Kirkland Lake Gold (KL.TO 11,40 C$)

Kirkland Lake Gold meldet Produktionszahlen für Q2/18

- ~165 koz Gold in Q2/18 (im Vgl. 148 koz in Q1/18)

- ~ 312 koz in H1/18 (im Vgl. 291 koz in H1/17)

- "on track" um die Prognose von 620 koz zu erreichen

http://www.klgold.com/news-and-media/...5-Ounces-of-Gold/default.aspx

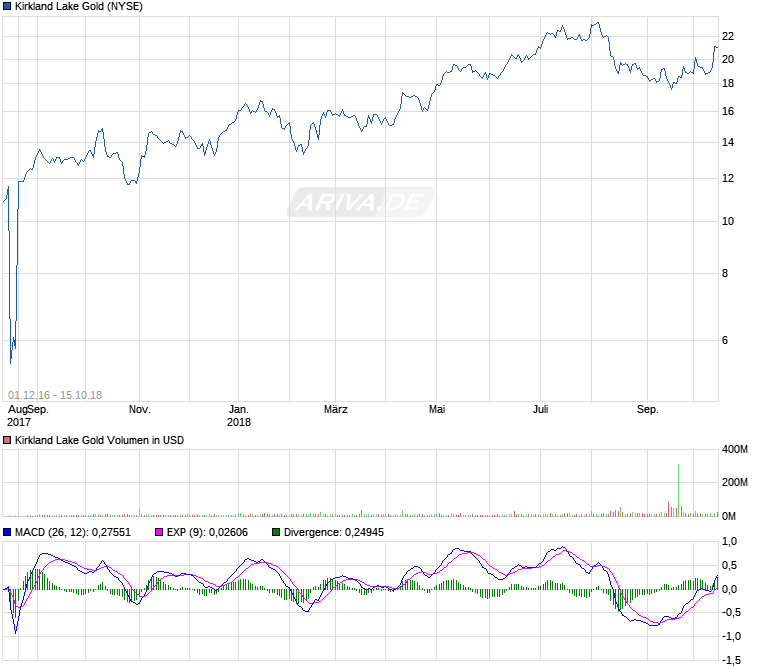

Warscheinlich die einzige reine Goldminenaktie auf der Welt die noch über einen Aufwärtstrend verfügt, bei den Goldpreisen ist natürlich die Frage wie lange noch ?

Ausblick

Das Umfeld für Edel- und Basismetalle hat sie leider in den letzten Wochen stark eingetrübt- daran ist zum großen Teil die "Trumpsche Zöllerei", die die Weltwirtschaft etwas abbremsen könnte.

Ein paar Monate später könnte dann wieder "die Finanzkrise" zurückkehren weil durch die abgewächte Wirtschaft weniger Steuereinahmen fließen, wäre wieder gut für die Goldnachfrage.

Tony Makuch, President and Chief Executive Officer of Kirkland Lake Gold, commented: “Positive grade performance at Fosterville and Macassa was a key driver of our strong second quarter performance and record first-half financial results. At Fosterville, our average grade for Q2 2018 of 20.6 grams per tonne was well ahead of expected levels, with the mine benefiting from a record month in June, producing 31,710 ounces at 30.4 grams per tonne. At Macassa, our stopes around the 5,700-foot level, the deepest mining done to date in the South Mine Complex, are high-grade stopes that have outperformed, which resulted in record quarterly production in Q2 2018 of 60,571 ounces at an average grade of 21.5 grams per tonne. Based on the strong results at both mines in the first half of the year, we have improved the full-year 2018 guidance for production and operating cash costs per ounce sold for both Fosterville and Macassa, as well as on a consolidated basis.

Kirkland Lake Gold meldet Ergebnisse für Q2/18

second quarter of 2018 results:

- Strong growth in net earnings: Net earnings totalled $61.5-million (29 cents per basic share), 78-per-cent increase from $34.6-million (17 cents/share) in the second quarter of 2017 and 23 per cent higher than $50.0-million (24 cents/share) in the first quarter of 2018.

