Die Produktion wurde aufgenommen!

Seite 1 von 2 Neuester Beitrag: 23.03.07 10:24 | ||||

| Eröffnet am: | 04.08.05 10:01 | von: Knappschaft. | Anzahl Beiträge: | 40 |

| Neuester Beitrag: | 23.03.07 10:24 | von: Knappschaft. | Leser gesamt: | 18.941 |

| Forum: | Hot-Stocks | Leser heute: | 6 | |

| Bewertet mit: | ||||

| Seite: < | 2 > | ||||

WKN: 909038 ISIN: US3811491030

Press Release Source: Golden Phoenix Minerals, Inc.

Golden Phoenix Minerals Enters Into Common Stock Purchase Agreement for up to $6.2 Million Standby Equity Funding

Friday July 15, 5:00 am ET

SPARKS, Nev., July 15 /PRNewswire-FirstCall/ -- Golden Phoenix Minerals, Inc. (OTC Bulletin Board: GPXM - News) is pleased to announce it has secured $6.2 million of standby equity capital with which to underpin company-wide operations including the start-up of its Ashdown molybdenum mine located in northwest Nevada. The funds are available on an as-needed basis through a common stock purchase agreement with Fusion Capital Fund II, LLC, a Chicago-based institutional investor.

ADVERTISEMENT

The agreement is the second phase of a two-part funding program initiated in 2002. Under the terms of the new 24-month agreement Golden Phoenix may elect, at its sole discretion, to sell up to $12,500 of common stock to Fusion Capital each trading day. In turn, Fusion Capital has committed to buy the stock at a cost that is based on the market price as of the date of each purchase, without any fixed discount to market. The agreement provides the Company a backup to the financing already in place and will be held in reserve as a secondary source of future funding, if needed.

Kenneth S. Ripley, CEO of Golden Phoenix, said, "Our management team carefully reviewed more than a dozen funding proposals over the past four months and came to realize that our existing relationship with Fusion Capital offers the most cost-effective source of standby capital to date. We believe Fusion Capital's willingness to renew their support demonstrates continued confidence in Golden Phoenix."

Mr. Ripley stressed that "we are particularly pleased with the flexibility and control this arrangement provides. The agreement does not limit our right to seek alternative debt or asset-based financing, which we continue to do. On the contrary, we regard our ability to attract other forms of funding and fulfill current loan obligations as clearly strengthened by the presence of this safety-net."

Under the terms of the agreement Golden Phoenix controls both the timing and amount of stock sold to Fusion Capital. The Company may also refrain from utilizing further funding and terminate the agreement at any time, without penalty. As a condition of financing, the Company has consented to sell $200,000 of common stock to Fusion Capital at $0.15 per share. The agreement stipulates that Fusion Capital will not engage in any direct or indirect short selling or hedging of the Company's common stock in any manner whatsoever.

Fusion Capital will receive a commitment fee of 2.19 million shares of restricted common stock, which are not to be sold or transferred for the duration of the agreement. The initial sale of stock and issuance of commitment shares to Fusion Capital is offset in part by the retirement of 2.65 million GPXM options, which expired during the first two quarters of 2005. A registration statement will be submitted to the Securities & Exchange Commission and must be declared effective before Golden Phoenix can access the funds. A detailed description of the transaction is set forth in a Form 8-K filed with the SEC.

About Fusion Capital

Fusion Capital Fund II, LLC is a broad-based investment fund, based in Chicago, Illinois. Fusion Capital makes a wide range of investments ranging from special situation financing to long-term strategic capital.

About Golden Phoenix

Golden Phoenix Minerals, Inc. is a Nevada-based mining company committed to deliver value to its shareholders by acquiring, developing and mining superior precious and strategic metal deposits in the western United States using competitive business practices balanced by principles of ethical stewardship.

Visit the Golden Phoenix Web site at http://www.Golden-Phoenix.com/

Forward-Looking Statements. Certain statements included herein may contain forward-looking information within the meaning of Rule 175 under the Securities Act of 1933 and Rule 3b-6 under the Securities Exchange Act of 1934, and are subject to the safe harbor created by those rules. All statements, other than statements of fact, including, without limitation, statements regarding potential future plans and objectives of the company, are forward-looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. The Company's actual results could differ materially from those anticipated in such forward-looking statements as a result of a number of factors. These risks and uncertainties, and certain other related factors, are discussed in the Company's Form 10-KSB, Form 10-QSB and other filings with the Securities and Exchange Commission. These forward-looking statements are made as of this date and the Company assumes no obligation to update such forward- looking statements as a result of a number of factors.

CONTACT:

Golden Phoenix Minerals, Inc.

Robert Martin

Director of Corporate Development

775/853-4919

E & E Communications

Paul Knopick

949/707-5365

pknopick@eandecommunications.com

Zeitpunkt: 01.04.06 11:50

Aktion: Forumswechsel

Kommentar: -

Schönes Wochenende

Eiswürfel

GPXM’s chart (not that BB’s are much affected by market forces beyond fear and greed) is a thing of beauty for those looking to buy at the bottom.

IMO, just about everybody that’s gonna bail out under .16 has pretty much disappeared in the prop wash, so it’ll continue to notch up, even at lower volume..

There’s plenty of attention on this play from people who understand that all of the high-strength steel in the 100’s of miles of pipe for the drilling and transmission of oil, gas, and LNG infrastructure, which will be pushed hard by the exponetial growth in energy demand, is now subsidized by the just passed energy bill. Those costs are now a write-off and all that demand for high-strength steel will vacuum moly like an addict hoovers a mirror.

Tough to get a significant fill under .17 now, so anybody trying to load up will be chewing on the ask.

It's only the first leg up and might fall to .15, but only on very light volume. The next leg up (PR) will get yer juices flowing.

ist ja wohl unstrittig im falschen Board!

The Water Pollution Control Permit authorizes commercial operation of the 100-ton per day flotation mill. The mill is designed to process high-grade molybdenum-bearing material recovered from Ashdown's Sylvia vein and produce molybdenite concentrates for sale through the Company's broker. Initially, the mill will be used to process and market the 1000-ton bulk sample authorized by an Amended Notice of Intent filed with the Bureau of Land Management. Upon approval of the final Plan of Operation for the Ashdown mine, the mill will be placed into continuous service.

The Reclamation Permit authorizes future remediation of the mill site once milling activities have been discontinued. In accordance with the permit, Golden Phoenix is to leave the project site safe, stable, and capable of providing for a productive post-mining land use. The $114,000 bond guarantee for this reclamation obligation has been posted and accepted by NDEP.

Both permits become effective fifteen days after Notice, at which time Golden Phoenix will erect the millworks on the concrete foundation that was completed in September and complete the adjacent tailings impoundment.

Golden Phoenix Minerals, Inc. is a Nevada-based mining company committed to deliver value to its shareholders by acquiring, developing and mining superior precious and strategic metal deposits in the western United States using competitive business practices balanced by principles of ethical stewardship.

Visit the Golden Phoenix Web site at http://www.Golden-Phoenix.com/

Fazit :

November 2005 ist die Mühle einsatzfähig

Dezember 2005 wird produziert

Januar 2006 wir das Moly verkauft.

Es steht also der Produktion nichts mehr im Wege.

Golden Phoenix erwartet einen monatlichen Cash flow von rd. 5 Mio US$. Das KGV sollte von unter 1 zurückfallen.

Strong Buy

Die beiden Genehmigungen war wirklich sehr wichtig für die Produktion und das fundament steht auch schon!

Molybdän (engl. Molybdenum) ist das 42. Element im Periodensystem und befindet sich in der 5. Periode. Molybdän hat das Symbol Mo.

olybdän und Mo-Legierungen

Molybdän zählt zu den 90 natürlich vorkommenden Elementen. Es ist ein seltenes Element, besitzt ein kubisch raumzentriertes Metallgitter und zählt mit seinem

Schmelzpunkt von 2620 °C zu den hochschmelzenden Metallen.

Der Name Molybdän leitet sich aus dem Griechischen ab und bedeutet " das Schwere" oder auch " Blei" . Molybdän wurde früher oft mit Blei verwechselt, da es im Mineral Wulfenit an Blei chemisch gebunden ist. Der schwedische Chemiker C.W. Scheele gilt als Endecker des Molybdäns.

