Morphosys: Sichere Gewinne und Milliardenpotential

http://www.hammerstockblog.com/...s-%E2%80%93-a-biotech-rule-breaker/

Morphosys – A Biotech Rule Breaker

Morphosys (MOR.DE) is one of the most unusual biotech companies, as it breaks three basic rules that apply to drug development companies:

Rule No. 1: Development-stage companies burn cash and therefore must constantly raise capital and dilute existing shareholders.

Rule No. 2: Development-stage companies are risky and volatile because they rely on a limited number of binary events.

Rule No. 3: Investing in cutting edge, growing segments of the pharmaceutical industry is associated with a high level of risk.

Morphosys is the only company I am familiar with that systematically breaks each and every one of these rules. It does not have any drugs on the market and is not expected to have any in the foreseeable future, yet it is profitable. It is involved in drug discovery which is associated with a high attrition rate, yet statistically, there is a very high chance that it will have commercial revenues at some point in the future. It is involved in one the fastest growing segments in the industry, but can be regarded as a conservative holding since it will never be dependent on a limited number of binary events. And finally, it has no need to raise cash in the coming decade in order to support its activities, as its costs are covered by other companies.

Morphosys has developed a unique technology for discovering and producing monoclonal antibodies. .......

Partnered Pipeline

......

Three partnered antibodies that were developed by Morphosys are currently in clinical trials, in the hands of Roche, Novartis and Centocor. To date, none of them generated proof of concept data, however, that might change during 2009.

Gantenerumab (Roche)

Roche is developing gantenerumab, an antibody for the treatment Alzheimer’s disease. The antibody is similar, in concept, to Elan’s (ELN) and Wyeth’s (WYE) bapineuzumab (bapi) as both antibodies target Amyloid beta, a protein which is one of the hallmarks of the disease. Roche advanced gantenerumab to phase I in 2006 and since then completed the accrual of 30 patients. This trial is somewhat atypical for a phase I study because it is a randomized, double blind comparative trial, so there could be signs of efficacy in the data. The market potential for Alzheimer disease is estimated at over $10 billion, however, to date, no drug proved successful in changing the course of the disease. Until recently, antibodies against Amyloid beta were considered a very promising target, however, following disappointing data for bapi, investors’ excitement towards this approach waned. Roche is expected to publish data from the phase I trial during the course of 2009.

BHQ880 (Novartis)

Novartis is developing BHQ880, an antibody against DKK-1, a protein that inhibits bone growth and has been shown to be involved in bone related conditions. By neutralizing DKK-1 with an antibody, it may be possible to stimulate bone formation. The potential market for BHQ880, providing it proves effective, is very large, spanning from osteoporosis to multiple types of cancer.

The concept of preventing breakdown of bones with an antibody has already been validated by Amgen’s denosumab (Dmab), currently evaluated in a battery of phase III studies. Last year, Amgen published very positive results from a study in post-menopausal women with osteoporosis, in which the antibody led to a meaningful improvement in fracture incidence and bone density. Additional trials showed that Dmab decreases bone loss in breast and prostate cancer patients who received hormonal therapy. A third potential use might be prevention or shrinkage of bone metastases in cancer patients, with data expected in the 2009-2010 timeframe. Dmab is expected to hit the market next year, and instantly become a blockbuster, due to the large addressable market (~5 million people in the US are receiving treatment for osteoporosis) and the substantial cost to society as a result of osteoporosis complications, such as fractures.

Novartis will probably pursue BHQ880 in the same indications Amgen’s Dmab is being evaluated, but the two antibodies should not necessarily be considered as competitors. Not only does each of the two antibodies binds a different target, they are involved in distinct biological signals. Dmab is thought to inhibit bone destruction whereas BHQ880 is expected to stimulate bone formation, so the two may even be synergistic. But first, Novartis will have to show BHQ880 is effective on its own and bring it to market. In order to do so, it picked a relatively small indication – multiple myeloma.

In February of 2009, Novartis started a phase I/II study in multiple myeloma, a blood cancer in which tumors colonize in the bone and degrade it. The vast majority of patients will develop bone lesions at some stage of their disease, resulting in bone loss, pain and increased likelihood of fractures. By stimulating bone formation, BHQ880 may decrease or even prevent bone loss that seems essential for the creation of bone lesions. This, in turn, may lead to not only better quality of life but also reduced tumor burden.