- Adjusted net earnings: Adjusted net earnings totalled $63.4-million (30 cents/share) versus $39.3-million (19 cents/share) in the second quarter of 2017 and $52.6-million (25 cents/share).

- Record quarterly cash flow from operations: Record cash flow from operating activities was $120.9-million, a 56 per cent higher than $77.5-million in the second quarter of 2017 and a 35-per-cent increase from $89.6-million in the first quarter of 2018.

- Substantial free cash flow: Free cash flow grew to $60.7-million, an 18-per-cent increase from $51.2-million in the second quarter of 2017 and 21 per cent higher than $50.2-million in the second quarter of 2018.

- Record quarterly EBITDA (earnings before interest, taxes, depreciation and amortization): Record EBITDA was $123.7-million, 30 per cent higher than $95.1-million in the second quarter of 2017 and a 17-per-cent increase from previous quarterly record of $105.9-million in the first quarter of 2018.

- Strong cash position: Cash increased $43.1-million or 16 per cent to $318.4-million at June 30, 2018, from $275.3-million at March 31, 2018, and $86.8-million or 37 per cent from $231.6-million at the end of 2017.

- Low unit costs: Production costs totalled $66.5-million in the second quarter of 2018. Operating cash costs per ounce sold averaged $404, a 16-per-cent improvement from $482 in the second quarter of 2017 and 10 per cent better than $447 in the first quarter of 2018. All-in sustaining cost (AISC) per ounce sold averaged $757 compared with $729 in the second quarter of 2017 and $833 in the first quarter of 2018.

- Production ahead of plan: Production totalled 164,685 ounces, a 3-per-cent increase from 160,305 ounces in the second quarter of 2017 and 12 per cent higher than 147,644 ounces in the first quarter of 2018.

- Capital expenditures: Sustaining capital expenditures totalled $44.1-million ($86.2-million for year to date 2018), while growth capital expenditures totalled $11.1-million ($15.7-million for year to date 2018), excluding capitalized exploration expenditures. Work related to key projects to ramp up in second half of 2018.

- Exploration expenditures: Exploration expenditures totalled $25.3-million ($43.9-million for year to date 2018), including capitalized exploration expenditures, with recent results including the continued intersection of high-grade mineralization outside existing mineral resources at Macassa, as well as additional high-grade, visible-gold-bearing intersections at the Swan zone at Fosterville in support of further growth Swan zone mineral reserves.

- Quarterly dividend increased on May 2, 2018, to three cents/share effective the second quarter 2018 quarterly dividend payment, paid on July 13, 2018 (the first quarter of 2018 quarterly dividend of two cents/share paid on April 13, 2018).

http://s21.q4cdn.com/967674075/files/...sultsjuly312018-FINALREV3.pdf

das wars nun mit der Konsolidierung würde ich sagen ....

Kirkland Lake Gold investiert 25 Mio. CAD in Osisko Mining

weiter gehts mit guten News

http://s21.q4cdn.com/967674075/files/doc_news/...r192018FINALrev1.pdf

Kirkland Lake meldet Produktionszahlen für Q3/18

Highlights of Q3 2018 and YTD 2018 production results include:

- Q3 2018 production of 180,155 ounces, a 30% increase from 139,091 ounces in the third quarter of 2017 (“Q3 2017”) and a 9% increase from 164,685 ounces in the second quarter of 2018 (“Q2 2018”)

- Gold poured in Q3 2018 totaling 187,331 ounces, with total gold sales of 184,509 ounces

- Quarterly production at Fosterville totaling 90,618 ounces in Q3 2018, an increase of 47% from 61,535 ounces in Q3 2017 and 17% higher than 77,462 ounces in Q2 2018

- Production from Canadian operations in Q3 2018 of 89,537 ounces, lead by Macassa, which produced 55,582 ounces, in line with target levels, production at Holt of 20,609 ounces and production at Taylor of 13,333 ounces