PLANSEE beschäftigt sich seit über 80 Jahren mit der Herstellung von Produkten aus Molybdän und Molybdänlegierungen. Molybdän und seine Legierungen werden vor allem wegen ihrer hervorragenden mechanischen Eigenschaften bei hohen Temperaturen eingesetzt.

http://www.321gold.com/editorials/reser/reser090705.html

Molybdenum - The Big Secret

Ken Reser

Sep 07, 2005

Subsequent to my previous report at 321Gold, " Molybdenum The 21st Century Metal" . I have done further extensive amounts of research for information on current and future uses of Molybdenum. This has been an undertaking of continual frustration due to lack of mainstream information on this Noble Metal. Outside of the continual references to Molybdenum being used in stainless steel and other specialty metal alloys, fertilizers, lubricants and all the other uses I previously outlined in the 321 report (some of which are not reported in mainstream media) I have found what I consider the 'Big Secret' in regard to Molybdenum.

This so called secret involves considering that few people in the mining industry pay much attention to the Catalyst market for Molybdenum, if any at all. It is considered a small portion of the overall world demand in any charts, graphs or articles one may see and read. This is not the case as I see it from all of my own research. Consider why, when so many pundits and experts have continually called for the same dramatic and rapid decline in Molybdenum prices as we have seen in past when it spiked in price, that it has confounded all the predictions and has remained high for months on-end, all the while outliving those same wrongful predications. Today I believe there are little known, but yet profound changes afoot in the world of energy due to scientific discoveries in catalyst research that are outside the scope of most mainstream reports and articles on Molybdenum, and they are so dramatic and exciting that soon the entire Oil industry will soon be in shock. These changes being brought about by the new discoveries in the catalyst sciences involve coal, plastics and even used tires. The energy field I'm speaking of is 'Liquefaction'. In the 1950's and even earlier, Coal Liquefaction to produce fuel oils was known and studied in the USA, Germany, Japan and S Africa among others. Japan in 1940 produced 30,000 T of liquefied coal oil. Production continued until the end of WW2. Immediately after the end of the war the US military banned further research into coal liquefaction, alleging that it was military research. The process was costly and compared to the price of a barrel of Oil, not yet feasible. It has been stated that for Coal Liquefaction to be cost efficient and profitable, a barrel of crude must sell for $32.00. The Japanese have published reports stating $20.00 p/barrel. The better the catalyst functions, the higher the liquid yield rate becomes. Through international cooperation coal liquefaction has gone from the research stage to commercialization in Japan. Today Japan, Germany, Indonesia, & the USA have all embarked on projects with coal liquefaction. Before I continue with this discussion on the Liquefaction process, I would like to dwell on crude oil for a moment.

Today thanks to the scientific study of new age band catalysts, and Molybdenum Oxide, Nickel, Iron & Cobalt compounds in particular, we now have catalysts that are helping refiners meet the stringent EPA & EEU pollution emission standards recently established. Sulfur is the culprit and the enemy of clean air and consequently due to the 2005 EPA standards (Diesel sulfur content has gone from 300 ppm to 50 ppm) the demand for refinery & hydro-cracking catalyst is going to increase dramatically. There is also another factor at work when considering the crude refinery catalyst demand.

For the last 20 to 30 years very few refineries have been built worldwide, and none in the USA. As I write this I'm reading of Venezuela building three new refineries and expanding two existing ones. China in a JV with its own Sinopec and Saudi Aramco & ExxonMobil have begun building their multi-billion-dollar refinery and petrochemical complex in China's Fujian province. Meanwhile a JV between Borealis & Abu Dhabi National Oil Co. is advancing another ethylene cracking facility in Abu Dhabi. One should be able to see the picture unfolding, " More Refineries" to come and most likely in Europe, Canada and the USA first. Other nations will invariably follow suit in this age of peak oil and rapidly increasing demand from developing nations like China, India, Brazil & SE Asia etc coupled with growth in the western world. The more refineries and hydro-cracking facilities in operation obviously mean's more Molybdenum catalyst demand. With less sweet crude now available and more sour heavy crude that has to be refined, it is going to mean more catalyst demand.

Next is the new looming production and market for (NG) Gas To Liquids Fuels (GTL). This market is fast becoming a reality and will invariably become a robust market for catalysts as well. GTL plants use catalysts of Cobalt/Iron/Molybdenum in the processes. Each GTL plant according to Bill Bell VP of Methanol & GTL Technology & Catalysts at Johnson Matthey " With GTL ready for ascension a big market for catalysts is now emerging & we are looking at thousands of tons plus of catalyst as inventory in a single plant" .GTL plants (in 2003) are being considered in almost every corner of the globe that has reserves of NG, especially in areas like the Middle East where there is little local market for it & there are no pipelines to market NG. GTL converts NG into an easily exported liquid form. Shell in 2003 had a plant in operation in Malaysia & pursuing another in Qatar, as is Sasol Chevron. Chevron is also considering other plants in Nigeria, Australia & Caribbean. Exxon-Mobil is also interested in Qatar and Syntroleum is looking at Bolivian gas fields. BP is experimenting with a test plant in Alaska. (As this info on the GTL market is from 2003 I have no idea which projects may now be completed) So now I have outlined another little spoken of and upcoming demand on Molybdenum. The refinery demand for catalysts is already in the Billions of dollars and the worldwide demand for all the different combined types of catalyst uses in 2003 was approximately $7.5 Billion according to published reports.

According to a Roskill Metals report on catalysts (30/10/03) based on the steel industry states, Molybdenum demand has been growing at 2-4% p/a and in hydro-processing catalyst sector by 3-5% p/a. I believe now with higher emissions standards these latter catalyst demand percentages are now much higher if the truth be known. Also w/o going into detail for the sake of brevity in this report I will only touch on the fact that a Molybdenum/Ruthenium catalyst has been developed by Hitachi and other companies for a low cost Fuel Cell. We do know fuel cells will appear in cars, homes & industry in the near future. Washington State University (WSU) research teams have discovered an improved method of converting hydrocarbons (such as methane) into hydrogen and carbon dioxide using Molybdenum Carbide (Mo2C) as a catalyst. This conversion is an important step in fuel cell systems and processes that convert natural gas (NG) into useful petrochemicals. This patent is pending.

On another front Osiris in France and others involved in the world nuclear industry are testing a Uranium/Molybdenum enriched fuel for Nuclear reactors worldwide. This fuel will do away with using weapons grade Uranium in reactors and once perfected will be used throughout the world. The cost savings from low enriched fuel as opposed to the current highly enriched fuel is substantial as well.

Now lastly before I return to the Coal Liquefaction aspect that gave inspiration for this report, you should realize that the global demand for Molybdenum rose by 7.2% in 2004 to 374 million lbs from 349 m/lbs in 2003 as outlined in a study commissioned by International Molybdenum PLC and performed by CRU Strategies Ltd. mining consultants. Further CRU states that conservatively Molybdenum demand thru 2009 will grow by 3.5% to 4.1% p/a and the projected demand will be up to 475 million lbs in the same year. They also (CRU) project a deficit in Molybdenum production in 2008 and as much as a 14 million lb deficit in 2009. The theory of the world entering a " Super Commodities Cycle" is supported by recent reports by Citigroup-Smith Barney (China - The Engine of a Commodities Cycle, March 31 /05) and Goldman Sachs (Metals & Mining March 21 /05) and US Energy (Oil March 30/05) and along with the likes of the renowned Jim Rogers I believe this super cycle in finite resources is well underway and will last for many, many years to come.

The mining industry has been slow in responding to current growth in Molybdenum demand and low inventories. Several new projects, both primary and by-product have been promoted in recent months. Given the need for financing and environmental studies it is questionable if any or most of these projects will be producing by 2009. One or two projects seem to have the thrust, reserves and capability to achieve production in 2007/08 nonetheless. As another aside to the focus of this report it is also noteworthy to mention that a memo from the US Army Research Office: Research For Toxic Compound Destruction, states that the University of Pittsburg has shown that Molybdenum, in the presence of oxygen, is a true catalyst for destruction of nerve gas stimulant. A patent has been awarded on this work.