The concept of targeting DKK-1 is based on a growing body of evidence which shows that DKK-1 has an important role in multiple myeloma. For example, a study published in 2003 showed that multiple myeloma cells can create bone lesions by secreting proteins which lead to bone loss, and that one of the proteins they secrete is DKK-1. In addition, the investigators examined cancer cells from patients and found that cancer cells in bone lesions secrete high levels of DKK-1 whereas cancer cells from the blood of patients without bone lesions do not produce the protein.

The decision to start from a small indication like multiple myeloma as opposed to larger indications such as osteoporosis or even prostate cancer has its merits. Despite the significant progress with drugs such as Celgene’s (CELG) Revlimid and Takeda’s Velcade, no drug has been able to cure multiple myeloma, so new treatments are in high demand. In addition, multiple myeloma is not nearly as prevalent as osteoporosis, making it an ideal fast track indication, with a short time to market and a relatively low cost. A typical registration study in multiple myeloma requires less than a thousand patients, while in order to file for approval in osteoporosis, Amgen had to accrue 7800 patients.

Novartis is evaluating BHQ880 in a fairly large study (267 patients) with a placebo arm, which could make potential positive results more credible and serve as a proof of concept for the drug’s activity. This demonstrates again the advantage of having a large partner behind the wheel, as a company like Morphosys would never start such a large and costly trial at such an early stage. Novartis will probably initiate clinical trials with BHQ880 in additional indications in the near future.

Undisclosed antibody (Centocor)

Centocor, a wholly owned subsidiary of Johnson & Johnson (JNJ), signed a licensing deal with Morphosys in late 2000. In the summer of 2007, Centocor promoted one of its programs to phase I trial in solid tumors. Five months ago, it started another trial in an autoimmune indication, idiopathic pulmonary fibrosis (IPF) with the same antibody. Although Centocor did not disclose the identity of the antibody and its target, it seems that the mysterious antibody is CNTO-888, an antibody targeting a protein called MCP-1. Similarly to the two other partnered programs, CNTO-888’s trials are relatively large with 54 and 120 patients planned for accrual in the cancer phase I and IPF phase II, respectively. The phase II is a placebo controlled study.

MCP-1 plays a role in recruiting cells of the immune system by mobilizing them to specific sites, and is therefore believed to be involved in processes such as immune response and wound healing but also in autoimmune diseases such as multiple sclerosis and even metabolic diseases such as type II diabetes. Although MCP-1 has never been validated as a target, many studies suggest that molecules that block the actions of MCP-1 may be useful in treating a range of diseases. According to Centocor, MCP-1 is also involved in blood vessel formation, so targeting it may be useful in solid tumors, which must build new blood vessels in order to grow and invade distant organs. By binding MCP-1, Centocor hopes that CNTO-888 will starve tumors, similarly to the mechanism of action of Genentech’s Avastin.

Centocor is the only company actively developing an antibody against MCP-1 in the clinic, but it is not the first one to try, and prior experience does not leave a lot of room for optimism. Novartis was developing its own anti-MCP-1 antibody several years ago but decided to discontinue the program shortly after it got into the clinic. In a phase I trial in RA, Novartis’ antibody did not only fail to show benefit, but also led to a worsening of disease symptoms in some patients. This casts serious doubts over the prospects of anti-MCP-1 antibodies in autoimmune diseases, but one still cannot reject the entire concept based on one antibody. Other companies are trying to inhibit MCP-1’s activity by targeting its receptor (CCR2) with a small molecule rather than an antibody. ChemoCentryx is evaluating its compound in a phase I trial in vascular restenosis, a condition caused by blood vessel blockade following a stent procedure. Incyte (INCY) also has a CCR2 inhibitor, but at the moment, the development program is on hold, due to financial constraints. BMS is currently enrolling patients in a phase II study in diabetes for BMS-741672, another small molecule inhibitor of the receptor. The most advanced antibody in the field was Millennium’s (now part of Takeda) MLN-1202, an antibody against the CCR2 receptor, but the company decided to discontinue its development after disappointing phase II results in RA.

To my knowledge, Centocor is the only one who is evaluating inhibition of the MCP-1 pathway in oncology. This could help to differentiate CNTO-888 from other drugs, but only based upon concrete data from the phase I trial, which is still ongoing. The decision to do a phase II in an autoimmune disease can be interpreted as turning way from cancer indication, but perhaps this is part of the planned development program Centocor had originally laid out. The initiation of a phase II trial implies that Centocor already reached the maximum tolerated dose, so if investigators see signs of activity in the phase I, the data should be available this year.

