over the review and presentation and disclosure of restricted cash. Specifically, $2,018,000 of cash that had been restricted as of July 2, 2005 related to a letter of credit for equipment purchased by EverQ was improperly classified as cash and cash equivalents on the balance sheet and was incorrectly omitted as an investing cash outflow in the statement of cash flows as a result of a failure in communicating the presence of such restriction by EverQ. This control deficiency resulted in the need to restate the Company's previously issued financial statements for the quarterly period ended July 2, 2005 which are included in the Quarterly Report on Form 10-Q filed with respect to such period. In addition, this control deficiency could result in a misstatement of cash and cash equivalents and cash flows from investing activities that would result in a material misstatement to the annual or interim consolidated financial statements that would not be prevented or detected. Accordingly, management has determined that this control deficiency constitutes a material weakness. Management had previously concluded that the Company maintained effective disclosure controls and procedures as of April 2, 2005 and July 2, 2005. Management has determined that the material weaknesses described above existed as of April 2, 2005 and July 2, 2005. Accordingly, management plans to restate its reports on disclosure controls and procedures to indicate that the Company's disclosure controls and procedures as of April 2, 2005 and July 2, 2005 were not effective. Such restated reports will be included in the Company's amended Quarterly Reports on Form 10-Q/A for the quarterly periods ended April 2, 2005 and July 2, 2005.

Subsequent to October 1, 2005, the Company has implemented enhanced procedures to properly prepare its financial statements and to ensure that information from EverQ is reported in a timely manner to the Company for inclusion in such statements. These procedures include weekly meetings or conference calls with EverQ financial management to review all restrictions on cash and review of a detailed monthly checklist which includes EverQ's cash restrictions. In addition, during the preceding several quarters, both the Company and EverQ have hired additional qualified personnel for their financial reporting functions and plan additional such hiring. Accordingly, management believes it has improved the design effectiveness of its internal control over financial reporting; however, not all of the newly designed controls have operated for a sufficient period of time to demonstrate operating effectiveness. Therefore, management continues to monitor and assess its remediation activities to ensure that the material weaknesses discussed above will be remediated.

Ist zwar nichts wirklich weltbewegendes, aber ich warte dann doch lieber nochmal etwas mit meinem Kauf ab. Zumindest, bis die vorbörslichen Kurse aus den USA heute nachmittag kommen.

------------------------------------------------

FAZ 11.11.05

Niederlage für Schwarzenegger

09. November 2005 Der kalifornische Gouverneur Schwarzenegger hat am Dienstag bei einer Sonderwahl in seinem Bundesstaat eine schwere Niederlage erlitten. Eine große Mehrheit der Wähler lehnte nämlich jene Gesetzesinitiativen ab, die der Republikaner Schwarzenegger in einer Reihe von Volksentscheiden durchsetzen wollte. Zwei Jahre nach seinem Amtsantritt hat der ehemalige Filmschauspieler damit einen Tiefpunkt seiner Popularität erreicht. Politische Beobachter halten Schwarzeneggers Wiederwahl bei der Gouverneurswahl im Herbst 2006 für gefährdet.

Der Urnengang am Dienstag war eine direkte Folge von Schwarzeneggers Führungsstil, politische Entscheidungen nötigenfalls direkt von den Wählern fällen zu lassen, wenn er mit den Abgeordneten in dem von Demokraten kontrollierten Landesparlament in Sacramento keine Einigung über Gesetzesinitiativen erzielen kann.

Methode Volksbefragung

Zweimal hatte er in den vergangenen achtzehn Monaten mit dieser Methode Erfolg. So stimmten die Wähler bei einem Volksentscheid im März 2004 der Ausgabe von Schuldverschreibungen im Wert von mehreren Milliarden Dollar zu. Vor einem Jahr setzte sich Schwarzenegger mit seiner Initiative durch, ein Institut für die Stammzellenforschung in Kalifornien ebenfalls durch Schuldverschreibungen zu finanzieren.

Bei den jüngsten Volksentscheiden ging es allerdings um politische Entscheidungen, die in den meisten anderen amerikanischen Bundesstaaten von Landesparlamenten und nicht in Referenden getroffen würden. So unterlag Schwarzenegger mit seiner Initiative die Wahlkreisgrenzen in Kalifornien künftig von einem unabhängigen Gremium zeichnen zu lassen und nicht, wie bisher, durch eine Entscheidung des Landesparlamentes. Außerdem lehnten es die Wähler ab, künftig Lehrern erst nach einer Probezeit von fünf anstatt von bisher zwei Jahren eine Festanstellung anzubieten. Ebenso unterlag der Gouverneur mit seinem Gesetzentwurf für einen ausgeglichenen Haushalt und eine eingeschränkte Reform der Parteienfinanzierung.

Insgesamt hatten die verschiedenen Befürworter und Gegner der Volksentscheide im jüngsten Wahlkampf mehr 250 Millionen Dollar für Anzeigen und Wahlkampfmaterial ausgegeben. Den Staat hat die Ausrichtung der Sonderwahl nach Angaben des Landeswahlleiters mehr als 50 Millionen Dollar gekostet. Schwarzenegger steuerte aus eigener Tasche über sieben Millionen Dollar bei. Trotz der außergewöhnlich hohen Ausgaben lag die Wahlbeteilung bei gerade 40 Prozent.

Ich halte mich dann doch eher an die harten Fakten und die Charttechnik... :)

Daher wird die Nachfrage im Solarsektor nicht abebben....und Evergreen ist im nächsten Jahr in der Lage auch grössere Kapazitäten (ua.Werk in Sachsen-Anhalt) zu fahren bzw.zu realisieren.

Heisst: mind. 4 Facher Mehrumsatz !!!

Der Terminator ist doch nicht zuständig für die Gesamte USA oder den rest der "Absatz"-Welt.

Man hat doch gesehen das nachdem im Golf von Mexico einige Ölplattformen sich verabschiedet hatten und der Preis (immer noch) auf Rekordhoch stieg die Leute sich sehr für Alternativenergieqellen Interessierten....

Meine Perönliche Prognose: mind. 100 %!! auf den Heutigen Kurs (aktuell~10,20 $) Kursziel: 21 US$ auf 12 Monatssicht!!

Orderbuch sieht auch ganz okay aus:

Bid Orders

Price Order Size

10.00 100

9.95 300

9.93 100

9.70 1000

9.69 125

9.55 1500

9.39 1000

9.30 1000

9.26 1576

9.25 2000 §

§

Ask Orders

Price Order Size

10.05 300

10.09 100

10.40 100

11.00 300 §

50.00§3300