Now back to the Liquefacton portion of this report. The China Daily News online on the 03/12/2004 carried an interesting article on China's liquefaction projects. They stated in part that China has set up its first coal liquefaction research centre in Shanghai, a move to safeguard the nation's increasing oil supply shortage. The centre will explore and develop direct and indirect liquefaction technologies to produce gasoline & diesel fuel.

Shenhua Corp. one of China's largest coal companies w/ an 80% interest in this centre, has almost completed construction of a US $3.3 billion coal liquefaction plant in Inner Mongolia. Operations of this plant are expected to commence in 2005 to produce 1 million tons of gasoline and diesel fuel p/yr. By 2008 they expect to produce 5 million tons of oil with four more production lines. The second phase of the project will involve an additional investment of US $7.3 billion. Plans for two more coal to oil projects are on the shelf.

In another article by People's Daily news of Jan. 24/05 it is stated that by 2013, 10% of oil imports to China will have been replaced by coal liquefaction. The article also states that international indicators show that the process is profitable at between $22.00 to $28.00 US p/barrel and that the National Reform and Development Commission is considering making coal liquefaction one of China's key construction projects this year.

The other aspect of this trend towards liquefaction is the use of recycled tires and plastics in the process. The plastics alone it is estimated comprise approximately 21% by volume of US landfill sites. There is obviously no need to mention the quantities of used tires in the world. The process for the process involving tires & plastic is called Co-Processing and is achieved by combining feed-stocks of coal with the other two products simultaneously.

Without going into a long scientific and technical overview of the coal liquefaction & the co-processing technologies it is important to realize that the present success and feasibility of coal liquefaction is hinged on the recent perfection of an Iron/Molybdenum catalyst used in the de-sulfurization portion of the process. Soon you will be reading about another new scientific field concerning Molybdenum & Nano-Particle Technology. After all I have written about here in this report, it is my estimation and firm belief that we are now witnessing a historic time in the new expanding uses and demands on Molybdenum in the ever changing world of the Catalyst & Alloy Metals markets and those changes/discoveries are becoming more intense as timepasses. To this end I believe now more than ever that,

" MOLYBDENUM IS THE METAL OF THE 21ST CENTURY"

(Post Script Notes)This report is not intended to infer that there is some conspiracy of silence afoot in the Molybdenum or Catalysts markets. In the title 'The Big Secret' simply refers to the seeming secrecy in the catalyst markets and to the lack of mainstream attention paid by mining media to Molybdenum.

Remember Molybdenum IS the biggest percentage dollar gainer of ANY metal in the last 18 months, and we hear little but negativity from media and mining websites.

Over the last few days I have read of Chinese Molybdenum traders stockpiling product for the end quarter of 2005 in order to have supply.

Sept 2/05 a London Mining article stated this in part- " Prices of Mo alloys all rose on Friday as buyers in search of large quantities found that the tightness of supply that had characterized the market in the early part of the year has not lifted." End

Yes there is a bottleneck in Roasting facilities and it is having some effect on Mo price, but why is there a bottleneck? Because demand is outstripping world roasting facilities. Quite simple really! With 5-7% more demand projected by various industry participants, I'd say they better get busy building a lot more roasters, and bringing new Primary Molybdenum Mines in the world onstream or we may see $50.00 p/lb Moly in future.

China's Metals Info Network, ANTAIKE on Aug 19/05 says new overseas roasting facilities will not be operational until after 2007.

Albemarle Catalysts of Louisianna who use approximately 10 million lbs of Molybdenum p/a, stated in a recent report- " We expect a 5% yearly growth rate in certain catalyst sectors and thatwith the peak oil events facing the world and new refineries coming onstream (in Saudi Arabia & China) and expect two more refineries in China as well as others around the globe, drilling exploration coupled with drill steel & pipelines etc, the demand for Molybdenum & Cracking catalyst should continue to grow as will the specialty steel demand. Molybdenum has gained a new place of stature in the world's insatiable demand for noble metals." End.

If anyone has information on the Molybdenum markets they wish to share or would like to follow any of the Jr companies I represent please feel free to phone or email me anytime.

Thanks for reading.

Sep 06, 2005

Ken J. Reser

Investor Relations Consultant

Adanac Moly Corp . website (AUA:TSX-V)http://www.adanacmoly.com/

Goldrea Resources Corp . website (GOR:TSX-V)http://www.goldrea.com/

South Pacific Minerals website (SPZ:TSX-V)http://www.southpacificminerals.com/

email: ykgold@telus.net

tel: 403-844-2914

Note: If you wish to become part of my occasional mailing list on Molybdenum & Gold reports please send me an email.

Previous Day's Closing

Previous Day's Closing

Market Update (previous day closing quotes)

[click item to view chart]

Current

Previous

Previous

Previous

Previous

Last

Day

Week

Month

Year

13-Dec-05

12-Dec-05

6-Dec-05

12-Nov-05

13-Dec-04

Last

% Chg

Last

% Chg

Last

% Chg

Last

% Chg

Last

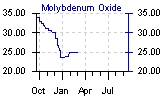

Golden Phoenix Minerals 0.187.6% 0.171.8% 0.17-7.2% 0.18-5.3% 0.19Moly Roasted $/lb

0.187.6% 0.171.8% 0.17-7.2% 0.18-5.3% 0.19Moly Roasted $/lb  30.000.0% 30.000.0% 30.00-3.2% 31.007.8% 28.75Gold USD 1oz-comex

30.000.0% 30.000.0% 30.00-3.2% 31.007.8% 28.75Gold USD 1oz-comex  528.500.3% 527.003.5% 509.008.4% 469.408.3% 433.50Silver-comex

528.500.3% 527.003.5% 509.008.4% 469.408.3% 433.50Silver-comex  9.00001.1% 8.90004.0% 8.560011.5% 7.675014.2% 6.7200Copper, comex

9.00001.1% 8.90004.0% 8.560011.5% 7.675014.2% 6.7200Copper, comex  215.0000-1.4% 218.00000.9% 216.10008.1% 199.900042.6% 140.2000CRB Index

215.0000-1.4% 218.00000.9% 216.10008.1% 199.900042.6% 140.2000CRB Index  328.003.5% 317.000.0% 317.00-0.3% 318.0015.0% 276.55PHLX Gold & Silver

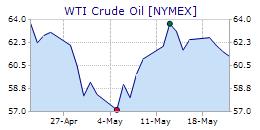

328.003.5% 317.000.0% 317.00-0.3% 318.0015.0% 276.55PHLX Gold & Silver  122.980.0% 122.945.6% 116.434.6% 111.2913.2% 98.32WTI Crude $/b-nymex

122.980.0% 122.945.6% 116.434.6% 111.2913.2% 98.32WTI Crude $/b-nymex  61.303.2% 59.39-0.8% 59.854.1% 57.5241.8% 40.57EUR/USD

61.303.2% 59.39-0.8% 59.854.1% 57.5241.8% 40.57EUR/USD  1.1923-0.3% 1.19631.6% 1.17790.4% 1.1728-11.9% 1.3305USD/JPY

1.1923-0.3% 1.19631.6% 1.17790.4% 1.1728-11.9% 1.3305USD/JPY  120.24000.4% 119.7400-0.9% 120.84002.4% 118.000012.6% 104.8200 TimeFrame

120.24000.4% 119.7400-0.9% 120.84002.4% 118.000012.6% 104.8200 TimeFrame  Click Chart to EnlargeWeek

Click Chart to EnlargeWeek Month

Year

3-Year

Heute gehen sehr große Blöcke über den Tisch!

Heute gehen sehr große Blöcke über den Tisch! aussicht auf gewaltige Gold vorkommen

MT.BURG MNG WKN: 870897 ISIN: AU000000MTB6

und die golden phoenix minerals sind ein grosser Produzent von Molybdenum?

mfg

Shaker

aus dem letzten Report Liquidity and Capital Resources: Since Golden Phoenix’s incorporation on June 2, 1997 and through September 30, 2005 the Company has incurred an accumulated deficit of $29,420,482.