Proprietary Pipeline

Morphosys’ proprietary pipeline is the third and most recent initiative of the company. The basic idea is simple: Using the tens of millions that flow into Morphosys’ bank account every year to build a small, early stage clinical pipeline. Therefore, Morphosys does not expect to burn cash in the foreseeable future, even as it anticipates having a handful of antibodies in clinical testing. These wholly owned programs are the only chance the company has to generate additional meaningful revenues in the near term future through licensing deals.

Morphosys does not intend to independently commercialize its wholly owned products, but to out license them after proof of concept data. This strategy is similar to Isis’ (ISIS) strategy, which alongside Morphosys, is one of the few companies that are developing drugs without burning cash. There is, however, one critical difference between the two companies – the fields in which they operate. Isis‘ antisense platform has the potential of revolutionizing the pharmaceutical industry by creating a completely new class of drugs, but to date, antisense drugs have not been fully validated. In contrast, monoclonal antibodies are a highly validated class of drugs, with over 20 approved agents to date, some of which have achieved blockbuster sales. Isis will have its first opportunity to prove that antisense drugs work with its high profile agent, mipomersen, a lipid lowering drug currently in several phase III studies.

Morphosys’ decision to build its own pipeline raises two principle issues. The first issue is the availability of good targets, as identifying the right target is the first and probably most important step of developing antibody-based drugs. Morphosys technology licensing deals usually revolve around specific targets, where the partner gets exclusivity for the target. In other words, Morphosys cannot license the same target twice or independently develop antibodies against an already licensed target. With more than 50 partnered programs ongoing and over a hundred future programs, the pool from which Morphosys can choose is rather limited. When I asked Morphosys’ CEO, Simon Moroney, how he views this issue, he admitted that a lot of targets are indeed taken, but claimed that on top of the substantial amount of available targets, there is a constant increase in the form of new targets every year. In addition, he added, the knowledge and experience gained through so many partnered programs compensates for the loss of potential targets.

The second issue is Morphosys’ ability to create and develop a clinical program from scratch, as this task requires a different set of skills on top the scientific know how. It is still too early to evaluate the company’s performance in this area, however, judging by the first clinical program, Morphosys’ management team know a thing or two about picking the right candidates.

Morphosys has several wholly owned development programs, only one of which, MOR103, is in the clinic. The company expects to promote a second antibody, MOR202, to the clinic in 2010. In addition, Morphosys expects to have several co-development programs in the clinic going forward, as part of the Novartis deal.

MOR103

MOR103 is an antibody targeted at GM-CSF, a protein traditionally known for its ability to stimulate the production of certain blood cells in the bone marrow. GM-CSF is used as a drug to stimulate the generation of new blood cells in cancer patients who undergo chemotherapy and following bone marrow transplantation. Although it was discovered over 30 years ago, GM-CSF’s role in inflammatory diseases is still being elucidated.

The past years saw the accumulation of data that implicate GM-CSF in inflammatory and autoimmune diseases. High levels of GM-CSF were found in joints of rheumatoid arthritis patients, and in animal models, targeting GM-CSF with an antibody led to a decrease in symptoms in several disease models. But perhaps the most convincing evidence comes from anecdotal cases in a 1990 clinical trial. In the trial, ovarian cancer patients were treated with chemotherapy followed by GM-CSF. Some of the patients on the trial also had rheumatoid arthritis and investigators noticed that the administration of GM-CSF led to deterioration of the disease in these patients. This finding implies that GM-CSF has a causative effect in RA and that disease control might be achieved by neutralizing it.

MOR103 entered a phase I study in the first quarter of 2008 in healthy volunteers. The study was expanded to evaluate higher doses than originally planned after no safety issues were observed in the original cohorts. During the second quarter of 2009, the company expects to publish data that will include both safety results as well as biomarker data, but obviously, no efficacy data can be generated in healthy patients. MOR103 will probably enter phase Ib/IIa in RA patients later in 2009, with potential proof of concept towards the end of 2010.

