Blockbuster insolvent - der Zock beginnt

02.08.11 13:28

#4794

zu urteilen, dürfte es heute weiter aufwärts gehen.

du sagst gar nichts mehr,nur wenn es steigt

Once a Netflix monopoly, the DVD streaming and mail delivery industry continues to get more competitive. After a recent price hike from Netflix, competitors have gone on the attack, and are aggressively targeting Netflix customers. The Bedford Report examines the outlook for companies in the Music and Video Stores Industry and provides equity research on Blockbuster, Inc. (PINKSHEETS: BLOAQ) and Netflix, Inc. (NASDAQ: NFLX). Access to the full company reports can be found at:

www.bedfordreport.com/BLOAQ

www.bedfordreport.com/NFLX

Shares of Netflix have been on the downswing since the company announced new subscription plans for its DVD-by-mail and streaming customers. Under the new plan, customers who seek to subscribe for both the DVD-by-mail and streaming services will have to pay $16.00 per month for unlimited access. Previously, Netflix used to charge $10.00 a month for the bundled offering.

Blockbuster immediately began to target disappointed Netflix customers. Blockbuster, which was purchased by Dish Network in April, has begun an email campaign to lure Netflix customers outraged by that company's price hike.

The Bedford Report releases investment research on the Music and Video Stores Industry so investors can stay ahead of the crowd and make the best investment decisions to maximize their returns. Take a few minutes to register with us free at www.bedfordreport.com and get exclusive access to our numerous analyst reports and industry newsletters.

Blockbuster's website offers movies, TV shows, and games. They also have on-demand options to stream, and renting by mail without a subscription.

Recently, Netflix reported second quarter 2011 diluted earnings of $1.26 per share on revenues of $788.6 million. The year-on-year revenues were primarily boosted by newer additions in the net subscriber base. At the end of the second quarter of 2011, the total number of subscribers was 24.6 million, an increase of 64.0% from the prior-year quarter.

The Bedford Report provides Market Research focused on equities that offer growth opportunities, value, and strong potential return. We strive to provide the most up-to-date market activities. We constantly create research reports and newsletters for our members. The Bedford Report has not been compensated by any of the above-mentioned publicly traded companies. The Bedford Report is compensated by other third party organizations for advertising services. We act as an independent research portal and are aware that all investment entails inherent risks. Please view the full disclaimer at http://www.bedfordreport.com/disclaimer.

Contact: The Bedford Report Email Contact

SOURCE: The Bedford Report

http://www.stockhouse.com/tools/...Fsymbol%3DBLOAQ%26newsid%3D8262326

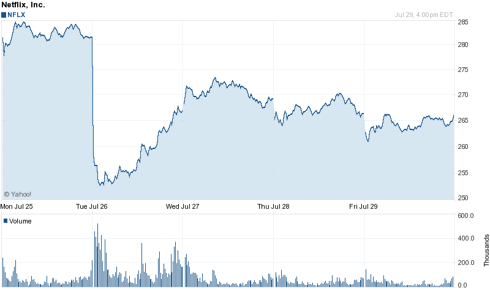

Things haven’t been terribly good for high-flier Netflix (NFLX) since it reported record second quarter profits last Monday. The company beat analysts’ estimates on earnings but missed slightly on revenues while guidance trailed estimates. But what is next for the stock?

Click to enlarge:

Since this is perhaps the most controversial stock of the last two years, arguments go both ways. The momentum crowd continues to think that the stock is a “buy,” as it focuses on earnings growth. The fundamentalist crowd continues to think that the stock is a “sell” or even a short, focusing on the company guidance.

So far, the momentum crowd have been winning the game, but I do think this time around, they are on the wrong side of the trade. Fundamentals are catching up with Netflix and the company will be squeezed on both ends of its business by Amazon.com (AMZN) and Blockbuster (BLOAQ.PK). Let’s take a look at each threat.

Though Amazon.com has been long rumored as a potential competitor, it is now official that it is going head to head against Netflix in video streaming-- just check the announcement on the company’s page. How many customers will Amazon.com take away from Netflix? We haven’t seen any estimates yet, but it will certainly slow the subscription growth, and eventually the revenue and earnings growth for the company. That's not a good omen for the momentum crowd which believes that the stock can reach the moon.

Long thought to be gone, Blockbuster video seems to be back. Contrary to what the momentum crowd wished, the new owner of the video store (Dish Network (DISH)) decided to keep the chain open. How many people will return to the old video store? Again, we don’t have any estimates, but it is certainly not a good omen for Netflix’s subscription base either.

Compounding the problem is Netflix’s strategy to raise its service bundle from $9.99 to $15.99. This helps Amazon.com and Blockbuster video more than it helps Netflix itself. Consumers who want the traditional video service can return to Blockbuster video, while consumers who want streaming only can go to Amazon.com.

http://seekingalpha.com/article/283446-amazon-and-blockbuster-should-squeeze-netflix?source=feed

Kurs geht auch wieder hoch... derzeit 0,083$

Auf eine gute restwoche....