As of September 30, 2005, the Company had $63,756 in cash and a working capital deficit of $9,264,725.

nicht mal ihren vorläufigen CEO Ripley können sie bezahlen,der musste ihnen das Geld pumpen,das ist wahrer Idealismus

By: D. Stewart Armstrong

Golden Phoenix (GPXM) is really a page out of the old west in every sensing. It’s difficult not to have a little fun with the story (hence the title) now that the company is finally back on track and in my opinion it is back on track. I’m going to jump right in here at the beginning and then pick up the story line as we progress. I have absolutely no problem recommending the company at this time. I might be a tad early but I’d rather be early than late in this resource market. And my opinion is that GPXM is a buy up to $.50 US, even with over 140 M shares outstanding on a fully diluted basis. In my opinion, the biggest negative at this point is the share structure because it could possibly impede the ability to raise funds. However, that may also become a moot point in a strong gold market and with Molybdenum (Moly) prices hovering around $23-$25 a pound. When one has a Molybdenum deposit of the magnitude discovered at <?XML:NAMESPACE PREFIX = ST1 />Ashdown, Nevada, several parts of the equation can be moot. Coincidentally, it feels as though GPXM may be getting ready to “break out”. I don’t know whether this is a function of their work program at Ashdown, the market, technical indicators or a combination of all the above. My suggestion is “don’t miss this train”. Now that we’ve gotten the negatives out of the way right up front, we can concentrate on the positives. The Positives One of those positives is that the Mineral Ridge Story has potential in its own right. Add to that a current management team that is focused on the big picture and in building a world class company, and then add to that the Ashdown story line and there appears to be a bright future in store for GPXM. I’ll give you the historical perspective in just a minute. It is fascinating. I’ve been following this company very closely for over six years having participated in a private placement way back when. That got me started with the company. So many players have come and gone since then that the company has taken on a life of its own. It has risen from the ashes of deceit, poor management, mismanagement, and misinformation due to the efforts of a few very special people. People just like you and I; ordinary people doing extraordinary things and actually becoming even more extraordinary in the process. Right now these people are weary but steadfast and unwavering in their desire to see GPXM through to its profitable conclusion. This is totally understandable given what they’ve been through—situations as diverse as underground tunnels and boardroom battles. It reminds me a bit of how the Founding Fathers of these United States believed that the common ordinary folk (citizen-statesman) would take their turn serving in the Congress or the government in some capacity and then return to their trades after their term was completed. It was a good concept at the time—actually it still is if the concept were honored and implemented. Golden Phoenix has ordinary folk taking on extraordinary responsibilities to rebuild a company that had been run into the ground. I believe that most of them have the idea that some day they too might return to their daily lives; turning over the day to operations to another team of their choosing and ratified by the shareholders. Go to The Website! Before we go any further, I’m going to direct you to one of the better web sites in the mining industry today—http://www.golden-phoenix.com/. They say a picture is worth a thousand words and if that’s the case, you’ll be looking at many thousands of words. Their web site is filled with pictures that tell a story. Actually, when you put all the pieces of this puzzle together, it’s more than a story. It’s a saga outlined in blood, sweat, and tears. It’s a saga of progress, dedication, and of hard work. It’s about overcoming incredible odds to get where they are today. The photos of the buildings, roads, mills, tunnels, tailing ponds, machinery, and tough men are all real (If you can believe it, the men are not professional models!). You can’t fake that stuff. You really don’t need to read any further—just go to the web site and follow the saga “post shootout”. Read about the projects, the progress, the people, and don’t neglect the financials. That way you’re covering all your bases. This is a saga in real time and it is now documented in pictures. And Golden Phoenix has indeed lived up to its namesake, having risen from the ashes and having done so on more than one occasion. You know the funny thing? The name “Golden Phoenix” is so appropriate and I don’t believe for a minute that the folks who named the company so many years ago would have ever dreamt how the company would fit into the mold of its namesake to such a degree of perfection. I’d bring one more element into focus concerning this saga. When the current management team finally took over the reigns of this company, GPXM was breathing its last breath. It was in very poor shape and many thought it wouldn’t make it. Remember that as you witness the rebirth first hand. You’ll find the documentation of their perseverance on the website, in their press releases, and what is going to occur in the not too distant future. They’ve uncovered layers of problems and obstacles and have resolved most of them. The one thing I cannot adequately relate to you was the depth and degree of the problems they uncovered when they eventually came into a position to deal with them. It was simply mind boggling. These people truly have turned lemons into lemonade. A little sugar wouldn’t hurt but its coming folks, its coming. Ashdown and Molybdenum Currently the focus of GPXM is their Ashdown Property and what many consider to be the richest deposit of Molybdenum in the world. Remember, I said the richest, not the biggest. The Ashdown mine is comprised of 101 unpatented lode mining claims covering four square miles in Humbolt Country near the town of Denio, in the northwestern corner of Nevada. The mine is owned by Win-Eldrich Mines, Ltd. (WEX), a publicly traded Canadian company based in Toronto. Golden Phoenix serves as Ashdown’s manager/operator under a Joint Venture Letter Agreement with Win-Eldrich.“ The Joint Venture split is along the lines of 60/40 with WEX receiving 40% and GPXM receiving 60%. Trust on all levels has had to be restored. Trust between WEX and GPXM and all the management teams, directors, and especially the shareholders. I think they’re getting there and both WEX and GPXM should be commended for getting this far with the most difficult of situations. What make this Ashdown Property so impressive are the grades of the Moly that have been discovered. The Sylvia Vein alone has values in the 5%-8% molybdenum per ton range! People get excited with only 1% Moly per ton and with Moly selling for around $23-$25 per pound, the economics of the project become nothing short of spectacular. Some analysts have conservatively suggested that there is $100 million US dollars worth of Moly concentrated in an area about the size of half a football field cubed. The core deposit is something along the lines of 300 feet long, about 100 feet wide and about six feet thick. It could be larger and open in all directions. They won’t know until they get to the face of the deposit and begin processing the ore. However, the core of the mineralization that has been described as the “target deposit” indicates figures as high as 21,500 tons averaging 8% Molybdenum. People, that is real, and it’s spectacular! (Thank you Terri!) One thing for certain is the quality of this project and the value that is staring us in the face. As of January fourth, 2006 the mining crew was approximately 75 feet from breaking through to the original mine tunnel or decline as it’s called. That was some 14 days ago, and it is January 18, 2006 today. It gives you some idea as to how close they may be from getting to the face of the deposit. Incidentally, this is all part of the saga and is well documented on their web site. Two teams of miners are working underground in ten hour per day shifts. They are getting so close they can taste it. And of course, the closer they get, the more they need to slow down and be careful. Excitement can never be allowed to get in the way of safety. I believe the company will be handling the news releases in a similar fashion the closer they get to the deposit. Excitement won’t be allowed to get in the way of accuracy. You won’t Have to Wait Long I mentioned that Golden Phoenix has been a saga; especially before the Shoot-out at Mineral Ridge (we’ll get to that!). As in all sagas the story lines have been mixed, mixed up, and full of surprises. Ashdown has been no different. There were expectations not met, there were production schedules that didn’t come in on time and there were credibility issues that forever had to be addressed and overcome. Credibility with the investors had to be re-established because “pre-shootout”, they were told one thing and then something else occurred. Who to believe? That was always the question. However, all things considered and with so many obstacles overcome, you won’t have to wait long for the conclusion of this particular story. I believe that we shall know within the next three to four months (if not the next three to four weeks) whether GPXM is going to be mining this Molybdenum deposit and shipping off super sacks (about 3900 pounds of molybdenite concentrates per sack) at current market value of around $24.00 per pound of elemental Moly. Never forget that mining is a high risk business and anything that can go wrong usually does. However, that being stated, I have to say that after watching this crew headed up by Ken Ripley, Earl Harrison, Rob Martin --- Jeff Tissier, David Caldwell, and the rest of the guys, I am nothing but favorably impressed in how they have attacked these problems. Seldom do you find your Interim CEO wearing a hard hat and helping to build the mill one minute and finessing any number of bureaucracies the next. This entire group has found it necessary to wear many hats and they’ve worn them all quite well. They’ve worked together as a team and they’ve made timely, accurate communication to the shareholders a priority; something I believe we can look forward to in the future. I fully understand how important it is to know how to do something, even if you don’t personally perform the task. This group has taken it upon themselves to learn how to do things so as not to be at the mercy of incompetents. Ever remodel your kitchen or add on an addition to your home using unknown carpenters or trades people? Ever take your automobile to an unknown mechanic? I have. Need I say anything further? Stories, oy veh! Do I have such stories!! I am always compelled to make disclaimers such as perform your own due diligence; visit the web site; talk to the management, and learn