As part of the development program, last year Morphosys acquired exclusive rights to a patent which covers the use of antibodies against GM-CSF for therapeutic use. The patent, which is valid only in the US, may block other companies from selling anti-GM-CSF antibodies in the American market, but it still remains to be seen how this patent holds up in court. If MOR103 becomes approved, this step may turn out to be brilliant, considering the fact that the US accounts for more than half of the worldwide RA market. Of note, there are additional companies that are developing antibodies against GM-CSF, including Nycomed with its partner Micromet (MITI). The two companies plan to start a phase I study with their antibody this year and do not seem too excited about Morphosys’ patent. Furthermore, Morphosys’ patent does not cover antibodies against GM-CSF receptor, such as Medimmune’s CAM-3001, which could compete with MOR103 if both get approved.

MOR202

MOR202 is an antibody against CD38, a protein expressed by multiply myeloma cells. According to the company, it will start a phase I trial in 2010. By that time, two more anti-CD38 antibodies are expected to be in the clinic. The first is Genmab’s HUMAX-CD38 which entered the clinic early last year. In addition, Sanofi-Aventis is expected to advance its antibody to the clinic in 2009. Antibodies for multiple myeloma are one of the most active areas in the industry, following Rituxan’s (another antibody) success in various forms of blood cancers. Unfortunately, Rituxan is not effective in multiple myeloma, so developers are looking for the “Rituxan of multiple myeloma” by targeting additional targets such as CD38. Companies developing antibodies for multiple myeloma also include Genentech and Bristol-Myers Squibb, but to date, no antibody has demonstrated clinical proof of concept in the disease. The value of MOR202 as a preclinical agent is low, but if Genmab or Sanofi validate CD38 as a target, Morphosys might be able to license its antibody without any clinical data. At that point, the company may still choose to wait until MOR202 generates clinical data, probably in late 2011.

Summary

Earlier this month, Morphosys celebrated a decade as a publicly traded company, a decade which was mostly comprised of research and pre-clinical activities. The next decade will be characterized by intensive clinical activity for Morphosys’ proprietary pipeline as well as for its partnered pipeline. While the company expects dozens of programs to reach the clinic in the course of the next decade, the biggest value creating events for the partnered pipeline will arrive only in 7-10 years time, with the potential approval of some of the antibodies.

Although the company is not involved in any late stage clinical programs, Morphosys still looks like it has plenty of upside potential for the coming years. First and foremost, Morphosys is looking at several inflection points with respect to its proprietary pipeline, the first of which is expected next year. According to the company’s CEO, they are actively looking at acquiring products from other companies, which could instantly enhance the company’s pipeline. In addition, Morphosys’ value will definitely be derived from the size and quality of its partnered pipeline, which is expected to grow by several candidates every year. Even a single agent that demonstrates good activity in phase II can be translated into substantial stock price appreciation. Immunogen, for example, derives most of its valuation from a single drug with good phase II results: T-DM1. Similarly to Morphosys’ licensing agreements, Immunogen is eligible for royalties of ~5% on T-DM1 future sales, but due to the impressive phase II data and the clear blockbuster potential, Immunogen’s market cap is now $357M, slightly higher than that of Morphosys. Lastly, from a financial standpoint, Morphosys is a solid investment with positive cash flow and almost half of its market cap in cash, so it will remain independent of the capital markets in the coming years.

The main disadvantage stemming from the company’s business model is its dependence on Novartis. Morphosys decided not to start new broad collaborations, so in several years time, projects with Novartis will capture most of the company’s bandwidth, turning it into an unlikely acquisition target for anyone but the Swiss giant. Therefore, Morphosys is not a likely acquisition target, despite its valuable assets, and even if Novartis decides to buy it down the road, most chances that it would not encounter competition from other big pharmas, who would not want to have such a commitment to one of their competitors. Some may view this situation as an advantage because it will allow Morphosys to stay independent in the coming years and build value for its shareholders.

In summary, Morphosys can be viewed as a blend of pharma and biotech. On the one hand it has the innovation and upside potential of a small biotech, and on the other, it enjoys the diversification and risk mitigation of a large pharma. Morphosys still operates in the drug development field, where failures vastly outnumber successes, but unlike most of its peers Morphosys has statistics on its side. Does it mean that Morphosys is a risk free investment? Absolutely not, but for investors who would like to get exposure to the growing biotech field but with limited risk, Morphosys is as good as it gets.

.....

Habe noch einiges interessantes kürzen müssen....