- YTD 2018 consolidated production totaling 492,484 ounces, an increase of 15% from 429,822 ounces in the first nine months of 2017 (“YTD 2017”), with year-over-year production growth of 26% at Fosterville, to 231,923 ounces, 19% at Macassa, to 170,190 ounces, 8% at Holt, to 50,996 ounces, and 15% at Taylor, to 39,328 ounces

- YTD 2018 gold poured of 498,124 ounces, with YTD 2018 gold sales of 496,577 ounces.

http://www.klgold.com/news-and-media/...ction-in-Q3-2018/default.aspx

☕️☕️

Kirkland Lake Gold , das sieht gut aus.

https://www.nasdaq.com/symbol/kl/institutional-holdings/new

Kirkland Lake Gold meldet Ergebnisse für Q3/18

Key highlights of Q3 2018 results include:

- Strong year-over-year earnings growth: Net earnings totalled $55.9-million (27 cents per basic share), while adjusted net earnings (1) were $60.6-million (29 cents share). (Adjusted net earnings exclude non-cash, mark-to-market loss related to fair valuing warrants.) Net earnings in Q3 2018 increased 28 per cent from $43.7-million (21 cents per share) in Q3 2017 and compared with $61.5-million (29 cents per share) in the previous quarter.

- Increased free cash flow (1): Free cash flow of $52.2-million increased 41 per cent from $37.1-million in Q3 2017 and compared with $60.7-million in Q2 2018.

- Record quarterly cash flow from operations: Record cash provided by operating activities (2) was $128.4-million, a 77-per-cent increase from $72.4-million in Q3 2017 and 6 per cent higher than $120.9-million in the previous quarter.

- Record gold sales drive revenue growth: Revenue totalled $222.7-million, a 26-per-cent increase from $176.7-million in Q3 2017 and 4 per cent higher than $214.7-million in Q2 2018, reflecting record gold sales of 184,517 ounces, which more than offset reductions of $78 per ounce and $97 per ounce in the average realized gold price versus Q3 2017 and Q2 2018, respectively.

- Solid year-over-year increase in EBITDA (1) (2) (3): EBITDA of $119.6-million was a 20-per-cent increase from $99.7-million in Q3 2017 and compared with record EBITDA of $123.7-million in Q2 2018.

- Record low unit costs: Production costs totalled $64.9-million in Q3 2018. Operating cash costs per ounce sold (1) averaged $351, a 27-per-cent improvement from $482 in Q3 2017 and 13 per cent better than $404 in Q2 2018. AISC per ounce sold (1) averaged $645, 24 per cent better than $845 in Q3 2017 and a 15-per-cent improvement from $757 the previous quarter.

- Growth projects ramp up: Growth capital expenditures totalled $33.2-million, excluding capitalized exploration expenditures, compared with $7.5-million in Q3 2017 and $11.1-million in the previous quarter. Of total growth capital expenditures, $21.5-million was incurred at Macassa, where work on the No. 4 shaft project included shaft collaring and advancing hoist and headframe construction.

- Continued exploration success: Exploration expenditures totalled $25.6-million ($69.5-million for YTD 2018), including capitalized exploration expenditures. Recent exploration results include exceptionally high-grade intersections from drilling in the Swan zone at Fosterville and the South mine complex at Macassa, highlighting the potential for continued growth in mineral reserves and mineral resources.

- Cash at Sept. 30, 2018, was $257.2-million, an 11-per-cent increase from $231.6-million at Dec. 31, 2017.

- The quarterly dividend was increased on May 2, 2018, to three Canadian cents per share, effective for the second quarter 2018 quarterly dividend payment, paid on July 13, 2018, and the Q3 2018 quarterly dividend payment, paid Oct. 12, 2018.

http://s21.q4cdn.com/967674075/files/...8-FINAL-OCTOBER-30-2018v2.pdf

Kirkland Lake baut seine Beteiligung an Osisko Mining auf 13,6% aus

https://steelguru.com/mining/...isko-mining-for-cad-25-million/526955

Toronto (www.aktiencheck.de) - Kirkland Lake Gold-Aktienanalyse des Analysten Craig Stanley von Eight Capital:

Laut einer Aktienanalyse spricht Craig Stanley, Analyst von Eight Capital, nunmehr eine Kaufempfehlung für die Aktien des Goldminen-Betreibers Kirkland Lake Gold Ltd. (ISIN: CA49741E1007, WKN: A2DHRG, Ticker-Symbol: NGDA, TSE-Symbol: KL) aus.