as much as you can about any company before investing a penny. However, once you’ve done all that, I believe you’ll agree that this is a story where you’ll learn if you’ve made the correct decision within a matter of months if not weeks. Look at those photos, read the story line, and follow along. You’ll realize that barring any unforeseen circumstances, they are a cat’s whisker away from success at Ashdown, success being defined as the production of the first super sack of Molybdenum. There is Additional Value in the Company! Besides the Ashdown Project, GPXM owns Mineral Ridge, a quality project in its own right. It is a property focused on gold and silver. “The Mineral Ridge gold deposits are located on the northeast flank of the Silver Peak Mountain Range in Esmeralda County, Nevada. This range lies in the southern reaches of the Great Basin within the Walker Lane structural corridor, a 60-mile wide region of wrench-faulting which separates the Sierra Nevada to the west and the Great Basin to the east.” There are several other properties such as the Lone Mountain Mill and the Contact Mine. I’m going to let you review the website for updates on these projects. For now, the focus is really on Ashdown and all that it has to offer. That is where we’ll maintain our focus but I want you to understand that this company is not a one trick pony. Furthermore, current management has demonstrated that they want to build this company into a real, viable, and profitable mining entity. The Shootout at Mineral Ridge-Virtual Bullets and Blazing Ballots Buzzing Everywhere There really was a shoot-out at Golden Phoenix, sort of—and maybe not exactly at Mineral Ridge, but there was a shootout. It was of the business variety vis a vis the board room, shareholders, investors, speculators, old management, new management, and analysts all “mixing it up” at one point or another. I didn’t know who was going to end up on top. I’m happy to report to you that I believe the good guys, the ones wearing the white hats, came out ahead and the other ones? Well, for the sake of professionalism, proper decorum, and diplomacy, I’ll simply say that saying nothing sometimes speaks volumes. I believe that is the appropriate course of action to implement here and now. The silence is deafening! As I mentioned previously, I’ve been following this story for six or seven years. Back in 2000 or thereabouts Jay Taylor named this company as his mining project of the year and that recommendation generated a good deal of shareholder interest. Jay’s word carries substantial weight because he has always demonstrated integrity and he has a sizeable audience. His recommendation got my wheels turning and so I began reading up on the project and talking with the folks in charge back then when the focus was on Mineral Ridge. Ashdown hadn’t even come into the picture at that point if I remember correctly. I’m not going into a lot of detail here other than to say mistakes were made back when. We all made them. For whatever reason, the information that investors were receiving was not accurate. Was the misinformation due to a lack of technical expertise? Was it a deliberate attempt to lead people astray? Was it an attempt to create a private “piggy bank” or was it a case of just being piggy? Was there too much ego and not enough commonsense.com? Was it simply incompetence? What was it that allowed a company to basically run through $20,000,000 US + and really have very little to show for it? I will say in their defense that six or seven years ago, the resource market had not turned around and it was a struggle to get funded. And yet millions of dollars were raised and spent and tens of millions of shares were created. I think that people bought into that scenario believing that if that much money could be raised, something good must be happening somewhere within the confines of this company. However, the company and its projects went no where. I recall several very large shareholders that were repeatedly contacted with the request for more money. “We’re almost there but we need a bit more dough.” Some of these people came through again and again and again. It eventually became apparent that trusts had been betrayed. An analyst is only as good as the information he receives. There were layers of people and information circling this story. It felt like things were upside down. Finally, there was a shareholder revolt—that is the “Shootout” to which I refer. I can’t put it any other way. Shareholders became disgruntled and fed up. They had heard one too many promises and had seen a small fortune disappear with very little to show for it. Their investments were in dire straights and there was the possibility of a total collapse, a complete implosion of the company. Normally, the story would have ended there—but the really interesting part of this saga is that it did not. People chose to get into the fray in order to save the company and their investments. People recognized the value of Ashdown and realized it could be the salvation of the company if there was a drastic change in the corporate culture. I’m going to save everyone from the dreary details because at this point its all counter productive; it’s water under the bridge. All we need to understand is that some large shareholders didn’t want to watch their hard earned money go swirling down the drain of incompetence. It was getting very close to that point when “they” stepped in. It was a battle royale and the battle lines were drawn. There were some very committed individuals who stepped up and saved the day—I know from talking with them that they thought that they should have been committed! The only reason I’m not going to name them is because if you do your homework you can figure it out. Most importantly the battle was won with brains and not brawn. If it had been the other way around, I would not be talking with you today. There’s a lesson here for all of us. When the going gets tough, the tough get smart. These guys, wearing the white hats, went to bat for the investors and for themselves. Of course, they had motive—they personally had large positions but some of them didn’t. A few of the directors who helped to win the day had a lot to lose and not that much to gain. But they did the right thing and in today’s world, that is something special. Yes, I was witness to almost all of it on a daily basis when events were churning at a very intense level. It was a daily grind that continued for months. It was brain to brain combat. You can’t imagine as to how the adrenalin gets flowing in these kinds of situations. When things did turn around, and the company acquired the quality of Ken Ripley as Interim CEO, Earl Harrison as Director of Mining, Rob Martin as Communications Director, David Caldwell and Jeff Tissier as Directors, it was truly a slow and steady change for the better. One of the first tasks was to create shareholder trust; even before shareholder value—good move guys. I have to say that I’ve talked with Earl on many occasions and I have every confidence in his abilities based upon past successes. I know he has a passion for this particular project because he believes it is historic; historic because he personally believes it is the richest deposit of Moly he has ever heard about and he wants to be a part of mining it. Incidentally, Earl is excellent at what he does. I also have to say that everyone one of these guys has worked tirelessly to resurrect this company and have been excellent at what they’ve done. Around this same time there were buzzards circling overhead—aren’t there always? They were ready to pounce—aren’t they always? They were unable to unleash their diabolical plans thanks to the foresight of some intelligent people who knew the value of every dollar coming and going. (There is a book in here somewhere because for my money this battle was the antithesis of Enron.) Are they home free? Heck no, they ain’t home free—not yet. They’re moving in the right direction sufficiently enough that I feel very comfortable suggesting that you take a very close look at the story. Do your own due diligence and nibble away, but not with the rent money. The good news is that they’re all hoping that most of the nasty surprises left behind by the old management have been addressed and they’re getting very close to having the mill ready, the permits in place, and the i’s dotted and the t’s crossed just when that first supersack of Moly comes hurling down the conveyor belt or wherever the heck it comes hurling from—and right into the hands of a prearranged buyer. Just make sure you’re out of the way when 3900 pounds comes hurling down the chute! Chin up people. You could be a party to something pretty spectacular. At the very least, you’re going to be examining a story that comes straight out of the old Wild West. Lean and Mean Ladies and Gentlemen, that is where we stand today: Golden Phoenix has risen from the ashes a meaner leaner bird and the future looks very promising. Currently, the team is closing in on the original mine shaft on the Silvia vein at Ashdown. Last I heard on January 4, 2006 they were about 75 feet away from breaking into the old existing tunnel (see the PR on the web site) and working their way through some pretty solid ground. Solid ground is good in the mining business. That was some fourteen days ago. So even if they only make about five feet per day, you can extrapolate the information and get some idea as to how close they really are to the main deposit. Once they get there, it should be a relatively short amount of time before the mining begins barring any unforeseen circumstances! Conclusion This article may sound a bit promotional but everything that I’ve told you is the gospel truth. In this case, truth is stranger than fiction and I haven’t even scratched the surface in telling you what really went on. You wouldn’t believe me. What I want you to know is that win, lose, or draw, I believe that this new group has put every iota of strength and integrity into this company and I believe they just might have pulled it off. We’ll know soon enough. Here we go—referring to the here and now: Management: Excellent Projects: Excellent Ability to Fund: Fair but may become a moot point once mining begins and cash flow follows Ability to Promote: Good to Excellent (By promote, I mean get the story out there just as I’m doing now!) Ethics: Excellent Stock Float: Poor—but again, this may be a moot point with $100,000,000 US of Moly in such a condensed area. I think there are many positives in the future of Golden Phoenix Minerals. Take a close look at it. Rob Martin has done an exceptional job with the web site and he makes it easy to navigate the site and learn the entire story. This is one company I have every confidence that you should review. Until Next time, D. Stewart Armstrong Consultant to the Junior Mining Sector

-- Posted Wednesday, January 18 2006

19-Jan-2006

Quarterly Report

ITEM 2. MANAGEMENTS DISCUSSION AND ANALYSIS OF PLAN OF OPERATION

Forward-Looking Statements and Associated Risks.