Hoffentlich bricht nichts aus der Pipeline-Spitze weg, dann Gute Nacht.

Daten/Zwischenergebnisse P1 durch Roche (R1450) am 28.5.09 in Uppsala/Schweden

28. Mai

09.45-10.15 A novel human Abeta plaque specific antibody for the treatment of Alzheimer’s disease

Bernd Bohrmann, F.Hoffmann-La Roche, Basel

http://www-conference.slu.se/immunotherapy/programme.html

Schaut mal auf die Redezeit: 9.45 - 10.15 Uhr.

Dafür braucht man doch keine halbe Stunde :-)))

Abgesehen davon war die P1 mit R1450 zwar für eine P1 sehr ausführlich angelegt, aber selbst im Erfolgsfalle sicher nicht nachhaltig statistisch belastbar. Dafür gibts P2 und P3.

Aber positive Signale in Richtung P2 wären für MOR doch sehr bedeutend. :)

Aber vor dem 28. Mai kommt der 28. APril.

Wieviel % Kursminus auf 4 Jahre wird Morphosys haben bei verdreifachung des Umsatzes und der Pipeline?

Wieviel mehr Pessimismus wird der Markt schaffen einzupreisen?

Aktuell sind pro Kurseuro mehr als 50 cent cash hinterlegt und der cash wächst laufend, weil MOR ja durchgehend GEwinne schreibt mit langfristigen Aufträgen....

Die Balken markeiren den Saldo aus 5 Jahren.

Wenn der Gesamtmarkt jetzt wieder runterfällt, wird man bei MOR weiterhin froh sein dürfen, wenn sie den Kurs so lala halten kann. Ein richtig gute MOR-Phase wird es wahrscheinlich nur in Verbindung mit steigenden Gesamtmärkten geben, oder aussergewöhnlich guten eigenen Nachrichten.

20% Umsatzplus und laufende Gewinne bei fortschreitenden Projekten reicht dem Markt im Moment nicht.

Today's Medical & Research News

Cancer

Research on cancer reported by scientists at OncoMed Pharmaceuticals, Department of Cancer Biology

April 6th, 2009

(NewsRx.com) -- Current study results from the report, 'Discovery of fully human anti-MET monoclonal antibodies with antitumor activity against colon cancer tumor models in vivo,' have been published. According to recent research published in the journal Neoplasia, "The receptor tyrosine kinase MET is a major component controlling the invasive growth program in embryonic development and in invasive malignancies. The discovery of therapeutic antibodies against MET has been difficult, and antibodies that compete with hepatocyte growth factor (HGF) act as agonists."

"By applying phage technology and cell-based panning strategies, we discovered two fully human antibodies against MET (R13 and R28), which synergistically inhibit HGF binding to MET and elicit antibody-dependent cellular cytotoxicity. Cell-based phosphorylation assays demonstrate that R13 and R28 abrogate HGF-induced activation of MET, AKT1, ERK1/2, and HGF-induced migration and proliferation. FACS experiments suggest that the inhibitory effect is mediated by 'locking' MET receptor in a state with R13, which then increases avidity of R28 for the extracellular domain of MET, thus blocking HGF binding without activating the receptor. In vivo studies demonstrate that the combination of R13/28 significantly inhibited tumor growth in various colon tumor xenograft models. Inhibition of tumor growth was associated with induction of hypoxia. Global gene expression analysis shows that inhibition of HGF/MET pathway significantly upregulated the tumor suppressors KLF6, CEACAM1, and BMP2, the negative regulator of phosphatidylinositol-3-OH-kinase PIK3IP1, and significantly suppressed SCF and SERPINE2, both enhancers of proliferation and invasiveness. Moreover, in an experimental metastasis model, R13/28 increased survival by preventing the recurrence of otherwise lethal lung metastases. Taken together, these results underscore the utility of a dual-antibody approach for targeting MET and possibly other receptor tyrosine kinases," wrote der Horst E.H. van and colleagues, OncoMed Pharmaceuticals, Department of Cancer Biology.

The researchers concluded: "Our approach could be expanded to drug discovery efforts against other cell surface proteins."

van and colleagues published their study in Neoplasia (Discovery of fully human anti-MET monoclonal antibodies with antitumor activity against colon cancer tumor models in vivo. Neoplasia, 2009;11(4):355-64).