Die Goldgehalt der Fosterville-Mine von Kirkland Lake Gold Ltd. sei höher als bislang im Bewertungsmodell berücksichtigt. Dadurch erhöhe sich das Produktionsvolumen.

Analyst Craig Stanley setzt das Kursziel von 25,00 auf 33,25 CAD nach oben. Der Titel verdiene wegen des niedrigen Risikoprofils und der anhaltenden Outperformance der Fosterville-Mine einen Bewertungsaufschlag.

In ihrer Kirkland Lake Gold-Aktienanalyse stufen die Analysten von Eight Capital den Titel von "neutral" auf "buy" hoch.

Aussichten für Gold sollen nächstes auch besser stehen als dieses Jahr, laut verschiedener handelshäuser.

Kirkland, mögliche Kursrücksetzer in Bereich 22$ zum Kauf nutzen, nmM.

Quelle: https://de.tradingview.com/chart/KL/iC21XBbe/

Fosterville performed stark

- statt der 300-310 koz Gold in 2018 wird nun eine Produktion von 330 koz Gold für Fosterville anvisiert

- Gesamtprognose auf 655-670 koz angehoben für 2018

- Ausblick für 2019 bei 740-800 koz Gold zu AISC 630-680$/oz

https://steelguru.com/mining/...mine-s-2018-production-outlook/527939

https://www.asx.com.au/asxpdf/20181213/pdf/4415vbqpzq8m8q.pdf

Kirkland Lake Gold meldet Produktionszahlen für 2018

- Q4/18 ~ 231 koz Gold

- 2018 ~ 723 koz Gold

- Ausblick 2019 ~ 740-800 koz Gold

http://www.miningweekly.com/article/...rly-gold-production-2019-01-08

https://www.klgold.com/news-and-media/...-Full-Year-2018/default.aspx

Kirkland Lake meldet Zahlen für 2018

- Umsatz 916 Mio. $

- Gewinn 274 Mio. $

- Ausblick für 2019 angehoben von 740-800 koz Gold auf 920-1000 koz Gold

- AISC von 630-680$/oz auf 520-560$/oz gesenkt

https://www.klgold.com/news-and-media/...unces-at-310-gt/default.aspx

https://s21.q4cdn.com/967674075/files/...rly/q4/MDA-Q4-2018-FINAL.pdf

alle schauen nur noch auf den Goldpreis, egal wie der Ausblick ausgeht. Ich gehe hier von einer weiteren Korrektur aus, wenn der Goldpreis weiter so schwach bleibt.

Kirkland Gold meldet Produktionszahlen für Q1/19

- 232 koz Gold

- davon 128 koz Fosterville

- davon 128 koz Fosterville

http://www.miningweekly.com/article/...erville-and-macassa-2019-04-05

wer sich Kirkland mal sauber und sehr einfach auf Deutsch erklären lassen möchte

sollte einfach mal ein paar Minuten sich dieses Video ansehen.

Ab Minute 34,40 wird man sehen warum KL zur Zeit die Beste Goldaktie ist was es auf der Welt gibt.

https://www.youtube.com/watch?time_continue=2&v=556hbywGCf4

unbedingt ansehen und sich dan Gedanken machen was passiert wenn der Goldpreis weiter steigt und wenn die Firma Ihr vieles Geld wieder in weitere Zukäufe und Exploration investiert.

Dann gibt es keine weiteren Fragen mehr ... Keine Schulden , Geld ohne Ende , ein Mangement dsa bisher alles richtig gemacht hat und wie ich vermute auch weiter sehr clever agiert .