This Filing contains forward-looking statements. Such forward-looking statements include statements regarding, among other things, (a) our estimates of mineral reserves and mineralized material, (b) our projected sales and profitability,

(c) our growth strategies, (d) anticipated trends in our industry, (e) our future financing plans, (f) our anticipated needs for working capital, and (g) the benefits related to ownership of our common stock. Forward-looking statements, which involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use of the words may, will, should, expect, anticipate, estimate, believe, intend, or project or the negative of these words or other variations on these words or comparable terminology. This information may involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed or implied by any forward-looking statements. These statements may be found under Managements Discussion and Analysis of Financial Condition and Results of Operations and Business, as well as in this Filing generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under Risk Factors and matters described in this Filing generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this Filing will in fact occur as projected.

Overview

Golden Phoenix Minerals, Inc. (Golden Phoenix or the Company) is a mineral exploration, development and production company, formed in Minnesota on June 2, 1997, specializing in acquiring and consolidating mineral properties with production potential and future growth through exploration discoveries. Acquisition emphasis is focused on properties containing gold, silver, copper, and other strategic minerals that are located in Nevada. Presently our primary mining property asset is the Mineral Ridge gold mine and the Ashdown gold-molybdenum project. The Company terminated its joint venture with International Enexco, Ltd. and its exploration license and option to purchase with F.W. Lewis, Inc. on December 23, 2004 at its Contact project. On January 31, 2005 the Company closed the sale of its Borealis project to Gryphon Gold Inc. for $1.4 million.

[[Image Removed]]

Mineral Ridge

Golden Phoenix purchased the Mineral Ridge mine in late 2000 out of bankruptcy for $225,000 in cash and the assumption of a $382,000 liability to Sierra Pacific Power Co. for a facility charge for the installation of a grid power line. Additional commitments were also assumed, including obligations to pay advanced royalty payments of $60,000 per year and the annual permit cost for the Nevada Department of Environmental Protection (NDEP) of approximately $20,000 during the time the permits were being transferred to Golden Phoenix from the previous operator. Golden Phoenix filed a $1.8 million interim reclamation bond, which allowed us to hold the Mineral Ridge property while other permitting was underway. The reclamation permit, which was in place when Golden Phoenix bought the property out of bankruptcy, was not transferable and the company holding the surety bond refused to write a new bond for a startup company. We were required to post a new bond, but this could not be completed until a new reclamation plan and permit was completed. The bond was due for a three-year review by the Bureau of Land Management (BLM) and NDEP. This review changed the cost of the bond from $1.64 million to $3.2 million for the same plan. The previous bonding company wanted to be released from the bond held by the BLM; however, without a replacement bond, the only method of release would have been by reclaiming the property. To avoid loss of the property value due to destruction of the infrastructure, Golden Phoenix needed to bring the property back into production. We negotiated an interim bond amount to keep the project in a status-quo status until a new plan and bond amount could be negotiated. The source for the cash bond was from the two (2) previous operators and one (1) of our shareholders.

On May 8, 2003, Golden Phoenix obtained a new amended operating permit and on June 23, 2003, we filed a $2.7 million reclamation bond with the BLM with respect to the Mineral Ridge mine. Now that the new permit and bond are in place the Company assumes its reclamation obligation to be $2.7 million. We began mine operations and gold production from the leach pad through the addition of new cyanide to the regular leach fluids and from initiating open pit mining and stockpile transfers to the pad. Pursuant to our internally generated feasibility study for Mineral Ridge, which was evaluated and reported by Behre Dolbear & Company, Inc. an independent mineral auditing consultant, the total value of the gold sales over the six-year mine life, at a $325 gold price, is estimated to be $59 million. The total operating cost, which includes royalty payments, refining costs, mining costs, milling costs, reclamation costs, and operating expenses, is estimated to be $36 million. Capital cost, including reclamation bonding, is estimated to be $6 million. The net income after taxes is estimated to be $12 million.

<!-------------------------------------------------- -->

On October 27, 2004 the Company made a $16,920 deposit with Cow County Title for the purchase of approximately 1,200 acres of land and an existing 1,600-ton per day mill. The mill, know as the Lone Mountain Mill or Millers Mill, is held under separate title and leases the 1,200 acre land parcel. Cost to the Company for this investment at the close of escrow is estimated to be $650,000 for the land and $600,000 for the mill. The current agreement is for the landowner to have possession of both the land and mill. The current mill owner is in default of rental payments and is required by contract to deed the property to the landowner. The purchase of these properties is now delayed until the mill title has been cleared to the property owner. Concurrently with the legal working for the Lone Mountain Mill acquisition, economic feasibility studies are ongoing and may reveal that the mill is not economical to purchase due to the cost of ore transportation. If this becomes true, the deposit of $16,920 will be refunded.

On January 12 , 2005, Golden Phoenix announced the inauguration of a comprehensive restructuring of all mining operations beginning with the winter idling of the Mineral Ridge gold mine. Mining and crushing operations have been suspended for the time being and employees who conducted this work have been furloughed. Leaching operations continued to extract gold from the leach pad through August, 2005. The operation is now on temporary full idle, and is scheduled to resume full operations pending management evaluation of an engineering study commissioned to identify techniques for improving recovery rates from existing and newly uncovered higher-grade ore deposits. Employees trained to maintain the facilities have been retained. They will also ensure site security, environmental compliance and safety protocols . Due to cessation of leaching in August 2005 at Mineral Ridge, the overall operation will incur minimum expenses until recapitalization as a milling operation is approved by the Board.

Ashdown

The Ashdown property near Denio, Nevada was originally held through a letter agreement with PRS Enterprises (PRS) with Golden Phoenix managing the project. PRS also had a letter agreement with Win-Eldridge Mines, Ltd. (W-E) which grants the Ashdown property to a three (3)-company venture. This agreement expired on December 15, 2003 due to the inability of PRS to fulfill their contractual obligations. Negotiations with W-E continued, which resulted in a signed letter of intent to joint venture on February 5, 2004. The terms of the agreement gives sixty percent (60%) to Golden Phoenix, as manager/operator of project, and forty percent (40%) to W-E, as owner of the property. Golden Phoenix will earn an undivided vested sixty percent (60%) interest in the project in either of two

(2) ways: by placing the project into profitable production using a small pilot mill, or spending $5 million toward development of the project on or before February 4, 2008. Upon signing the letter of intent, Golden Phoenix paid W-E $50,000, and beginning three (3) months after the signing, it has paid $5,000 per month each month for seventeen (17) months and will continue to pay $5,000 per month until a cash distribution through profitable production is achieved. All payments are current.

On September 8, 2004 the Company entered into a purchase agreement for a one hundred (100) ton per day mill located in Kingston, Nevada. This mill is known as the Kingston Mill. The agreement called for payment of back taxes, liens and reclamation of land on which the mill was located. The mill was disassembled and moved to the Ashdown mine area where it was held in storage awaiting permits for construction and operation. To date, we have made payments totaling $116,952 for the mill.

On April 19, 2005 Golden Phoenix announced it has secured a long-term lease on the Morris Mill site, a highly suitable twenty (20) acre parcel adjacent to its Ashdown gold/molybdenum joint venture in northwestern Nevada. In doing so, the Company plans to increase Ashdowns molybdenum processing capacity from 10,000 tons in a pilot mill scenario to 120,000 tons, a twelve (12)-fold increase, and to lengthen the mills initial operating period to five (5) years. A reclamation bond in the amount of $114,000 has been posted with the Nevada Department of Environmental Protection for the Morris Mill site.