For additional information, contact E.H. van der Horst, OncoMed Pharmaceuticals Inc., Dept. of Cancer Biology, 800 Chesapeake Dr., Redwood City, CA 94063 USA..

The publisher's contact information for the journal Neoplasia is: Nature Publishing Group, 345 Park Avenue South, New York, NY 10010-1707, USA.

Keywords: United States, Redwood City, Anticancer Therapy, Antitumor Activity, Biotechnology, Colon Cancer, Colon Carcinoma, Embryonic Research, Enzyme Research, Gastroenterology, Kinase, Monoclonal Antibody, Neoplasia, OncoMed Pharmaceuticals, Oncology, Pharmaceutical Business, Pharmaceutical Company, Proteins, Proteomics, Treatment, Tyrosine Kinase.

This article was prepared by NewsRx editors from staff and other reports. Copyright 2009, NewsRx.com.

R13 und R28 von Oncomed sind durch Morphosys HuCAL-Technologie generiert worden. Siehe

http://www.neoplasia.com/pdf/manuscript/v11i04/neo081536.pdf

bisher nur in Mäusen, kann ja aber noch werden.

http://thefutureofthings.com/news/6684/...s-neutralize-avian-flu.html

Human Antibodies Neutralize Avian Flu

Wednesday, March 18, 2009 - Anni Shaer Levitt

A recent study conducted at the Burnham Institute for Medical Research in California, led by Professor Robert Liddington, showed that human antibodies can neutralize the effect of the avian flu virus. These antibodies can be used to generate vaccines and treatments for a large variety of influenza viruses.

(Credit: Burnham Institute

for Medical Research)

Influenza pandemics are worldwide outbreaks of disease that occur when a new influenza virus emerges for which people have little or no immunity. The disease spreads very quickly; moving from person to person and can affect whole countries. Many health professionals are concerned that the spread of avian flu throughout eastern Asia presents a significant threat to human health. Worldwide, more than 250,000 deaths from seasonal influenza occur annually. Current treatment methods include vaccines which have to be updated yearly and anti-viral medications which only have limited effectiveness. “The head portion of hemagglutinin is highly mutable, leading to the rise of forms of the virus that can evade neutralizing antibodies,” said Robert Liddington, Ph.D, one of the investigators on the study. “However, the stem region of hemagglutinin is highly conserved because it undergoes a dramatic conformational change to allow entry of viral RNA into the host cell. It’s very difficult to get a mutation that doesn’t destroy that function, which explains why we aren’t seeing escape mutants and why these antibodies neutralize such a variety of strains of influenza.”

Researchers at the Dana-Farber Cancer Institute, Burnham Institute for Medical Research, and the Centers for Disease Control and Prevention have discovered that monoclonal antibodies (mAb) neutralize an unprecedented range of influenza A viruses, including avian influenza A (H5N1) virus, previous pandemic influenza viruses, and some seasonal influenza viruses. The team identified antibodies that neutralize a broad range of influenza A subtypes. The antibodies bind to a highly conserved stem area in the H5 type hemagglutinin (HA). Once they bind to the stem, the virus cannot change to a conformation, which is necessary in order to enter the host cell. This prevents further infection of host cells and the proliferation of virus mutants. The research showed that a great number of different types of bird flu were inhibited by the mAb and that mAbs protected mice that were exposed to the H5N1 virus even when injected three days after the infection.

Hier noch ein link zu einem etwas wissenschaftlicheren Artikel vom Februar:

MOR ADRs seit US-Notizaufnahme im Vergleich zum Index BTK und NBI sowie Einzelwert Medarex (Basis US-Dollar):

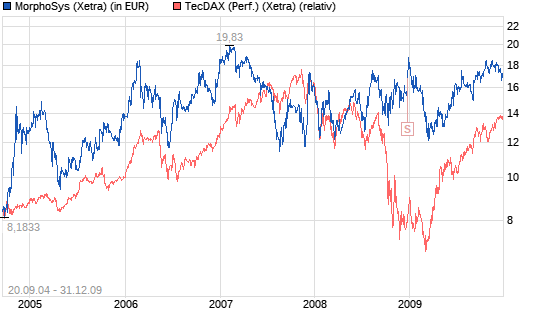

Thema: Morphosys im TecDAX

Performancevergleich mit TecDAX seit Indexaufnahme 20.9.2004.