On June 10, 2005, the Company was provided written notice that Win-Eldrich Mines Ltd. planned to remove a 1,400-ton stockpile of mineralized material mined by a previous operator and that it considered personal property not subject to the joint venture. The material had been stored on site for twenty three (23) years and had been identified by the BLM as an item for reclamation. It is the opinion of the Company that the material is subject to the letter of intent to joint venture (LOI) dated February 5, 2004. The Company agreed to the removal of the material while reserving its rights under the LOI to share in the proceeds generated from the stockpile. The stockpile was removed over a five (5) week period which commenced in June 2005, and the Company intends to resolve this matter with Win-Eldrich at a later date.

<!-------------------------------------------------- -->

On June 15, 2005, the Company and regional officials with the BLM entered into a verbal agreement to remove and to take possession of a two hundred (200) ton per day mill located near Austin, Nevada. This mill is known as the Austin Mill. The agreement constituted the removal of the mill and reclamation of the land. The Company has recognized an estimated cost of $80,000 to comply with the verbal agreement.

On June 29, 2005 the Company announced it had taken title from the BLM to take possession of the Austin Mill. The BLM acquired the Austin Mill following abandonment of an un-bonded mining project situated on public land. Golden Phoenix offered to assist the BLM in reclaiming the property, and has accepted the responsibility to remove the mill and the building in exchange for clear title to the equipment. The Austin Mill is complete with crushing, grinding and flotation gear, all in excellent condition. The Company scheduled a truck and trailer to transport the equipment to Winnemucca, Nevada where it has been stored until permits are issued allowing it to be moved to the Ashdown project. The mill is ideal for processing gold and molybdenum ores and provides several key components that will enhance the capability of the primary millworks. It also gives Golden Phoenix the flexibility to double its molybdenite-processing capacity or to add a separate gold circuit, as may be warranted in the future. Disassembly and relocation of the mill is expected to take six (6) weeks. The Company plans to merge both the Kingston and Austin mills into what will be known as the Pilot Mill with a milling capability of one hundred (100) tons per day.

On August 15, 2005 the Company received approval from the BLM to extract 1,000 tons of molybdenum mineralization from its Ashdown mine for the purpose of metallurgical testing. The approval was issued by the BLM as an amendment to an existing Notice of Intent (Amended NOI). Under the Amended NOI, Golden Phoenix may access and remove molybdenite-bearing material using underground mining techniques, and then mill, metallurgically test, and trial-market the moly concentrates. The intent of the bulk sample program is to prepare Golden Phoenix for full-scale mining at Ashdown, scheduled to begin following the BLMs final approval of the comprehensive Plan of Operations and its associated Environmental Assessment. Ashdown mine personnel have dewatered and rehabilitated the portal section of the Sylvia decline and determined that it is safer, shorter and faster to drive a new bypass from inside the portal directly to the targeted ore-shoot rather than to attempt to restore the original decline. Once full-scale mining is approved, this bypass will serve as the main haulage way for daily operations.

On August 26, 2005 the Pilot Mill was deeded to an earth working company known as Retrievers LLC. The deed states that a signing fee of $30,000 shall be paid to Retrievers LLC and that when the Ashdown mill final permit is issued, an additional $30,000 shall be paid to Retrievers LLC. The Company agreed to an exclusive arrangement with Retrievers LLC for all earthworks over a five (5) year period. At the conclusion of the agreement period, the Pilot Mill deed shall be transferred to the Company at no cost.

On September 26, 2005, the Company entered into a Production Payment Purchase Agreement (PPPA) with Ashdown Milling Company, LLC, a company of which Mr. Kenneth Ripley and Mr. Rob Martin are both members. Under the terms of the PPPA, Ashdown Milling agreed to purchase a production payment to be paid from the production of the Companys Ashdown Mine for a minimum of $800,000. This minimum purchase price will be paid upon the achievement of certain milestones related to the exploration and development of the Ashdown Mine. In addition, the PPPA provides that Ashdown Milling has the right to increase its investment in the production payment up to an additional $700,000 for a maximum purchase price of $1,500,000. The Company must use the funds for qualifying exploration and development expenditures on the Ashdown Mine in a sharing arrangement of its obligation to explore and develop the mine under the letter of intent to joint venture dated February 5, 2004. The amount of the production payment to be paid to Ashdown Milling is equal to a twelve percent (12%) net smelter returns royalty on the minerals produced from the mine until an amount equal to two hundred forty percent (240%) of the total purchase price has been paid. However, the production payment is paid solely from the Companys share of production it is entitled to receive under the letter of intent to joint venture.

The Company received $200,000 of the minimum purchase price upon execution of the PPPA and will receive an additional $200,000 upon approval of the mill foundation and $200,000 upon receipt of a water pollution control permit. Additional production payment proceeds may be purchased by Ashdown Milling upon completion of the mill building.

<!-------------------------------------------------- -->

In addition to the foregoing, the PPPA provides that for each dollar of the purchase price up to the maximum purchase price paid for the production payment, the Company will issue one (1) share of its restricted common stock and one (1) common stock purchase warrant. The warrants will be exercisable for a period of three (3) years from the date of the PPPA and entitle the holder to purchase one

(1) share of the Company's restricted common stock for $0.20 per share. For each dollar of the purchase price for the production payment, $0.17 has been allocated to the purchase price for each share and warrant as a unit. Pursuant to the representations provided to the Company in the PPPA, Ashdown Milling is an accredited investor and the shares and warrants were offered and sold by the Company in reliance on an exemption from registration pursuant to Section 4(2) of the Securities Act of 1933, as amended and Rule 506 of Regulation D promulgated thereunder.

To date, permitting at Ashdown is underway on federal lands administrated by the BLM for a selective underground mining operation designed to extract molybdenum mineralization from a vein setting. Milling facilities designed to process the mineralized material extracted from the mine are being permitted concurrently on private land two (2) miles from the mine. Beginning towards the end of 2004 permit applications were being reviewed by the agencies, including the Water Pollution Control Permit, Reclamation Plan, the Air Quality Permit and the Storm Water Discharge Permit. Permitting efforts for a larger mill and underground mine including the Plan of Operations and gathering base line information for the Environmental Assessment was underway. To date, a total of $45,368 has been placed in bond to secure the work currently being performed at the Ashdown mine site, and $114,000 has been placed in bond to secure work currently being performed at the mill site. Full-scale mining will proceed upon receipt of the final permits from the Bureau of Land Management and the Nevada Division of Environmental Protection. The Ashdown property currently has no SEC compliant reserves, and will require significant investment in delineation drilling and underground development before a reserve base can be developed and audited by a third party mining engineer.

Borealis

The Borealis property was held under a lease agreement with the Borealis Partnership, which consists of three (3) separate individuals who entered an exploration partnership to facilitate leasing the entire mineralized zone owned by the three (3) partners. On July 18, 2003 the Company signed a joint venture agreement for its Borealis gold project with Gryphon Gold Corporation, a Nevada incorporated company. On January 31, 2005 the Company closed an agreement to sell its thirty percent (30%) interest in the Borealis Gold Project to Borealis Mining Company/Gryphon Gold Corporation (Borealis/Gryphon) for a series of cash payments totaling $1,400,000. The terms of payment are as follows: $400,000 paid on January 18, 2005, followed by four (4) payments of $250,000, paid in ninety

(90) day increments. In accordance with the terms of the joint venture agreement to date, the parties agree that Borealis/Gryphon has earned seventy percent (70%) of the overall joint venture. With the purchase of the Companys thirty percent (30%) interest, Borealis/Gryphon will own one hundred percent (100%) of the project. In return, Gryphon Gold Corporation will guarantee Borealis Mining Companys payment obligation to Golden Phoenix by depositing as security fifteen percent (15%) of Borealis Mining Companys shares into escrow. All payments to Golden Phoenix are current with $[900,000] paid to date.

Contact

The Contact project property was held through agreements with two (2) separate entities, the International Enexco Ltd. (Enexco) joint venture and an exploration license and purchase option agreement with F.W. Lewis, Inc. (Lewis). Golden Phoenixs operating control over property owned by these two (2) entities allowed it to combine deposits within the district allowing for economic mining, which was previously not possible. On January 28, 1998, we acquired the right to earn a sixty percent (60%) percent interest in the Enexco patented mining claims through a combination of annual work commitments totaling $2,600,000 on the Enexco property and $4,000 per month payments to Enexco totaling $313,000 over seven (7) years. The Enexco agreement terminated on December 23, 2004, and at December 31, 2004 the total liability for the minimum work commitments to Enexco was $2,175,200 and $4,000 for the monthly lease payments.

On July 10, 1998 Golden Phoenix entered into an exploration license and purchase option agreement for the Lewis portion of the Contact project. On February 19, 2003 Lewis and Golden Phoenix amended the exploration license and purchase option agreement which extended the term to December 31, 2007 and made other modifications to the original agreement. On May 7, 2003, the parties signed a second amendment that clarified that expenditures for work performed by Golden Phoenix on either the Lewis property or the adjoining Enexco property shall be applied to Lewis minimum work commitment. On December 23, 2004 the Company terminated the Lewis agreement. With respect to the Contact project the Company reports as a liability on its balance sheet the following as current accrued liabilities: (a) land lease payments of $21,000, (b) work commitments of $2,420,643 and (c) equity payables of $1,743,807. The Company still controls six

(6) unpatented mining claims over a portion of the Banner Zone deposit and over the highest grade drill hole in the area.

<!-------------------------------------------------- -->

The Company has a history of operating losses, and we expect to continue to incur operating losses in the near future as we initiate mining operations at our two (2) mines and conduct additional exploration in their vicinity. As a development stage company we have been funded primarily through stock sales and loans from officers and shareholders with the addition of revenue from gold sales through the production from the Mineral Ridge mine and the Purchase Agreement with Fusion Capital. We intend to develop and mine existing reserves and to further delineate additional, identified mineral deposits at our mines. We also intend to explore for undiscovered deposits on these properties and to acquire and explore new properties, all with the view to enhancing the value of such properties. We have been open to and will continue to entertain possible joint ventures with other mining company partners. We currently have a letter of intent to joint venture dated February 5, 2004 with W-E for the Ashdown project. The Company is currently working with W-E to finalize a formal joint venture operating agreement. No other joint ventures have been entered into.

Our ability to satisfy the cash requirements of our mining development and exploration operations will be dependent upon future financing and cash flow from the Mineral Ridge gold mine and any questions from the Ashdown property that additional financing will be obtained, although no assurance can be made that funds will be available on terms acceptable to us.

Recent Corporate Developments

On January 29, 2005 the Board Compensation Committee voted on and approved compensation payments to Directors that attend supplemental meetings. The proposal was voted on and approved by the Board. Directors attending meetings supplemental to the quarterly general meeting are now compensated at $250 per meeting and the general meeting compensation of $500 was not changed.

On February 7, 2005 the development of an Advisory Board to the Board was finalized. The Advisory Board members are compensated for any hours worked in excess of eight (8) hours during any given month. To date, there has been no compensation dispersed. Compensation is made in restricted common stock payable in blocks of 2,500 shares for each eight (8) hours over the minimum requirement. In addition, normal expenses are paid by the Company. To date, there have been no submittals for expenses. Advisory Board members consist of: (a) Mr. Daniel Breckenridge from Oklahoma, (b) Mr. Robert Martin from Hawaii, (c) Mr. William R. Thomson from London, England, (d) Mr. David W. Payne from Kansas and (e) Mr. Ripley from Washington State.

On February 12, 2005 Mr. Jeffery Tissier, our former Co-Chairman of the Board, resigned his position due to pre-existing professional commitments. Mr. Tissier was also Chairman of the Audit Committee. Upon Mr. Tissier's resignation, Mr. Steven Craig assumed the position of Chairman of the Board.

On February 18, 2005, Mr. Michael Fitzsimonds resigned his positions as Chairman of the Board and Chief Executive Officer. For consideration of Mr. Fitzsimonds service, the Board of Directors (the Board) agreed to the following: (a) full compensation for one (1) year at and annual rate of $95,000, (b) the payment of all accrued vacation at full annual rate for two (2) months, (c) health insurance for fourteen (14) months at $685 per month, (d) one (1) company portable computer system valued at $1,200, (e) life insurance at $181 per month,

(f) payment of legal fees at $3,515 per month to be deducted from a note payable issued from the Company to Mr. Fitzsimonds, (g) one (1) Company truck valued at $658 per month, (h) a severance bonus of $100,000 and (i) monthly interest payments of $1,350 for a period of approximately seventy two (72) months.

On February 18, 2005 Mr. Kenneth Ripley was employed as Interim Chief Executive Officer. Currently, the Board Compensation Committee and Mr. Ripley have not agreed to an employment contract. For accounting liabilities, the last known proposed agreement made to Mr. Ripley was used as the liability basis. The offer consists of: (a) a base annual salary of $185,000, (b) per diem meals at a rate of $28.00 per day, (c) a Company vehicle with a monthly value of $600, (d) Company housing with a value of $1,000 per month, (e) reimbursement of travel expenses from Mr. Ripleys home to the Company's headquarters and return on a weekly basis equal to $280 and (f) and other items such as cell phone, parking, etc. equal to $1,000.

<!-------------------------------------------------- -->

On February 18, 2005 the Board approved the formation of an Interim Governing Board. The Interim Governing Board has daily management control of the Company. The Interim Governing Board reports directly to the Board. Members of the Interim Governing Board consist of: (a) Mr. Kenneth Ripley, (b) Mr. Ronald Parratt and (c) Mr. David Caldwell.

On May 10, 2005, the Company entered into a loan agreement with William and Candida Schnack. The basic loan agreement is for advances of $1,000,000 with a payback including principal of $3,000,000. Under the terms of the Companys payback, certain portions of the loan compute annual interest rates of approximately 500%. Average computed interest for the loan with timed payback is approximately 300%. The Company is currently in default of the first $500,000 payment due October 20, 2005, and is negotiating an amendment to the original loan agreement that will restate the payment schedule of the loan to conform with the actual progress of the mining activities at Ashdown.

On June 14, 2005 the Company entered into a short term loan with Kenneth Ripley. The combined amounts of $241,000 constitute two (2) loans payable on July 31, 2005. These loans have been extended for an indefinite period. Interest rates for the short term advances are at eighteen (18%) per annum and with setup charges have an annual rate of twenty-three percent (23%).

On July 13, 2005, we entered into the Purchase Agreement with Fusion Capital pursuant to which Fusion Capital agreed to purchase, on each trading day during the term of the agreement, $12,500 of our common stock or an aggregate of $6.2 million. Upon the effectiveness of a registration statement Fusion Capital has agreed to purchase $200,000 of the Companys common stock at a price of $0.15 per share (or 1,333,334 shares). The remaining $6 million of common stock is to be .

bauwi bauwi | 19.01.06 19:49   |

| Allerdings sind alle Interessierten gewarnt, mit Vorsicht ran zu gehen! |

Das kann ich Dir auch nicht zu 100% beantworten. Wenn ich mir die Homepage mir so anschaue und mir auch die neu gebauten Anlagen so ansehe, und die beantwortet Mails, die Analysen, die Kostenstruktur und die Investitionen dann denke ich nicht gleich an Betrüger oder Gaunern. Und ich denke auch nicht das diese Aktie besonders massiv gepusht wurde, aber ohne eine Analysenmeinung hätte ich diese Aktien nie gefunden und wäre heute auch nicht in diese Firma investiert.

Und es wäre sehr schön wenn Du @bauwi und auch @Kicky ihre Kritiken auch einwenig mehr schriftlich unterlegen würden. Und wenn Kicky hier einen finanziellen Engpass sieht dann hat er einwenig recht weil Investitionen in Millionenhöhe den Cash Flow tatsächlich mindern weil eine Bilanz nun mal Gleichgewicht bedeuten.

Fazit: Nur wer Investiert und Risiken trägt kann auch richtig Geld verdienen! Von nichts kommt hat auch nichts!![]()

Golden Phoenix Completes Ashdown By-Pass, Reaches Sylvia Decline Leading to High-Grade Moly Deposit

Monday January 23, 5:00 am ET

SPARKS, Nev., Jan. 23 /PRNewswire-FirstCall/ -- Golden Phoenix Minerals, Inc. (OTC Bulletin Board: GPXM - News) is pleased to announce that its mining crews have completed a 600-foot by-pass tunnel and broken through to the Sylvia Decline that leads to the high-grade molybdenum mineralization at the Ashdown Mine in Humboldt County, Nevada.